Through a notice dated April 23, 2020, Franklin Templeton Mutual Fund announced its decision to wind up six schemes which faced intense redemption in March 2020 and April 2020.

We have compiled data on these six funds and the maturity profiles of the fund’s underlying papers, calendar year wise (quarterly) which of the funds are likely to receive, which in turn will be used to pay the unitholders.

Please note that the data on which the analysis has been done is based the last published portfolio as on March 31, 2020 and since then there have been considerable outflows and thus the portfolio positions could be different. This data has been compiled on the basis of maturity dates of the underlying papers. Coupon payments and prepayment of the bonds have not been considered.

Once the latest portfolios (April 2020) are out, we will update this data to reflect the same.

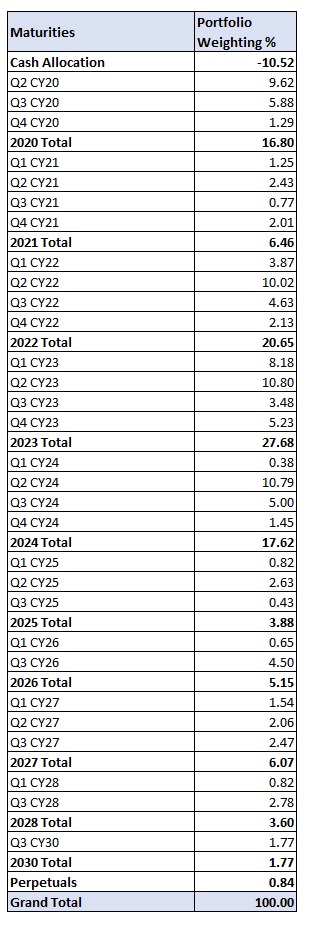

Franklin India Credit Risk Fund

As on March 31, 2020 the fund size was approximately Rs 4,433 crore. This also includes cash borrowings of Rs 466 crore (approx. 10.5% of the portfolio) which the fund has to repay to the banks. The forthcoming potential maturities in CY 2020 over the three remaining quarters is Rs 744 crore. Q2 CY 2020- Rs 426 crore (9.6%), Q3 CY 2020- Rs 260 crore (5.8%) and Q3 CY2020 - Rs 57 crore (1.2%). This constitutes approximately 16.8% of the fund assets. In CY 2021 and CY 2020, there could be potential maturities of Rs 286 crore (6.4%) and Rs 915 crore (20.6%), respectively. Cumulatively, by CY 2022, there would be potential maturities worth approximately Rs 1,946 crore (43.9%) of the fund’s assets. It is worth highlighting that there are three segregated portfolios of the fund consisting of two Vodafone Idea papers and Yes Bank papers which have been marked to zero. As these papers potentially mature, the proceeds will be used to first pay off the existing liabilities and then to the unitholders.

