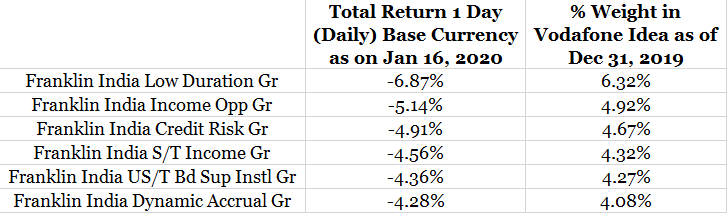

On January 16, 2020, Franklin Templeton Mutual Fund proactively marked down its investments in Vodafone Idea Limited (VIL) held in its fixed income schemes to zero. Consequently, the fixed income funds, having exposure to these securities, witnessed a sharp fall in their NAVs and one day return as of January 16, 2019 (see visual below).

What Triggered the Mark Down?

This development is largely in lieu of the financial strain that telecom companies such as Vodafone Idea Limited have been going through given their enhanced financial liability. As per the fund house ‘Pursuant to the Honorable Supreme Court (SC) decision on the interpretation of Adjusted Gross Revenue (AGR) for computation of license fee, the financial liabilities of several telecom operators including VIL stand increased significantly. A review petition was filed by VIL before the SC on account of the fast approaching deadline of January 23, 2020 to discharge the dues, and the SC dismissed the review petition on January 16, 2020.’ As per the news reports, with this decision, VIL has admitted its inability to retain financial solvency in the absence of relief measures, given the huge quantum of AGR dues which they are required to pay immediately. Because of the uncertainty arising in the light of the ongoing scenario in case of VIL, the fund house took the decision to proactively mark down its exposure in the debt securities of the company.

Why Not Side Pocketing?

This could raise a question as to why the fund house didn’t side pocket VIL exposure. And the answer to that is that there has not been any rating action yet on this security, which as of now carries an investment grade rating of either CRISIL BBB- or CARE BBB-. A security can be side pocketed in case of a downgrade to a rating below investment grade.

The Purpose of Proactively Marking Down the Security

As per the fund house, the idea is to protect existing unitholders interest. Infact, the valuation adjustment here only reflects the realisable price of the relevant securities on the date of valuation and does not indicate any reduction or write-off of the amount repayable by VIL.

Moreover, fresh inflows in the schemes having exposure to VIL have been limited to INR 2 lacs per day per fund per investor, till further notice. This limit is imposed only on the new applications received after the cut-off time on 16th January 2020. This is to ensure that the interest of existing unitholders does not get diluted to a large extent in case of debt recovery form VIL.

Impact on Investors and the Approach they should Adopt

The fall in returns may put many investors in panic mode and prompt them to take hasty decisions, and the most obvious one would be to exit the funds. However, we would like to advise them to adopt a more measured approach towards this situation. For starters these securities have been pre-emptively marked down to zero and thus there is no further loss possible on these holdings. The fund house will now need to work with the borrower towards a resolution. The best thing for investors to do would be to see if these funds meet their requirement and are in line with their risk appetite and continue to hold on to their investment if that is the case.

Investing in Sub-AAA rated segment of the Indian bond market forms the crux of the investment strategy followed by the fixed income team at Franklin Templeton Mutual Fund. Over the years, they have mastered the art of investing in sub-AAA rated segments. They have created a niche for themselves by being one of the largest players from the mutual fund industry in double-A and single-A rated segments of the fixed income market. Although to the team’s credit, they have done well despite intermittent hiccups, it’s important to comprehend that that credit risk is inherent to such an investment approach.

Clearly, with Indian fixed income markets witnessing significant credit crisis for some time now, this investment style has been out of favour. Infact in 2019, the team saw few of their investments defaulting on the debt obligations for which the funds had to absorb haircuts. For instance, the fund house had to take significant markdown, to the extent of 60%, on its exposure in Reliance Infrastructure Consulting & Engineers Private Limited, Reliance Big Private Limited and Reliance Broadcast Network Limited.

Investors must therefore ensure the aptness of such funds in their portfolio before investing. They need to evaluate them from the perspective of their risk appetite. Investors who doesn’t have the risk appetite required to invest in credit funds, they would be better-off investing in funds which generally invest in AAA rated securities. Short-term volatility tags along with such funds and it becomes more prominent in an environment which we have been witnessing over the last two years. Therefore, we believe that investments in credit-oriented funds should be made with a long-term investment horizon of not less than 3 years.

This is an evolving scenario which at Morningstar we will continue to watch closely. We will update our readers on any development in this regard with our view and the step forward for them.