This post by Robert J. Martorana, CFA was originally published on CFA Institute's Enterprising Investor.

In the first segment of this series, I described how financial news is like a crying baby: There is noise and commotion followed by a narrative that may or may not make sense. Narratives follow prices because readers want an explanation, and a consensus eventually emerges.

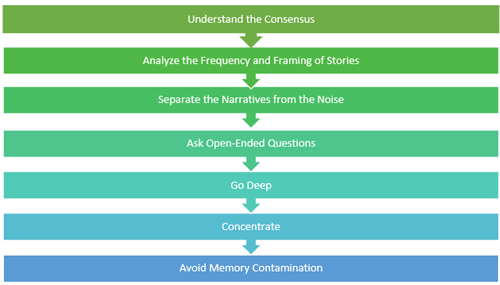

This consensus forms a narrative, and the consensus is also embedded in market prices. Since investors look to the future, market prices imply a set of assumptions and probabilities about what will happen. These assumptions may be optimistic or pessimistic, and these assumptions may be coherent or incoherent. Either way, consensus expectations are a logical starting point for putting any financial news in the proper context.

The Usual Suspects

I consult a variety of media, both financial and otherwise, to inform my understanding of the markets and the economy. My daily news sources are the New York Times, Wall Street Journal, and Google News. No surprises there. I also subscribe to The Week, which provides contrasting political viewpoints and catches some stories I might have missed.

For investment news, the four sources below are my favorites when it comes to understanding the consensus. These fall into the “if it ain’t broke, don’t fix it” category. (They also help me question the narrative — more on that below.)

-

Dash of Insight

: Jeff Miller provides comprehensive and systematic reviews in Weighing the Week Ahead (WTWA). Miller writes extensively about how to detect nonsense in the financial media and how popularity ≠ accuracy, and he has done excellent work on recession forecasting tools. I have known him for over 10 years, and I trust his judgment and integrity without any reservation. I can say the same about . . .

- Brian Gilmartin, CFA, at Fundamentalis, who gives insightful analysis, particularly about trends in US corporate earnings. He has been at it for a long time, and his experience shows. Like Miller, Gilmartin is independent and publishes consistently, based on a disciplined method, and calls it as he sees it without a hidden agenda. Sources like Gilmartin and Miller are great assets because we can just read their work and get on with our jobs. They’re like finding a lost set of car keys: We can just stop looking, hop in the car, and drive.

-

FactSet Insight, Companies and Earnings

: John Butters writes chart-intensive weekly reports on aggregate revisions and estimates for the S&P 500. FactSet Insight is simple, authoritative, and free. (FactSet used to offer Dividend Quarterly, among other quarterly reviews.)

-

JP Morgan 2019 Long-Term Capital Market Assumptions

: As an adviser, I make financial plans based on long-horizon expectations about inflation, expected returns, correlations, volatility, etc. The annual guide from JP Morgan provides a solid framework, and Guide to the Markets provides comprehensive updates.

Analyze the Frequency and Framing of Stories

What drives the interpretation of financial news? How is consensus formed?

Let’s say there is news about the trade dispute between the United States and China, and I read today’s edition of the New York Times and Wall Street Journal. Here is what I look for:

1. Story Selection

Did each paper cover the story? Was it on the front page? How deep was the coverage? Such editorial choices say a lot about the story.

A single article rarely changes investor sentiment though. I don’t mean that a single event does not change investor expectations, but the coverage of that event in a single article rarely influences public opinion. Story selection, therefore, is not as important as story frequency or story framing.

2. Story Frequency

The frequency of a news story does influence public opinion and investor sentiment. If everyone is writing about a topic, it must be important or at least perceived as such. For example, a slowdown in corporate earnings growth was a popular topic in the fourth quarter of 2018, as was the trade dispute in the first quarter of 2019. The frequency of coverage affects sentiment. So how do we distinguish between fads and trends? I use these three sources:

-

WTWA

: In Next Week’s Theme and Final Thoughts sections, Miller teaches investors how to read the news with a critical eye.

