March 2020 was a torrid month for the equity investors, with the global impact of the COVID-19 crisis and the subsequent lockdown in several countries including India resulting in a risk-off trade from global investors. Indian equity markets corrected as much as 30% through the month and finally ended ~23% down for the month. The fall was swift and brutal and across the entire capitalization spectrum of Small, Mid and Large Cap stocks.

Foreign Institutional Investors for their part sold to the tune of Rs 62,000 crore from Indian equities, which further exacerbated the fall in the Indian markets. On the positive side, this presented a great buying opportunity for domestic investors, who stepped in with significant buying given the relatively attractive stock prices.

Mutual fund investors kept the faith and continued to invest into equity funds with net inflows of Rs 11,700 crore in actively managed equity funds plus another Rs 6,900 crore in Index Funds and ETFs. In addition to this, equity fund managers deployed cash levels to buy additionally into stocks and allocation fund managers rebalanced portfolios after the crash to bring equity allocation levels back up by buying into equites. Many Dynamic Asset Allocation funds used the attractive valuations to increase net equity exposure in their portfolios. This resulted in Indian Mutual Funds buying an estimated Rs 34,300 crore in Indian equities in March 2020.

In this article we look to analyze the estimated buying activity of Indian Mutual Funds across market capitalizations and sectors and stocks.

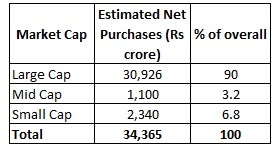

Estimated Net Purchase by Market Capitalization (March 2020)

Includes the Rs 1,750 crore IPO subscription to SBI Cards and Payments.

Managers had a clear focus towards large cap stocks, with Rs 30,926 crore invested in large cap stocks, which accounted for 90% of the overall equity investments made in March 2020. There has been a clear preference towards large cap stocks, given the sharp correction in stock prices leading to attractive valuations on several bluechip stocks which are expected to be better equipped to deal with the ongoing crisis and its fallout on the economic scenario.

Estimated Net Purchases by Sectors (March 2020)

Financials stocks were amongst the top picks for several reasons, for starters financials is the largest sector exposure in the broader benchmarks coupled with the fact that as a sector it was amongst the biggest losers in the month. Significant positions were also added in Energy, Technology and Consumer Cyclicals. Healthcare also witnessed some measured additions.

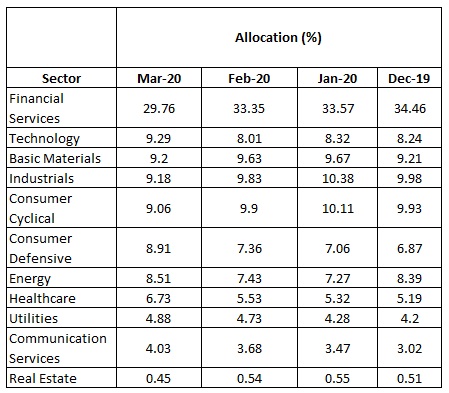

Overall Industry Sector Exposure

Financials still remain the highest owned sector, although the allocations have come off primarily due to stock price movement. Technology continues to see steady additions, albeit primarily in a couple of names (TCS & Infosys). Healthcare is still under owned but has risen based on a relative stock price outperformance.

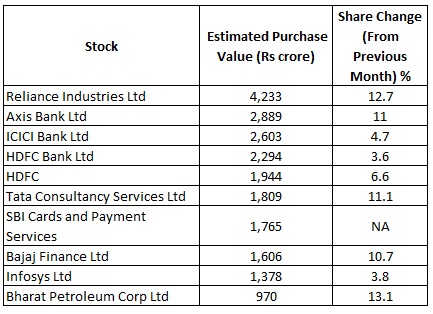

Large Cap (Top 10 Buys)

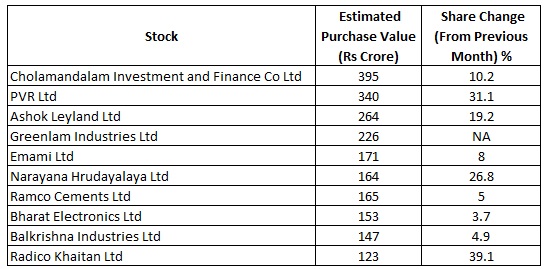

Small & Mid-Caps (Top 10 Buys)

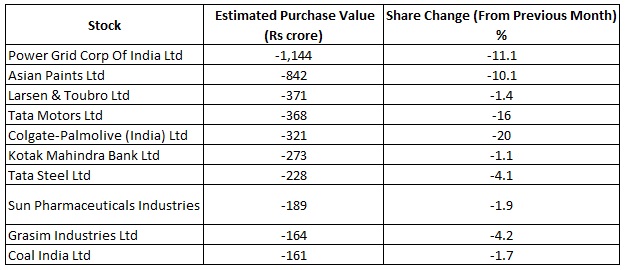

Large Cap (Top 10 Sells)

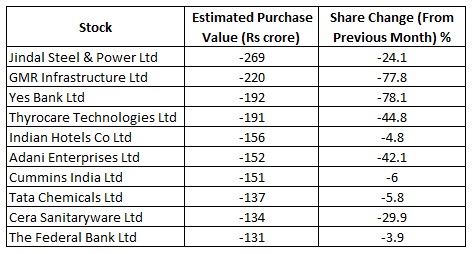

Small & Mid-Caps (Top 10 Sells)

As is evident from the market cap and sector data, benchmark heavyweights, especially from the financials space saw significant additions. Reliance was the highest bought stock after witnessing a significant price correction in March. ICICI and Axis Bank continue to evince manager interest as did the HDFC twins and Bajaj Finance which also witnessed a sharp correction in March. The SBI Cards IPO was also bought into along with the IT pack of TCS and Infosys. On the Small & Mid Cap side Cholamandalam Finance, PVR & Ashok Leyland witnessed additions after sharp price corrections. Amongst the Large Caps stocks sold, Power Grid saw a fair bit of selling, primarily on the back of selling by the CPSE ETF.

March was a significant month from the perspective of Mutual Funds buying into equities, with managers using the correction to buy into stocks, albeit primarily focused towards index heavyweights. Investor flows have so far remained solid, plus cash levels were used judiciously by managers to buy into during the fall. It will be interesting to see how this activity pans out for the rest of the year w.r.t to investor flows as well as manager preferences towards market caps, stock and sector allocations.

Data Source: Morningstar Direct.