The sharp correction in markets in response to the COVID-19 pandemic has opened up buying opportunities for small cap fund managers. Fund houses like DSP, SBI and Nippon have started accepting lumpsum investments in their small cap funds.

The BSE Small Cap Index has plunged by 25% YTD. The correction is across sectors. BSE Mid Cap and BSE 100 are down by 24% and 25%, respectively. To capitalise on this opportunity, few fund houses have opened gates for lumpsum investments in their small cap funds.

DSP Small Cap Fund, which managed little over Rs 5,000 crore as on February 2020 has started accepting lumpsum flows from April 1, 2020. Similarly, SBI Small Cap Fund intends to open the fund for lumpsum flows till it gets net inflows of Rs 1,000 crore. Reliance Small Cap, the second largest fund (Rs 8,567 crore) in the category as on February 2020, has started accepting lumpsum flows without any upper cap. (The AUMs of some of these funds have fallen in March 2020 due to the correction in market.)

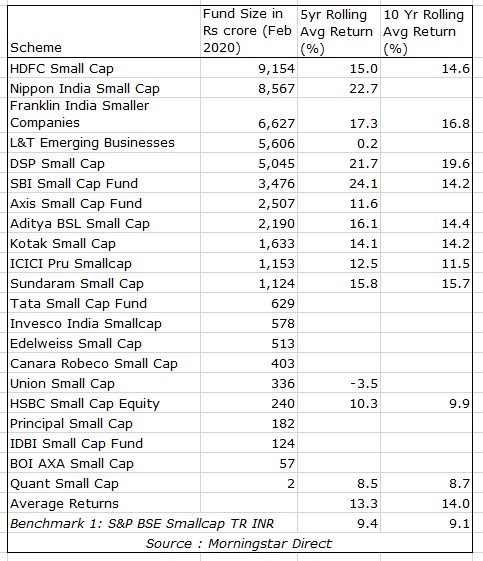

To see how small cap funds have fared, we ran the data on Morningstar Direct over a 15-year period. We looked at the rolling returns for every five-year period (for instance, 2005-10,2006-11 and so on).

The category average 5-year rolling return tracked from 2005-20, shows that small category has beaten the benchmark S&P BSE Small cap TRI by a good margin. The small cap category generated 13% CAGR while the benchmark yielded 9.37% average return during this period. The returns were almost similar over ten-year period which can be seen in the table below.

Performance of small cap funds

Returns as on April 3, 2020.

