Services offered by advisers are intangible. This could make it difficult for clients to understand why they should pay fee to distributors/adviser, bundled or unbundled.

Further, rising popularity of low-cost DIY investing and availability of a repository of information at fingertips could lead clients to manage their investments on their own. But just like a dentist or doctor can’t perform a surgery on his own body, investors can harm themselves by thinking they can cure their financial woes independently. Here are some ways financial advisers add value in client’s lives.

Professional Expertise

Today, a plethora of information on personal finance is available on internet. Clients may think that they could read a few articles on Google and invest in products on their own. Further, the popularity of DIY investment apps and portals has attracted millennials. Though investors can gain some degree of knowledge through reading but it may not be enough to help them tide over when markets turn volatile or when they need to get out of bad investment choices. Investors can get lured by past returns and end up investing in sector funds and regret the decision later. The recent spate of credit events serves as a good example of how clients can burn fingers without seeking professional advice. In such situations, advisers who bring decades of experience coupled with professional qualifications like CFP and CFA help clients make smart investment decisions. Advisers will monitor client portfolio regularly and rebalance the asset allocation to make sure they reach their goals.

Avoid Costly Mistakes

In India, it is common for investors to acquire a pile of debt by buying discretionary products or ‘invest’ in insurance for saving. I have come across friends who pay just the minimum due of their credit card bill without realising how the interest can compound. Some even end up taking personal loans to clear off their credit card bills! A good adviser will help clients get out of expensive debt like credit card/personal loans, avoid illiquid investments and make their money work harder for themselves. Adviser will act in client’s interest and helps them increase savings, avoids mistakes and manage their expectations and behaviour.

Bespoke Solution

Every client is unique. Someone in his 30s might be planning to buy his/her first house while someone in his/her 40s could be planning to generate corpus to fund children’s higher education abroad. Life goals, except for retirement, could change. This requires regular interactions with clients to understand how their priorities are changing and adjust the plan accordingly. Advisers gain insights on client behavioural aspects by being in regular touch and handhold them through their emotional moments to help them make rational decisions. This may not be achieved through DIY portals who offer standardised solutions based on pre-determined risk assessment questionnaire.

Behavioural Coaching

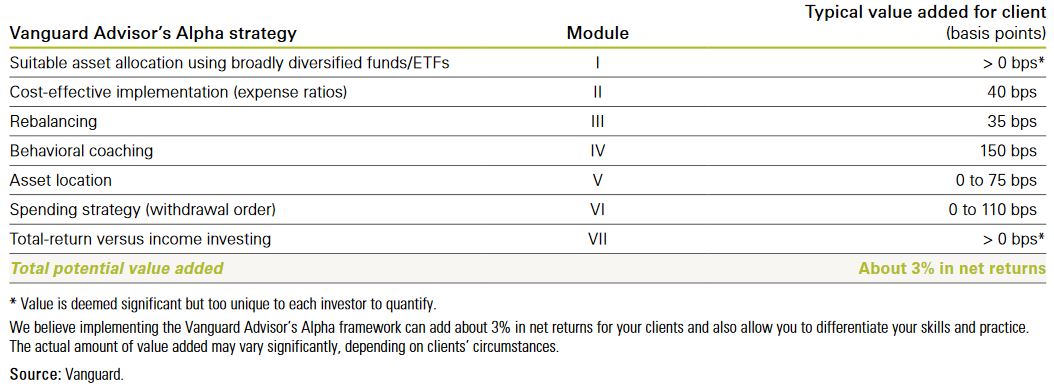

Research in behavioural science shows that cognitive biases and other behavioural obstacles often inhibit investors from making sound financial decisions, especially when their emotions are running high. Advisers help clients in different situations like a market crash, herd investing, help overcome choice paralysis and other such behavioural biases faced while investing. Vanguard’s study shows that advisers can add 150 bps additional returns through behavioural coaching.

Holistic Approach

People often end up investing in different products over the years through banks, LIC agents and their financial adviser, and some investments done on their own. Many investors would have not even discussed or kept their family members informed about these investments. In any unfortunate event, family members are ones who would suffer. Ideally, one should have all investments done through a single adviser to declutter and more importantly to have peace of mind.

Investment Advisers are not like transactional salespeople who will vanish after executing one transaction. They will ascertain your life goals, sources of income & expenditure, risk appetite, draw up a plan to achieve your goals. They will educate investors, seek feedback, and try to be client’s trusted source of adviser for a lifetime.

Alpha and Gamma

A Morningstar study present a concept called “Gamma” which measured the value added achieved by an individual investor from making more intelligent financial planning decisions. It revealed that better planning done by advisers allows for an increase in retirement income of 29%. Another study by Vanguard states that advisers add about 3% in net returns. The table below shows how advisers can add value through different ways.

Though studies have attempted to quantify adviser value, it can be difficult to approximately quantify it. Investment performance seems to be the obvious barometer. But returns are not in advisers’ control. They can only manage asset allocation, diversification and investors behaviour. The value add for each client would differ based on their unique circumstances.