-

DataTrek

monitors trends in Google searches, which helps to quantify the frequency of various stories. Its sample on housing demonstrates the approach.

-

The Industrial Sentiment Survey

from Corbin Advisors has a helpful wordcloud depicting story frequency trends.

3. Framing

How an event is framed affects the news and how it is perceived. The media can spin a story in countless ways that influence how we interpret it. I read financial news to help understand the world as it is, not how it should be. I identify the political biases of the media and act accordingly, and I do my best to remain nonpartisan.

Conservative vs. Liberal: Political bias is everywhere, so we need to spot it quickly, read multiple viewpoints, and come to our own conclusions about the underlying story. We need to keep a particular eye out for changes in how liberal and conservative media cover a story or issue: Editorial deviations from the typical left/right paradigm suggest a significant shift may be underway. When conservative sources frame a story in a liberal manner, or vice versa, something important is happening.

Take income inequality. Left-wing sources have placed it at the center of their economic narrative for years now. The conservative press, on the other hand, may have stories about the minimum wage, student debt, and access to health care, but tends not to frame these around “income inequality” per se. So if Fox News suddenly shifted gears and focused specifically and intently on income inequality, it would be important.

The chart below arranges various media outlets according to where they sit on the liberal-conservative spectrum and how accurate they are as news sources. Created by Vanessa Otero, the chart resembles a normal bell-curve, with most sources falling in the middle of the spectrum and a few at the right and left tails of the curve.

Are the media outlets conducting original unbiased reporting? Are they fabricating stories wholesale? Or are they simply putting an ideological spin on news reported elsewhere?

Optimistic vs. Pessimistic: Some news sources are perpetually upbeat about business and the economy. Others are permabears. We need to read both varieties and make our own interpretation.

- In “Jobs Report Has Food for Both Bulls and Bears, a Classic Case of Confirmation Bias,” I demonstrate how we see what we want to see. In the jobs report example, optimists focused on payroll growth, and pessimists on the labor force participation rate. These are two different ways to frame the same data.

- People are systematically pessimistic about global trends, according to Hans Rosling in Factfulness. This phenomenon is widespread across countries and professions. Moreover, 10 simple questions demonstrate that nearly all of us have basic facts wrong. Everyone is more or less equally guilty of bias and makes just as many factual errors, regardless of their intelligence or leadership skill. And I believe the media are making us more pessimistic: They want our attention, so they stoke our fears. (By the way, since investor expectations tend to be pessimistic, I suspect that long-term stock prices are on the low side.)

Short Term vs. Long Term: A news story could focus on stock returns for a month, a year, or a decade. Depending on the time frame chosen, the stories could come to contradictory conclusions. When I was an editor at The Street, some contributors were short-term traders while others were long-term investors. The contrast led to illuminating discussions or heated debates, depending on the personalities involved.

Reported Results vs. Investor Expectations: One story might say that a company’s earnings rose 20% last quarter; another that the company missed expectations. Both stories are true, but the implications are quite different.

Pro-Business vs. Anti-Business: Income inequality was originally portrayed as a political problem in the New York Times. Meanwhile, the Wall Street Journal focused on how the minimum wage affected business costs and employment. Same story, two narratives.

Pro-Government vs. Anti-Government: Some sources are skeptical of all government statistics but offer no alternative. Others accept reported figures as gospel truth. For some reason, inflation statistics are a big battleground:

The frequency of stories and the framing of narratives around them have an enormous impact on how we perceive and interpret the news and how we survey the investment landscape. As investors, we must develop a systematic framework — a set of filters — to address this issue. But that would merit a book-length discussion.

Narratives vs. Noise

Understanding consensus expectations are only the first step in the process of interpreting financial news. The next step is filtering the narrative from the noise, which will be the subject of the next installment in this series.