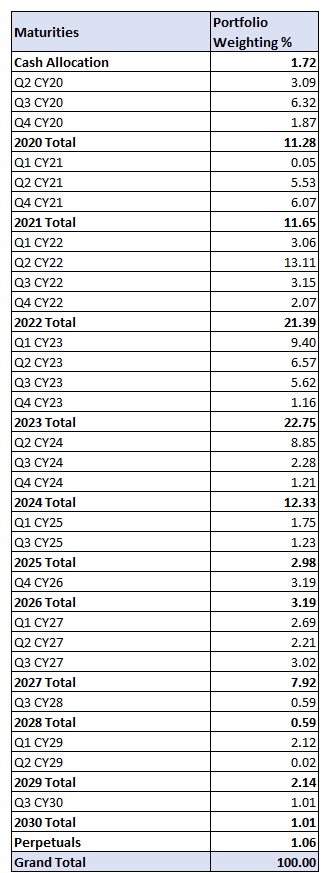

Franklin India Dynamic Accrual Fund

As on March 31, 2020, the fund size was Rs 3,119 crore. The potential forthcoming maturities in Q2 CY 2020 is approximately Rs 96 crore (3%), Q3 CY 2020 - Rs 197 crore (6.3%), Q4 CY2020 - Rs 58 crore (1.8%) which cumulates to Rs 351 crore worth of potential maturities in CY 2020 which is approximately 11.2% of the fund’s assets. CY 2021 and CY 2022 will potentially have maturities worth Rs 363 crore (11.6%) and Rs 667 crore (21.3%) of the fund’s assets. Cumulatively, by CY 2022 we will see potential maturities worth Rs 1,382 crore (44.3%) of the fund’s assets. The fund also has around 1.7% in cash and cash equivalent papers. There are three segregated portfolios of the fund consisting of two Vodafone Idea papers and Yes Bank papers which have been marked to zero. As these papers potentially mature, the proceeds will be used to pay the unitholders.

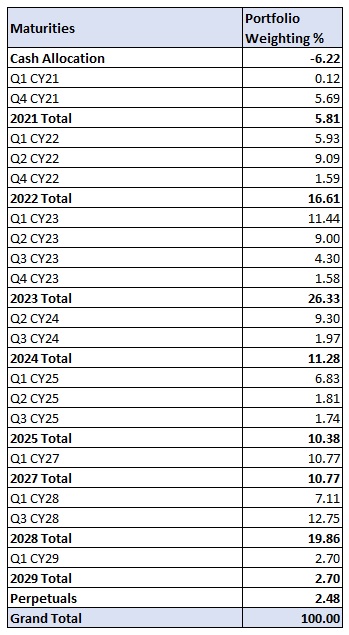

Franklin India Income Opportunities Fund

As on March 31, 2020, the fund size was Rs 2,505 crore. This also includes cash borrowings of Rs 155 crore (approximately 6.2% of the portfolio) which the fund has to repay to the banks. There are no forthcoming maturities coming up in CY 2020. The potential forthcoming maturities in CY 2021 are Rs 3 crore (0.1%) in Q1 CY2021 and Rs 142 crore (5.6%) in Q4 CY 2021. The potential forthcoming maturities in CY 2022 is approximately Rs 416 crore (16.6%) of the fund’s assets. Cumulatively, by CY 2022 there would be potential maturities worth approximately Rs 561 crore (22.4%) of the fund’s assets. There are two segregated portfolios of the fund consisting of two Vodafone Idea papers which have been marked to zero. As these papers potentially mature, the proceeds will be used to first pay off the existing liabilities and then to the unitholders.

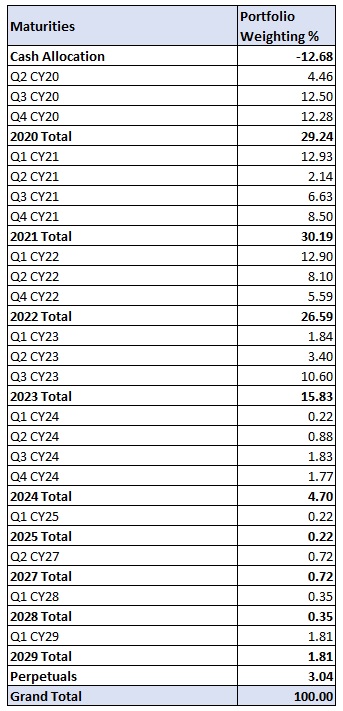

Franklin India Low Duration Fund

As on March 31, 2020, the fund size was Rs 2,737 crore. This also includes cash borrowings of Rs 347 crore (approx. 12.6% of the portfolio) which the fund has to repay to the banks. The potential forthcoming maturities in CY 2020 is approximately Rs 800 crore. Q2 CY2020 - Rs 122 crore (4.4%), Q3 CY2020 Rs 342 crore (12.5%) and Q4 CY2020 Rs 336 crore (12.2%) cumulating to 29% of the fund’s assets. Another 30% of the fund’s assets approximately Rs 826 crore will mature in CY 2021 and a further Rs 727 crore (26.5%) worth of assets will mature in CY 2022. Cumulatively, by CY 2022 there would be potential maturities worth Rs 2,354 crore (86%) of the fund’s assets. There are two segregated portfolios of the fund consisting of two Vodafone Idea papers which have been marked to zero. As these papers potentially mature, the proceeds will be used to first pay off the existing liabilities and then to the unitholders.

