It certainly is not the most desirable situation to be in; not for the investor, not for the industry, not for the asset management firm in question.

Franklin Templeton Mutual Fund, or FT, abruptly wound up six schemes, pulling the carpet from under everyone’s feet. The move was instigated by a dearth of liquidity coupled with huge redemptions.

This is not the space where we attempt to explain FT’s moves. We received a fair amount of flak for our positive ratings on the specified funds. This is where we tackle the issue head-on.

Has this event surprised us? Of course it has.

Were we completely off the mark with our ratings? Not at all. And we tell you why.

Our history on FT’s ratings go back years.

When it came to the Indian fixed income market, Franklin Templeton Mutual Fund was one of the early entrants in the lower credit space. Cognizant of the risk that is inherent to such strategies, they developed a research-intensive investment process and security selection framework around it. With a unique investment style, it was not long before they created a niche for themselves.

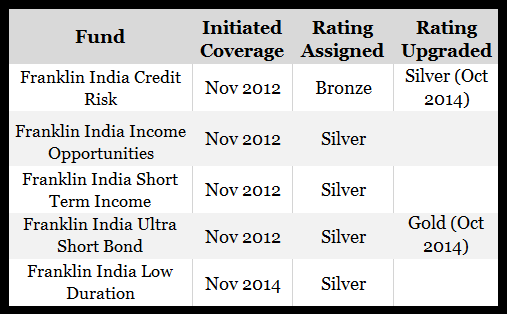

Years ago, we initiated the Morningstar Analyst Rating coverage on these funds:

(The other fund, Franklin India Dynamic Accrual Fund, has not been a part of our coverage.)

Franklin India Credit Risk was upgraded from Bronze to Silver taking into account their expertise in the credit space.

Franklin India Ultra Short Bond was upgraded to Gold, given its exceptionally low expense ratio within the peer group.

We continued to retain positive ratings on these funds given our opinion on the fund house, the investment process and the strength of the team.

What was our conviction based on?

Our conviction was driven by the team’s research-intensive investment approach, which complements well with the strategy of taking credit exposure in the portfolios. Their investment approach is a combination of qualitative aspects with quantitative analysis. The focus is on investing in companies where there is a good degree of comfort with the management, including management background, execution capabilities, track record and financial strength of the promoter group. This is followed by quantitative analysis to understand the company’s cash flows, future capex requirements, underlying security/asset, and leverage ratios, among others to gauge the credit worthiness of the entity.

Clearly, the investment team invested in line with their investment style and strength. And our research process looks at precisely that.

We do not attempt to take the role of policing when it comes to investment style. Neither do we adjudicate on the strategy. You won’t find Morningstar analysts sitting in judgement on whether credit funds are bad as compared to non-credit funds, or a momentum-driven strategy is a unsatisfactory as against a buy-and-hold. We do not consider that a sensible approach towards research. Investment teams and asset manager have different abilities and skill sets. Our task is to evaluate whether the team and the manager have the ability, expertise and the requisite skill set to run a given strategy.

FT’s fixed income team fit the bill on that count.

Did we consider risk?

Of course. We took risk into account from the strategy perspective.

Some strategies are inherently more risky than others. On the equity side, small-cap strategies are more risker. On the fixed income side - interest rate, credit and liquidity risk come with the terrain.

Credit risk funds, by their sheer nature and investment universe, tend to be high on credit and liquidity risk. These risks get magnified when faced with adverse market conditions. The risk of downgrades and defaults are inherent and can be minimized, but cannot be eliminated. It is for this very reason that we have consistently articulated in our reports that these strategies take on higher credit risk than their peers.

In the past, the investment team at FT has managed to wade through such crisis.

The Taper Tantrum in 2013 did not have any significant impact on their funds.

When JSPL defaulted in 2016, FT absorbed a haircut on their exposure. Despite the short-term blow, the funds made a comeback.

The last few years have been tough for the Indian fixed income market, where downgrades and defaults have been the norm. The default of Infrastructure Leasing & Finance Services, or IL&FS, on its debt obligations in September 2018 sent reverberations throughout the system. Worth noting is that the fixed income funds of FT had no exposure to it. Given this scenario, funds that are run with a credit strategy have not had it easy. No one escaped unscathed.

