Arbitrage funds, which leverage price differential in cash and derivatives market, to generate returns are gaining traction among high net worth investors in recent times.

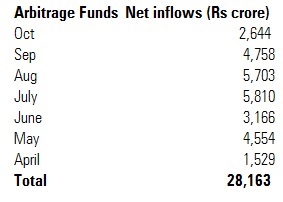

From April 2019 till October 2019, arbitrage funds have received net inflows of Rs 28,163 crore. “Arbitrage funds as a category seem to be continuing to attract investor attention probably on account of their relatively stable returns and tax efficiency,” says G Pradeepkumar, CEO, Union Mutual Fund.

“There is a flight to safety among some investors from debt funds which have been in the news due to credit events. Investors in the higher tax bracket make better post-tax returns in arbitrage versus liquid funds. The markets have been volatile which has provided a good opportunity for this category. Also, the awareness about this category has increased,” says Hemant Rustagi of Wiseinvest Advisors.

Equity funds pay dividend distribution tax of 11.64% (including surcharge and cess) while liquid funds pay 29.12% DDT (including surcharge and cess). This puts arbitrage funds in an advantageous position. Also, the short-term capital gains tax in arbitrage funds is 15% while investors in the higher tax category have to shell out 30% tax in liquid funds.

Investors moving to short duration funds

Overnight funds received inflows of Rs 5,748 crore in October.

Medium and long duration funds saw outflows while ultra-short term, low duration and money market funds received combined inflows of Rs 15,874 crore in October 2019. Ultra short duration funds category has delivered 7.52% return over one year period while money market funds have delivered 7.54 % return during the same period.

Due to September quarter end, liquid category had seen net outflow of Rs -1.40 lakh crore. In October 2019, liquid funds received inflows of Rs 93,203 crore.

Equity flows

Net inflows in Equity ETFs increased substantially from Rs 1,033 crore in September to Rs 5,906 crore in October 2019. Index funds received inflows of Rs 779 crore. “Passive funds did well when only a few stocks contributed to the market rally. As a result, passive funds outperformed active funds in the past. However, there is a broad-based market rally now due to which active funds are doing better than passives,” added Hemant. Hemant says that liquidity is still a concern in ETFs and index funds in India.

Inflows in equity funds fell marginally in October 2019 to Rs 6,026 core from Rs 6,609 crore in September 2019. The AUM of equity funds increased by 3% from 7.01 lakh crore (excluding ELSS and ETFs) in September 2019 to Rs 7.25 lakh crore in October 2019.

SIP AUM crosses Rs 3 lakh crore

The systematic investment plan inflows dipped to Rs 8,245 crore in October 2019 from Rs 8,263 crore in September 2019. SIP assets have crossed Rs 3 lakh crore mark in October 2019. “The SIP flows have remained robust even in the face of continued volatility in the market which augurs well for the mutual fund industry as well for the broader markets. It is also encouraging that there has been about 65% increase in the number of new SIPs," added G Pradeepkumar.

Gold ETFs

After receiving net inflow of Rs 145.29 crores and Rs 44.11 crores in August and September respectively, Gold ETFs witnessed a net outflow of Rs 31.45 crores in October, largely due to profit booking.

“For a long time, especially after its spectacular run in 2011 and 2012, gold prices have largely remained muted, except for some intermittent surge in prices. Therefore, it was after a long hiatus that gold has found its mojo back this year and delivered one its best performance of recent times. While this attracted investor attention and the category received net inflows in August and September; this also provided investors a profit booking opportunity, especially given the uncertainty over its future course,” says Himanshu Srivastava, Senior Research Analyst, Morningstar Investment Advisers India.

Gold ETFs manage assets worth Rs 5,574 crore as on October 2019.