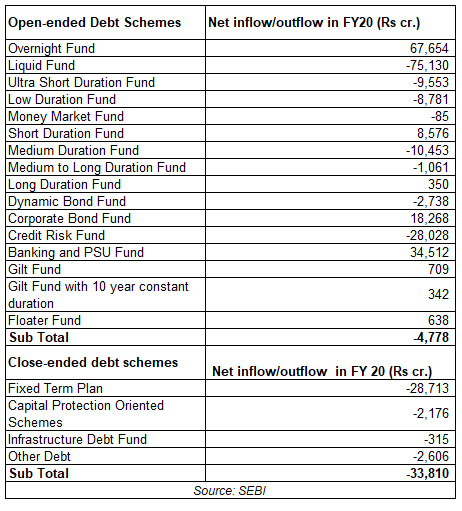

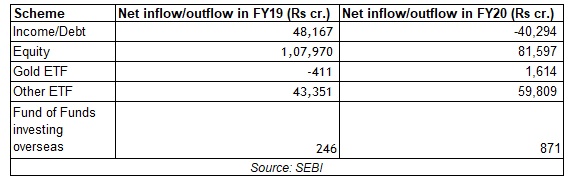

Debt funds faced the wrath of investors in FY2020 as the category saw net outflows of Rs 40,294 crore. A majority of the outflows were from close-ended debt funds worth Rs 33,809.89 crore. Of this, Fixed Term Plans saw outflows of (Rs 28.712.78 crore). Medium duration funds saw net outflows of Rs 10,452.59 crore.

Credit Risk Funds

Credit risk funds, which have been in the limelight lately, saw net outflows of Rs 28,028 crore in FY20. A series of downgrades/defaults have caused panic among investors, which is evident by the sustained outflows. The category is seeing further redemptions in the aftermath of Franklin Templeton shuttering its six schemes.

Banking & PSU Funds

Banking & PSU funds have been gaining investor attention lately due to a flight to safety. The category received net inflows of Rs 34,512 crore in FY20. Safety has become a prime concern for investors, especially in the aftermath of the markdowns witnessed owing to downgrades and defaults following the outbreak of the NBFC crisis in September 2018. These funds manage assets worth Rs 75,147.36 crore as of March 2020.

Equity Funds

The industry received net inflows of Rs 83,787 crore in open-ended equity funds in FY20 while close-ended equity funds saw net outflows of Rs 2,190 crore during last fiscal.

Open-ended multi-cap and large caps collectively mopped up Rs 31,563 crore, which accounted for 38% of the total Rs 83, 787 crore inflows in FY20. Mid and small-cap funds collected Rs 23,948 crore while focused funds mopped up Rs 12,835 crore.

*In FY19, equity savings fund, and arbitrage funds were clubbed under the equity AUM. In FY20, these scheme categories are reported under Hybrid Funds category.

Gold Exchange-traded funds (ETFs) received Rs 1,614 crore net inflows. The market meltdown ensuing the Corona outbreak helped the yellow metal. Gold ETFs category average return stood at 23% YTD. As of March 2020, Gold ETFs manage assets worth Rs 7,794 crore.

Other ETFs (excluding gold ETFs) received net inflows of Rs 59,809 crore owing to a series of new ETF launches, including Bharat Bond ETF and CPSE ETFs. Reflecting this trend, ETF asset base increased by 30% from Rs 1.20 lakh crore in FY19 to reach Rs 1.56 lakh crore in FY20.

Total industry AUM inched up by 1% from Rs 24.58 lakh crore in March 2019 to Rs 24.70 lakh crore in March 2020.