Credit Risk funds have witnessed a sustained rise in portfolio YTMs (Yield to Maturity) over the past year. This rise in portfolio YTMs is especially stark given the drop in AAA yields in recent months.

One would assume that such a rise in YTMs of Credit Risk Funds, in an otherwise benign rate environment, is due to general risk aversion from the sector. However, on deeper analysis we realise that a major cause for this rise in YTM of Credit Risk Funds is attributable to sharp sell-offs in certain specific companies. This sell-off has caused the yields on their respective securities to spike (sometimes by over 5%!) and in turn has contributed to higher YTMs in portfolios that hold such securities.

Increasing exposure to ‘High Yield’ bonds a major contributor to higher YTMs

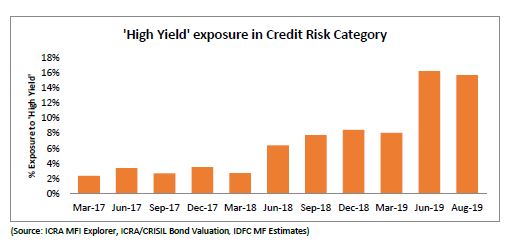

To highlight this impact, we analyse the trend in exposure of the Credit Risk category to ‘High Yield’ bonds. ‘High Yield’ bonds are defined as those having a yield of greater than 12%. There is no scientific rationale behind choosing 12% apart from the fact that such bonds are valued at nearly 5% over AAA PSU bonds which is a reasonably large risk premium, in current market scenario. This is not to say that all bonds valued above 12% are risky, but merely highlights some level of stress pricing by market for such securities. ‘High Yield’ securities in this study range from 12% all the way to even 28% in case of few securities! (For the analysis, we have ignored bonds which are sub-investment/default grade)

It is clear from the above chart that a key contributor to higher portfolio YTMs is the increasing exposure in ‘High Yield’ securities. It is also interesting to note that in spite of several haircuts/ write-offs, the stock of ‘High Yield’ holdings have continued to increase in recent months. In many instances, these securities have in fact migrated to ‘High Yield’ over the last few months owing to increased risk perception by the market.

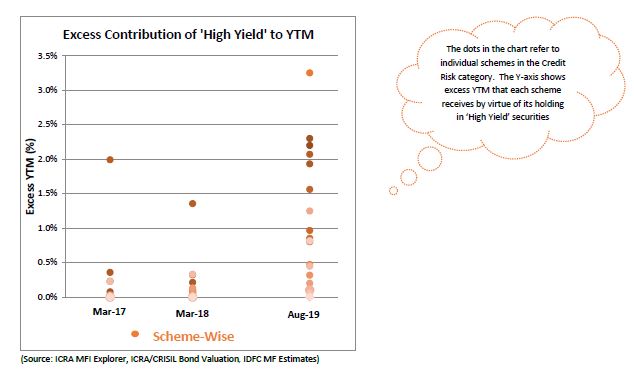

Taking this one step further, we analyse the contribution that such ‘High Yield’ securities have towards portfolio YTMs. In order to do this, we calculate the excess YTM contributed by holding such papers over a traditional credit bond at a yield of 9%. Here again, we assume 9% to be the average yield of a reasonably liquid AA corporate bond. As can be seen in the chart below, holding in ‘High Yield’ securities contribute meaningfully to portfolio YTM. In some cases, their contribution is in excess of 2%!

The continuing fallacy of YTM in Credit Risk funds

In summary, it is important for investors to discern the causes for rise in portfolio YTMs. As highlighted above, these could be owing to a combination of the following: 1) specific sell-off in select credits causing a rise in portfolio YTM and 2) generalised credit sell-off due to risk aversion. In the case of the former, one would need to see resolutions in many of these ‘High Yield’ issuers before their yield can actually translate to bond performance. On the other hand, a continued deterioration in these ‘High Yield’ securities will provide little value to investors apart from optically boosting YTMs of portfolios which hold these securities.

(we have considered a total of 20 schemes in this category)