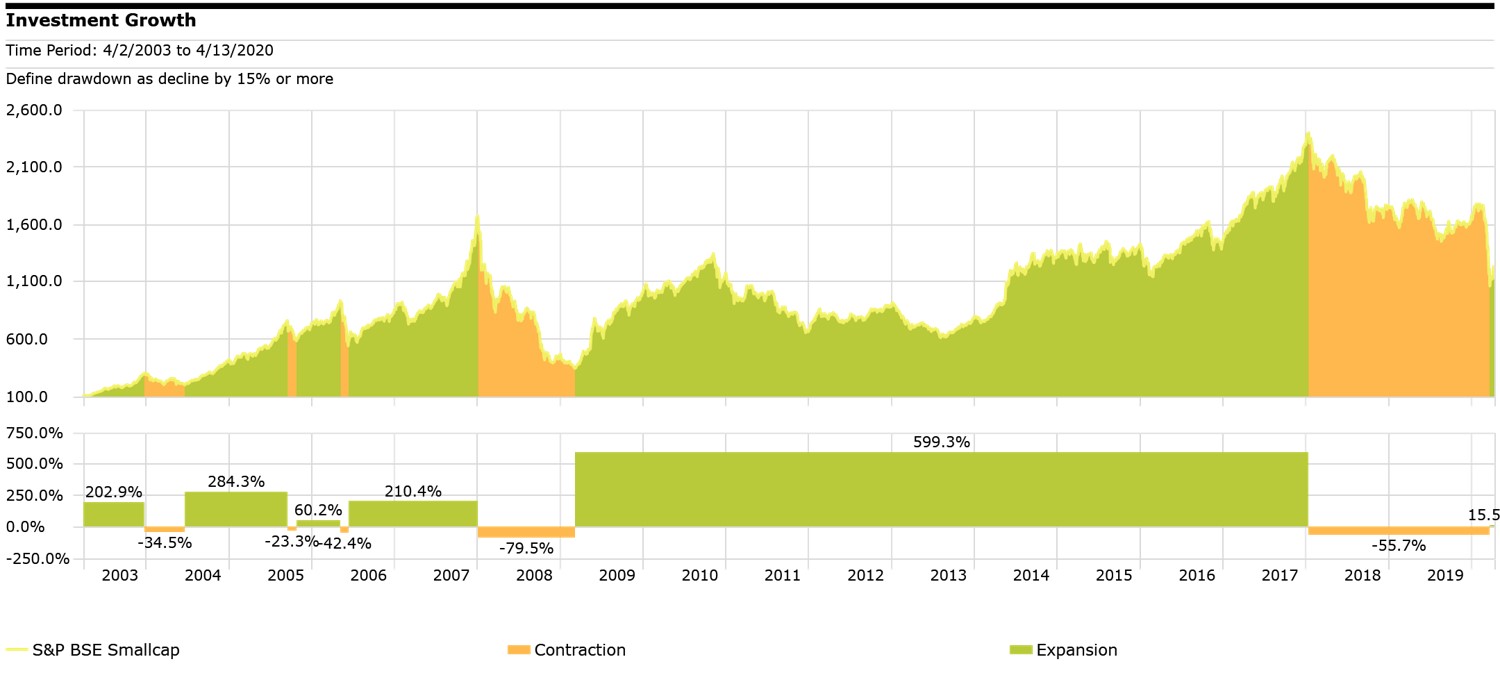

Investment Growth of Rs 100 since 2003

While the category has generated handsome returns over long term, the returns can be quite volatile during short periods. For instance, if we look at the most recent data (April 2019-April 2020), some funds have fallen by over 40%. On an average, the small cap fund category has yielded negative 32% return on an absolute basis during this period. The BSE Small Cap Index has dived by 36% during the same period.

Stock selection is key

Dhaval Kapadia, Director, Portfolio Specialist, Morningstar Investment Adviser India, says that stock selection plays a pivotal role in generating alpha in the small cap space. “Given the sharp correction (50% to 60%) in small cap indices since early 2018 initially due to high valuations and economic slowdown and more recently due to Covid-19 related concerns, from a valuation perspective, small caps look attractive relative to 2017. From a fundamental growth standpoint, small caps are a more diverse basket vis-à-vis large & mid cap due to higher uncertainty in earnings & cash flows, hence stock selection is key. We were underweight Indian equities, particularly small & mid-caps since April 2019 (when the Morningstar Managed Portfolios were launched). Since September/October 2019, we’ve been reducing these underweight positions given the continuing correction in small & mid-caps. Over the last few weeks, we’ve further narrowed the underweight vis-à-vis our neutral or benchmark allocations considering the underperformance of small & mid-caps vs large caps, leaving only a marginal underweight position.”

Fund managers have a universe of 100 stocks in large cap, 150 in mid-caps and over 4,000 companies in small cap category. Of course, not all companies in the small cap universe is investible due to low liquidity.

Small caps are nimble

Small cap stocks tend to rebound faster than large caps when the economy recovers. This is because small firms can respond to market opportunities and implement ideas faster in comparison to large ones due to their organisation structure. It is worth noting that small caps witness larger drawdowns in comparison to their large cap peers during a downturn.

Should you invest?

Investors who do not have any allocation to small cap funds, have the risk appetite for digesting higher volatility and an investment horizon of 7-10 years could look at allocating some portion to this segment. That said, we don’t recommend investors to time the market when it come to investing in small cap funds. It is best to follow the asset allocation approach. Staggering investments through SIP/STP would be ideal.

How should investors go about selecting the right fund? Vinod Jain of Jain Investments suggests that the fund size should ideally be Rs 500 crore to Rs 1,500 crore. This is because the liquidity in this segment tends to be thin and small funds can enter and exit stocks swiftly in comparison to larger funds. Also, Jain recommends investors to evaluate the existing portfolios of these funds to get an idea about the underlying companies.

“Investors should consider a fund’s size and ability to manage flows while picking a scheme. Funds receiving significant flows may have to hold higher cash levels to ensure effective deployment into small- caps given constrained liquidity on these counters,” says Kaustubh Belapurkar, Director – Manager Research, Morningstar Investment Advisers India.

For instance, a fund with Rs 9,000 crore assets with 2% holding in one stock will be worth Rs 180 crore. It could be difficult for a manager to liquidate Rs 180 crore swiftly and buy another stock worth Rs 180 crore. Whereas, a fund size with Rs 400 crore will have to deal with just Rs 8 crore.

Further, Jain says that low PE should not be the sole reason for investors to increase allocation towards small caps and recommends investors to take a balanced approach. “If investors already have exposure to small caps based on their current asset allocation (say 5% - 10%), then they should stick to it. Don’t increase allocation just because funds have started accepting lumpsum investments. It is not that only small cap stocks have fallen. The correction has been across large and mid-caps too. Don’t increase allocation to small caps disproportionately. There is no visibility on earnings due to the lockdown. Nobody can make prediction based on the PE multiple of the market.”

To sum up, taking a staggered approach to investments in small caps would be ideal if you have zero allocation to this segment. Invest in a mix of equity, fixed income, international funds and gold funds to diversify your portfolio. Consult your financial adviser to understand how different funds fit into your goals and risk appetite.