The ongoing crisis in debt market seems to have put SIP investors on the backfoot. After reaching a peak of Rs 8,238 crore in April 2019, SIP inflows dipped marginally to Rs 8,183 in May and further to Rs 8,122 crore in June 2019. This SIP inflow includes investments across debt and equity funds.

While net inflows in equity funds increased in June 2019 to Rs 7,663 crore from 5,407 crore in May 2019, debt funds witnessed massive outflows to the tune of Rs 1.71 lakh crore, largely from liquid fund, overnight, low durations and credit risk funds.

The number of SIP folios touched 2.74 crore in June. Association of Mutual Funds in India (AMFI) data shows that the industry had added, on an average, 9.32 lacs SIP accounts each month during the FY 2019-20, with an average SIP size of about Rs 3,000 per folio.

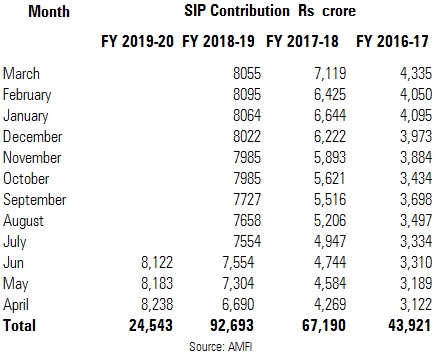

Due to the sustained effort of industry and advisers, SIP culture has been gaining popularity among retail investors. As can be seen from the table, SIP inflows have more than doubled from Rs 43,921 crore in FY 16-17 to Rs 92,693 crore in FY 17-18.

Unlike in the past, investors today are not hitting the panic button during a correction in markets. In fact, some investors look forward to some correction in markets to benefit from the dip. This shows that advisers behavioral coaching and investor awareness programmes is working its magic.