With the impact of the Coronavirus and the subsequent lockdown globally, we have seen significant drawdowns in the equity markets since mid-February. While Indian small & mid-caps have been in correction mode since early 2018. Large caps had made new highs in Jan 2020. The correction has been swift and unrelenting across the board, with stocks across sectors and market capitalizations witnessing a sharp drop in prices. Equity mutual fund performance has been no different in this bear market, although we have witnessed several funds fall lesser than their category benchmarks.

We look at performance of the various equity fund categories as well as some of the best and worst performing funds. We also discuss the concept of Downside Capture Ratio of funds and its implications.

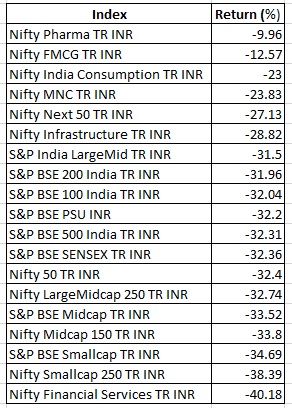

Index Movement (Feb 19, 2020 to April 3, 2020)

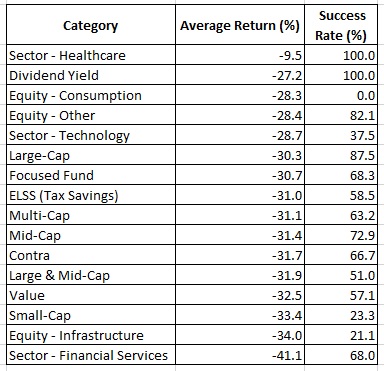

Category Performance (Feb 19, 2020 to Apr 3, 2020)

*Success rate is defined as % of funds beating the category benchmark.

Healthcare funds have been the most resilient during this fall, followed by consumption funds & technology funds. Amongst the diversified funds, large caps have fallen the least. Amongst the worst performers have been financials and infrastructure funds. The other interesting point to note is the significant fall in the value category, although this is also driven by the performance of a few funds that more oriented towards mid & small cap stocks which have fallen more significantly.

Several diversified categories have displayed significant success rates (% of funds falling lesser than the category benchmarks). Large caps witnessed 87.5% of the funds fall lesser than their category benchmark. For mid-caps this is at 72.5% and multi-caps at 63.2%. On the other hand, many small cap funds struggled with only 23.3% funds falling less than the benchmark. We have typically observed that funds tend to fall lesser than their benchmarks during a bear market. This can be observed using the Down Capture Ratio. While in a bull market most funds will typically capture a significant part of the upside of the benchmark return but not the entire upside. This can be observed using the Up Capture Ratio. A combination of a lower Down Capture Ratio and reasonable Up Capture ratio leads funds to outperform their benchmarks over a market cycle.

Best and Worst Performing Funds

Leaving aside the Healthcare (Best) and Banking Funds (Worst) aside here are some of the best and worst performing funds during this fall:

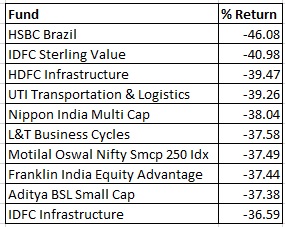

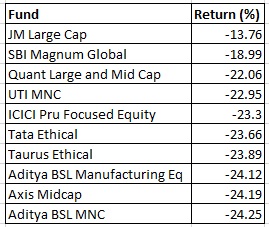

Funds with the biggest fall (Feb 19, 2020 to April 3, 2020)

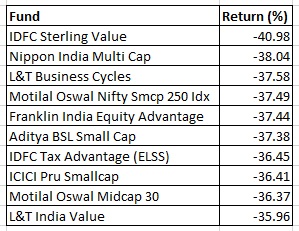

Diversified Equity Funds with the biggest fall (Feb 19, 2020 to April 3, 2020)

Funds with the lowest fall (Feb 19, 2020 to April 3, 2020)

This list comprises mostly of global funds, where the equity drawdowns have been lower than that of the Indian markets plus the added benefit of INR depreciation, helped these funds perform relatively better during these markets.

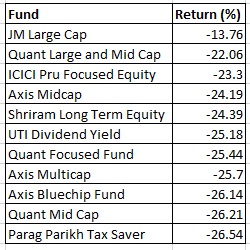

Funds with the lowest fall (India Equity only) (Feb 19, 2020 to April 3, 2020)

Funds with a focus towards MNC stocks and Ethical (Shariah Compliant) funds have fallen lesser than the market during this fall. Also, funds that have been holding a fair amount of cash, expectedly fell to a lesser extent than the market.

Funds with the lowest fall (India Diversified Equity only) (Feb 19, 2020 to April 3, 2020)

Down Capture Ratio

Downside Capture Ratio measures fund’s performance in down markets. A down-market is defined as those periods (months or quarters) in which market return is less than zero. In essence, it tells you what percentage of the down-market was captured by the fund. For example, if the ratio is 110%, the fund has captured 110% of the down-market and therefore underperformed the market on the downside. A number lower than 100% indicates, the fund has outperformed its benchmark in a falling market. Lower the Down Capture Ratio the better.

Over historical periods of down markets we have witnessed that typically most funds outperform their benchmarks.

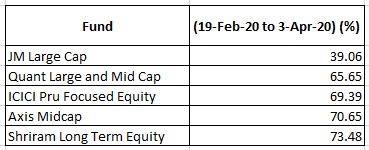

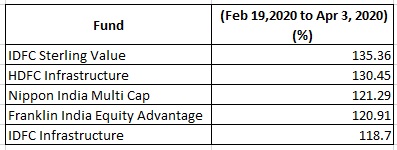

In the recent market fall, here are the top 5 and bottom 5 funds by Down Capture Ratios.

Best Down Capture Ratio (Feb 19, 2020 to April 3, 2020)

Worst Down Capture Ratio (Feb 19, 2020 to April 3, 2020)

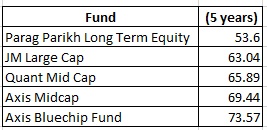

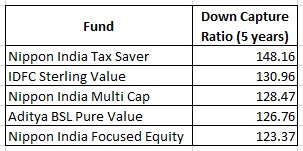

Over the longer term (5 years), here is a list of Top 5 and Bottom 5 funds by Down Capture Ratio

Best Down Capture Ratio (%)

Worst Down Capture Ratio (%)

Down Capture Ratio is a useful data point to evaluate and shortlist funds from the context of choosing funds that cushion portfolios can during market falls. Although this needs to be looked at in conjunction with the Up Capture Ratio and cash levels as well as conducting a holistic analysis on the fund on quantitative and qualitative parameters before making an investment decision.