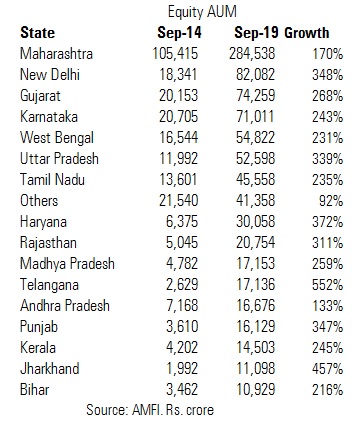

Hyderabad is not just famous for its biryani. The capital state of Telangana is emerging as the hotspot for fund houses and advisers for its increasing investor appetite for mutual funds. For instance, equity assets in Telangana have increased by 552% from just Rs 2,629 crore in September 2014 to Rs 17,136 crore in September 2019.

Telangana-based adviser Shiva Prasad Konduru attributes the growing interest in the state due to multiple factors. “Awareness about mutual funds has increased in smaller towns due to social media and the industry advertising campaign. Also, a lot of regional media houses are now publishing personal finance content. A few large fund houses have appointed district relationship managers in districts where they see potential. Also, AMCs are setting up their branch offices in Hyderabad. The state has also benefitted as many IT firms have set up their offices here.” This investing wave is reflected in the growth of his business. Shiva’s assets under advisory has increased from Rs 10 crore to Rs 43 crore in five years.

Shiva says that as markets have been supportive, many new distributors have joined the industry in the last five years. Further, he says that many established advisers/distributors operating from Bengaluru and Mumbai are opening branch offices in smaller cities to cash in on the potential of Telangana.

Peer motivation is also helping. “Veteran IFAs like Sanjay Khatri, Roopa Venkatakrishnan and others travel to our city to motivate and share their tips with budding IFAs. This helps us remain motivated and learn from their practices,” says Shiva.

Also, banks which have large networks are increasingly focusing on distributing third party products like mutual funds which is providing impetus to the industry. Further, new age investing tools like mobile apps and robo advisers/online investing portals are helping the industry reach out to investors in the remotest towns. Market regular Securities and Exchange Board of India (SEBI) permits fund houses to give higher incentives to distributors in beyond thirty cities to boost the mutual fund penetration.

Increase in equity assets are a function of two factors – mark-to-market gain and fresh inflows. The Sensex has jumped 45% during the past five years.

After Telangana, Jharkhand has seen the second highest growth in equity assets (in percentage terms). Equity assets in Jharkhand increased from Rs 1,992 crore to Rs 11,098 crore in the past five years. Similarly, Punjab is not far behind. Equity assets in Punjab increased from Rs 3,610 crore to Rs 16,129 crore during the same period.

The equity AUM in Uttar Pradesh has increased from Rs 11,992 crore to Rs 52,598 in five years. Shifali Satsangee of Funds Ve'daa says, “The industry campaign has helped allay fear about mutual funds. Generally, there is a lot more acceptance and awareness about mutual funds. Some of the other factors for this growth are increasing retail assets coming through systematic investment plans, ease of onboarding clients and online transaction facilitation through digital channels and increasing thrust on investor awareness seminars conducted by IFAs.” Funds Ve'daa, which operates from Uttar Pradesh, has seen its assets under advisory grow from Rs 170 crore in 2014 to Rs 400 crore in 2019. (This AUM also contains fixed income assets.)

Maharashtra continues to hold the mantle of the state with highest equity assets at Rs 2.84 lakh crore. Maharashtra has recorded 170% growth in equity assets from Rs 1.05 lakh crore in September 2014 to 2.84 lakh crore in September 2019.

After Maharashtra, New Delhi is the second largest market for equity funds. In the last five years, equity assets in New Delhi have increased from Rs 18,341 crore in September 2014 to Rs 82,082 crore in September 2019.

Lakshadweep has the lowest level of penetration with equity AUM of Rs 4 crore.

Total industry equity AUM

In the last five years, the industry has added Rs 6.27 lakh crore equity assets to its kitty. As a result, the equity asset base increased from Rs 2.79 lakh crore to 9.06 lakh crore during this period. Maharashtra contributed the highest (29% or Rs 1.79 lakh crore) in this growth.

Advisers believe that India still remains an unpenetrated market for mutual funds and while the growth so far is commendable, there is a long way to go.