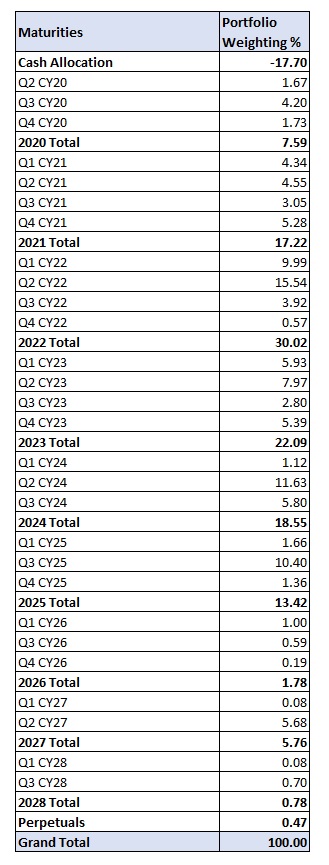

Franklin India Short Term Fund

As on March 31, 2020, the fund size stood at Rs 7,093 crore. This also includes cash borrowings of Rs 1,255 crore (approx. 17.7% of the portfolio) which the fund has to repay to the banks. The potential forthcoming maturities in CY 2020 is approximately Rs 538 crore. Q2 CY2020 - Rs 118 crore (1.6%), Q3 CY2020 - Rs 298 crore (4.2%) and Q4 CY2020 - Rs 122 crore (1.7%) cumulating to 7.5% of the fund’s assets. CY 2021 will potentially see maturities worth Rs 1,221 crore which is 17.2% of the fund’s assets and CY 2022 will potentially see maturities worth Rs 2,129 crore (30%) of the fund’s assets. Cumulatively, by CY 2022 there would be potential maturities worth Rs 3,889 crore (54.85%) of the fund’s assets. There are three segregated portfolios of the fund consisting of two Vodafone Idea papers and Yes Bank papers which have been marked to zero. As these papers potentially mature, the proceeds will be used to first pay off the existing liabilities and then to the unitholders.

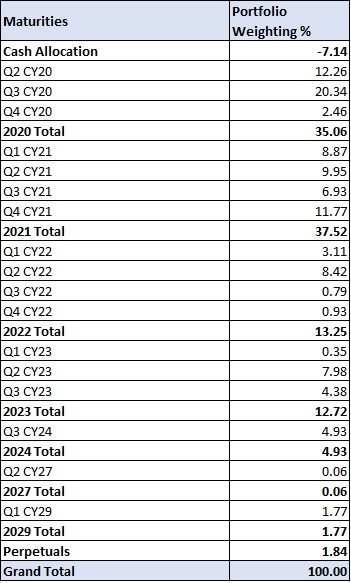

Franklin India Ultra Short Bond Fund

As on March 31, 2020, the fund size was Rs 10,964 crore. This also includes cash borrowings of Rs 783 crore (approx. 7.1% of the portfolio) which the fund has to repay to the banks. The forthcoming potential maturities are Q2 CY 2020 - Rs 1,344 crore (12.2%), Q3 CY 2020 - Rs 2,230 crore (20.3%) and Q4 CY 2020 - Rs 269 crore (2.46%) cumulating to approximately Rs 3,844 crore ~35% of the fund’s assets. CY 2021 and CY 2022 will potentially see maturities worth approximately Rs 4,113 crore (37.5%) and Rs 1,452 crore (13.2%) of the fund’s assets respectively. Cumulatively, by CY 2022, the fund will potentially see maturities worth Rs 9,410 crore (85.8%) of the fund’s assets. There is one segregated portfolio of the fund consisting of Vodafone Idea papers which have been marked to zero. As these papers potentially mature, the proceeds will be used to first pay off the existing liabilities and then to the unitholders.