When markets correct as sharply as they did in March, due to the COVID-19 crisis, some of us are tempted to just sell everything and sit on cash. And not for the first time. From trade wars to Brexit, to now the dramatic implications of the coronavirus, we’ve had plenty to deal with. But ‘staying the course’ is also an art that some of the world’s most successful investors have mastered.

The key here is to focus on the goal that you set in the first place and ensure that your behaviour is aligned to it.

Most of us investors are hard-wired to be pro-cyclical, chasing the winners and selling out what we think are losers because of a desire to make our money work harder for us. If you see the inflows that mutual funds have got in the last 20 years and in what periods they’ve got their maximum inflows, it show that investors pour more amounts when markets peak than when they hit the bottom.

Is staying on course really beneficial?

The best thing investors can do when contemplating change is to reflect on their goals.

Ask yourself:

- Given where I am now, what actions move me closer to my long-term goals?

- Would an investment-change align with the original plan for reaching well-defined goals?

No doubt losses are painful. But reactivity to losses can induce a person to act rashly and make things worse in the long run.

So, the key question to ask is whether anything has fundamentally changed since setting the original strategy or whether it’s just that you are disappointed with your progress toward your goals.

If something has fundamentally changed, the question to ask is, whether you can clearly identify what has changed. Write it down; then balance this by stating what it might mean if you’re wrong. This should include any misjudgement risk as well as the added costs if you decided to change investments (given where you are now). You may often find that the impulsive change you desire is not necessarily going to increase the probability of reaching your goals.

If it has “just” disappointed you, but nothing has fundamentally changed, the likely best option is to stay the course. By remembering that markets never move in straight lines, you may avoid the perils of trying to time the market. Furthermore, you may benefit by doing the opposite of what your intuition suggests and teach yourself to be a contrarian. Simply put, when markets fall, your portfolio is already hurt, and that's in the past.

A contrarian views this volatility as an opportunity to find overlooked value in the market and invest in solid companies available at low valuations.

Therefore, it is vital that as investors we remain aware of how animal spirits can drive irrational decision-making, and adopt a well-reasoned and principled framework for investing. Principles matter; it is easy to have principles with a nice tailwind and smooth waters. But those calm conditions are not when principles are most valuable.

The importance of staying invested

Look at the chart above. If you had invested Rs 1 lakh in 2000 and stayed put, you’d have made Rs 5.48 lakh so far. If, after the global financial crisis of 2008, you had shifted to cash for just a year and then shifted back to equities, you’d have made Rs 2.68 lakh by 2020. If you had stayed in cash all throughout from 2009 onwards, never wanting to invest in equities again after the 2008 crisis, you’d have ended up with just Rs 2.47 lakh.

Clearly, staying the course turned out to be the best option.

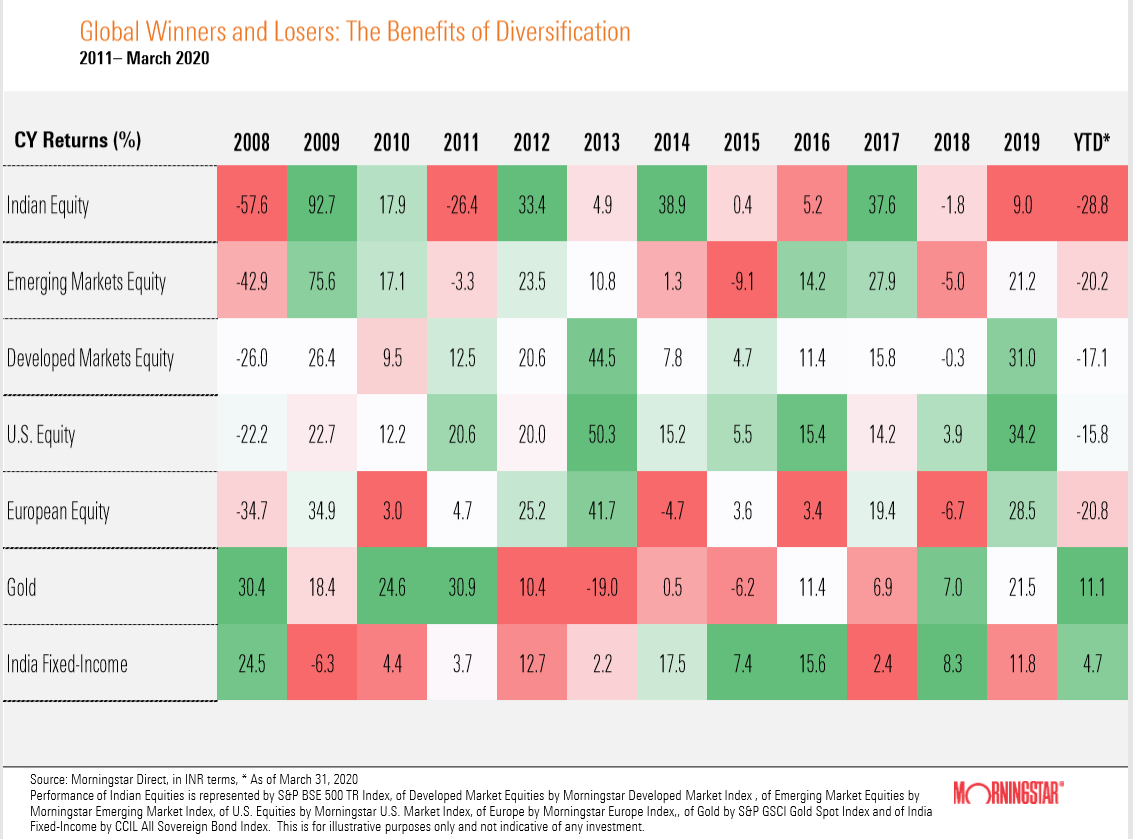

Diversification insulates the portfolio

In the context of investing, diversification is the strategy of holding more than one type of investment – stocks, bonds, or cash – in a portfolio, to help reduce risk. In addition, investors can diversify their stock holdings by buying a combination of large, small, or international stocks, and their bond holdings by buying short-term and long-term, government, or high and low-quality bonds.

A diversification strategy helps reduce risk because stocks, bonds, and cash generally do not react identically in changing economic or market conditions. This is especially true for assets whose underlying fundamentals—the source of their cash flows—differ from other assets in the portfolio.

The typical Indian investor holds a financial portfolio consisting of Indian equities/funds and bonds. Interest rates are a key driver of bond and equity market performance. Any major changes in domestic interest rates may significantly impact both asset classes. For instance, in 2013, when domestic interest rates rose sharply in response to RBI’s measures towards controlling the steep INR depreciation due to global events, both Indian equity and fixed income markets witnessed sharp drawdowns. In such a scenario, holding assets such as international equities in a portfolio may provide additional diversification benefits, by offering a currency hedge and exposures to different economic growth drivers.

Diversification does not eliminate the risk of experiencing investment losses; however, by investing in a mix of these instruments, investors may be able to insulate their portfolios from major downswings in any one investment.

The benefits of diversification become more apparent over a shorter time period, such as the 2007-2009 Global Financial Crisis. Investors who had portfolios comprising only stocks, suffered large losses, while those who held bonds or cash in their portfolios experienced less severe fluctuations in value.

This article is written by DHAVAL KAPADIA, portfolio specialist at Morningstar Investment Advisors India. It originally appeared on MoneyControl.com