The Corona Virus has rattled markets with the Sensex diving 29% from its high. But SIP investors are not hitting the panic button on their investments.

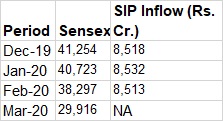

The Sensex has been on a free fall since December 2019, from 41,253 levels to reach 29,915, dipping by 27%. However, investments from SIPs are steady which is evident by the table below.

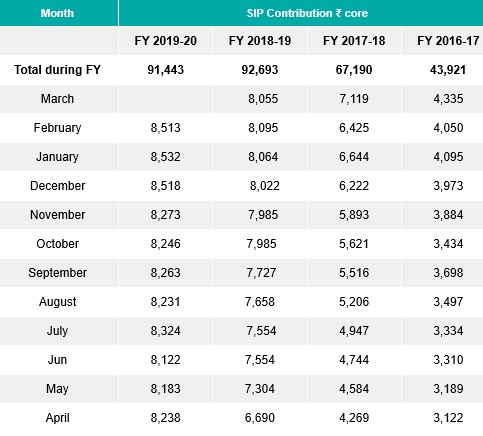

In fact, the industry is estimated to get 7% higher inflows through SIPs this fiscal year in comparison to last fiscal. From April 2019 till February 2020, the industry has received inflows of Rs 91,443 crore through SIPs. In FY 2018-19, the industry had received inflows of Rs 92,693 crore. Even if we account for a 5 % dip in SIP net inflows in March 2020 (from Rs 8,500 crore to Rs 8,075 crore), the industry could receive total net inflows of Rs 99,443 crore in FY19-20, 7% more compared to previous fiscal. Experts say some investors are looking at this as an opportunity to invest lump sum and there has been no rush to pause SIPs.

Association of Mutual Funds in India (AMFI) data shows that the industry has added on an average 9.95 lakh SIP accounts each month during FY 2019-20, with an average SIP size of about Rs 2,750 per SIP account.

As on February 2020, the SIP assets stood at Rs 3.11 lakh crore, which is 11% of the total industry assets. There are 3.10 crore SIP folios as on February 2020. A large chunk of SIP inflows continued to come via regular plans. Of Rs 8,513 crore SIP inflows in February 2020, regular plans received Rs 7,229 crore while direct plans mopped up Rs 1,284 crore.