When FT encountered defaults and had to markdown some of its investments and create side pockets, we evaluated each on a case-to-case basis. Having said that, given the environment, clearly the strategy was out of favour and risk was playing out.

So why did our ratings continue to remain positive?

When we assign ratings, we take a long-term perspective as short-term hiccups and underperformance are part and parcel of all strategies. While that becomes important during adverse market conditions when the strategy is out of favour, it cannot be the guiding principal for evaluating a fund on a qualitative basis.

(At the end of this article, we explain how the Morningstar Analyst Rating must be interpreted. You can read that for more clarity on our process.)

In our reports and communication, we have always called out the inherent riskiness in the strategy. We have consistently emphasized that it is solely targeted at investors who have an appetite for the risk and can grasp the volatility that comes along with credit strategies. They were NEVER a substitute for high credit quality funds. This aspect, we believe, many people overlooked.

As far as retaining the Gold rating on Franklin India Ultra Short Bond Fund is concerned, besides its low expense ratio, the team has relatively played it safe here. Which is why, besides Vodafone Idea, the fund had no exposure to other stressed assets.

The liquidity aspect was also given due consideration. It’s a well-known fact that the liquidity in the lower credit space of the corporate bond segment is relatively less. But, to tackle that, the fund manager had instituted several measures to reduce the liquidity risk – namely laddering of portfolio maturities over time to create frequent liquidity, introduction of steep exit loads, bank borrowing lines and diversified investor base to reduce investor concentration.

However, what followed was unprecedented and completely unforeseen. Frankly, we never expected the situation to deteriorate to the point of FT taking a call to wind up these funds.

What has been our learning?

At Morningstar, we continually evaluate ourselves and our systems to align with investors’ needs and empower their success. And it would be extremely foolhardy if we did not ruthlessly scrutinize the event to highlight our blind spots and take corrective measures to ensure better efficacy of our ratings outcome.

The decision to wind up the funds given the unprecedented redemptions was the right one at that point of time. However, in the overall scheme of things it is a poor outcome for the investors of those respective funds.

The presiding learning is that if a fund is an outlier in its peer group, it would be better suited to be more cautious in our rating outcomes. While we do clearly articulate risks of a strategy, investors may tend to focus more towards the final rating and the return outcomes.

Liquidity management is another focal point. We typically look to understand the liquidity management of portfolio and the measure taken to reduce this risk. The recent events have shown us that extreme scenarios need to be factored in. Which means that the liquidity evaluation purely at a fund level is insufficient, but must also be viewed holistically from the context of overall asset manager exposures as well as industry level.

We are committed to integrity, and never have we compromised on that front. Our learnings here will be cemented into our process going forward.

How to interpret the Morningstar Analyst Rating.

The Morningstar Analyst Rating for funds is expressed on a five-tier scale running from Gold to Negative. For actively managed funds, the top three ratings of Gold, Silver, and Bronze all indicate that our analysts expect the rated investment vehicle to produce positive alpha relative to its Morningstar Category index over the long term, meaning a period of at least five years.

The Analyst Rating does not express a view on a given asset class or peer group; rather, it seeks to evaluate each strategy and associated vehicle within the context of the category benchmark and peer group.

The Analyst Rating is not a buy or sell recommendation on fund. The suitability of the asset class, fund category, investment mandate & inherent risks in the portfolio needs to be aligned by the investor to his or her own risk profile before making an investment decision

When we rate a fund, we are agnostic to the investment style with which a fund is managed. We are not biased towards an investment approach or style. Hence, we may assign a high rating to a fund which takes high risk, but where we believe that the team has the wherewithal to manage that across a market cycle. But then, as we all know, those funds are not an apt fit in all investors’ portfolio.

We have positive rating on small cap funds, mid cap funds as well as credit funds. But then, investments in them must be decided in a prudent way based on one’s risk appetite and their aptness in portfolio. A high rating simply signifies that this is a fund good in that space, whether to buy or not is the call of the investor along with his advisor. Just because they have high rating shouldn’t give them direct entry into an investors’ portfolio. These are basic tenets of investing with doesn’t change with changing environment. Ignoring them is an invitation for a disaster.

Also, our analyst rating is not a short-term view on how a fund will fare. We understand that a strategy may go through rough phases and be out of favour, at times for a prolonged period. Hence, we take a long-term view on funds, accounting for short-term underperformance, when we assign them rating, and that is true even for debt funds.