In India, gold and festivals go hand in hand, especially during Diwali. Dhanteras also called Dhantrayodashi, marks the first day of Diwali and is one of the auspicious muhurats to buy gold. Dhan refers to wealth, and gold, the precious yellow metal, is an indispensable part of it.

Not just in India, gold has always been a mark of wealth, carrying immense value across the globe. And lately, it’s worth has increased manifold on the backdrop of uncertainty looming due to:

- Subdued global economic growth (slowest pace in the last three years) and no signs of a sustainable recovery anytime soon.

- A slowdown in global trade growth (lowest since the last ten years), signalling a possible recession.

- Frail investment growth (particularly in advanced economies).

- Trade war tensions between the US and the other economies.

- Oil prices blazing (after Iran's drone strike on Saudi Arabia's Aramco refinery triggered supply concerns).

- Geopolitical tensions.

- Upside risk to retail inflation.

- Pause in rate hikes by the US Federal Reserve, in fact, they cut rates by 25 bps in its last meet (and it's possible that the Fed may continue to be accommodative amidst a slowing growth).

- The ECB open to fresh stimulus measures.

- Delay in Brexit, drop in the value of the Pound.

- And heightened volatility in major equity markets of the world.

On the backdrop of the above, gold is looked up to as an effective hedge, a safe haven against any form of major upheaval and systemic risk.

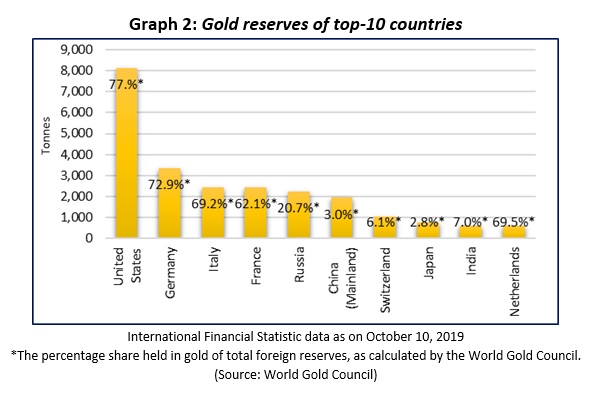

Recognising the risk involved, even the central banks of major economies aren’t taking chances – they are buying gold (see graph 2).

Even the banks of Saudi Arabia and the United Kingdom, are holding gold to the tune of 323 tonnes and 310 tonnes, respectively (which is approximately 3% and 9% of their reserves).

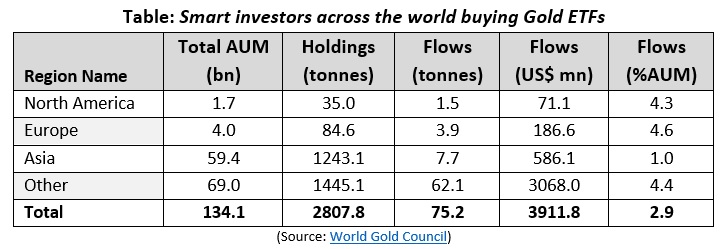

Smart investors, too, are buying gold the smart way – through gold ETFs, reveals the World Gold Council data (see table above). The month of September has witnessed US $3.9bn of net inflows across all regions, increasing their collective gold holdings by 75.2t to 2,808 tonnes(t), the highest levels as per the WGC report.

In India, the falling rupee against the US dollar, slowdown blues, sluggish consumer demand, rising crude prices, upward pressure on the trade deficit, and the possibility of fiscal deficit getting breached, is encouraging the RBI to add more gold to their reserves.

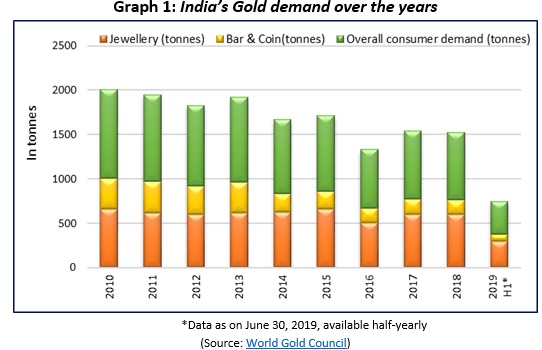

As per the WGC report, there are two significant factors influencing the Indian gold demand in the long run. One, rising income --- which is the most significant factor having a positive effect; and second, higher gold prices ---which has a negative effect.

In the recent past, gold demand in India spurred due to elevated global gold prices, weak rupee, and some buying abetted by above-normal southwest good monsoon (nearly two-thirds India’s gold demand comes from the rural areas, where agriculture is the main source of livelihood).

At the same time, elevated prices (due to higher import duty), high unemployment rate are proving to be dampeners -- making it very expensive for Indians to purchase gold.

The WGC report states that weaker economic growth and the possible impact of higher gold price volatility may result in softer consumer demand this year, especially in emerging markets that make up the lion share of annual demand.

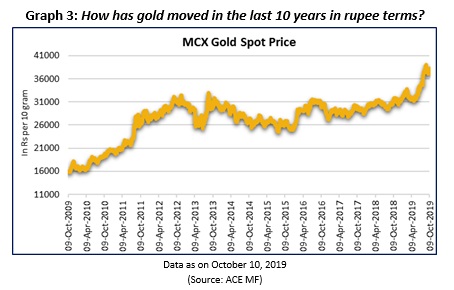

That being said, the heightened global uncertainty and headwinds at play will prevail and owning gold will help as a store of value during economic uncertainty, as a safe haven, and a shield against inflation in the long run.

So, buy gold strategically this festive season and be a smart investor. The long-term secular uptrend exhibited by gold invites attention and highlights the importance of owning gold in the portfolio with a longer investment horizon.

So, consider allocating upto 10-15% of your entire investment portfolio to gold and hold it with a long-term investment horizon; avoid a speculative approach while investing in gold.

If you invest through gold Exchange Traded Funds (ETFs) or gold savings funds, you can actually tangibly hold gold without facing any storage concerns or worries about theft.

Go ahead and buy gold this Diwali!