Communicable diseases, plagues, epidemics and pandemics have ravaged humanity throughout its existence. India being no exception.

DHRUV GIRDHAR of RichifyMeClub looks at the stock market’s behaviour during the earlier outbreaks.

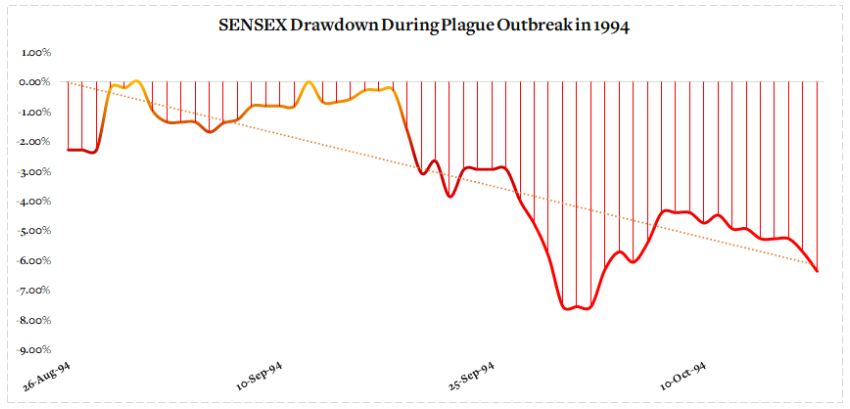

The Plague (August 26 – October 18, 1994)

The plague that originated in Surat was mostly pneumonic, though the bubonic form was found in three villages in Maharashtra preceding the pneumonic outbreak in Surat. When compared to the bubonic form, the pneumonic plague spreads rapidly and hence caused widespread panic. Within 48 hours, more than 3,00,000 people fled from the city, and flights to India were cancelled. Total number of lives lost was 56.

The Sensex slid by 6.83% during this period. That slight dent was only temporary. It stayed flat and continued to rise until the dot-com era of 2000.

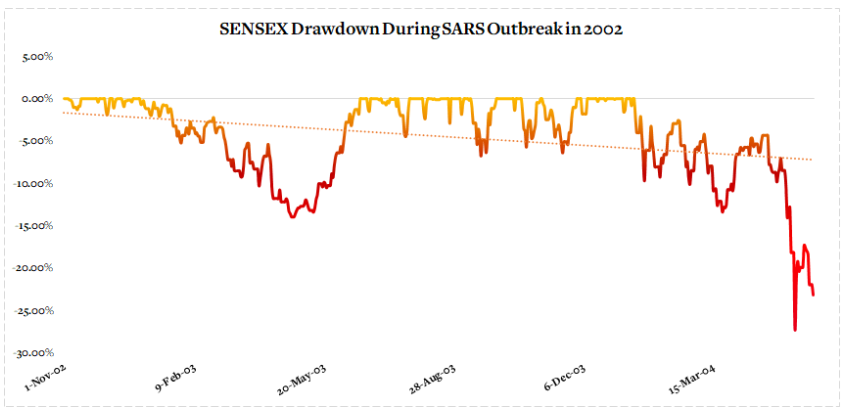

Severe Acute Respiratory Syndrome, SARS (November 2002 – May 2004)

Though the first case of atypical pneumonia was reported in 2002 in the Guangdong province of China, it was in 2003 that the World Health Organization issued a global alert for a severe form of pneumonia.

The Sensex slid by more than 14%, and was followed by a V-shaped recovery. The Sensex recovered by more than 30% in the following 6 months.

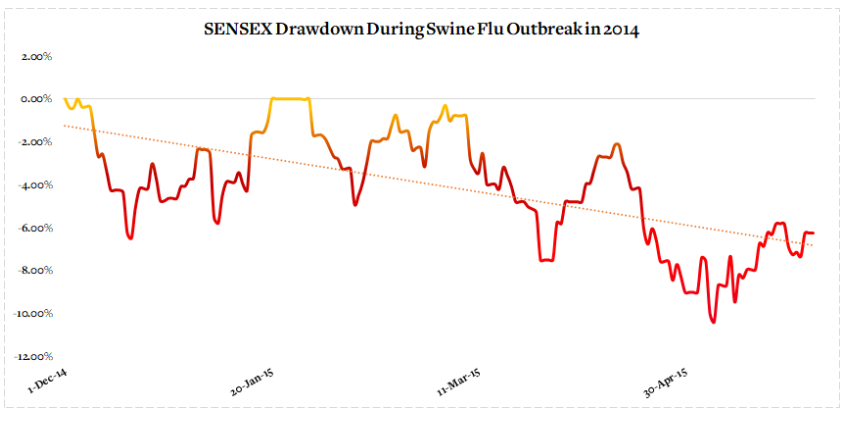

H1N1 (December 2014 – May 2015)

Many will remember this as the Swine Flu. It originally was a pandemic in 2009-10, but India witnessed an outbreak again.

The Sensex slid by around 11%, and after a few months witnessed a sharp recovery.

The above are just some graphical representations of the movement of the Sensex.

During Zika (December 2013 – February 2014), the Sensex slid by more than 13% during the initial 3 months, and took less than 6 months to recover by more than 18%.

During Ebola (November 2015 – February 2016), the Sensex slid by 3%, and witnessed a recovery of more than 20% in the next 5-6 months.

The Avian Flu between January and August, 2004, saw the Sensex drop by over 10%.

Dhruv Girdhar has some advice for investors today.

The ongoing Coronavirual pandemic has jolted investors. The stock market took a major hit as investors panicked at the global lockdown and chatter about a looming global recession. Investors believed that there was no ray of hope in the distant horizon and the odds were heavily tilted against them.

The Sensex cracked by more than 12,000 points from its peak of 42,000. It witnessed its largest single-day decline, as well as its largest single-day recovery. On the very same day.

The mood is pessimistic. Even after announcing stimulus packages and moratoriums, the outlook is grim as investors envisage the repercussions of a lockdown. Truth be told, no one knows what the future holds. Will we bounce back soon or are we staring at a scenario that is reminiscent of 2008?

What we do know, is that this is not the first time that an epidemic has hit India. What we also do know, is that the setback will be temporary.

If you have cash that can be deployed, a lot many companies with impeccable management and excellent fundamentals are available at a discount. You could build your portfolio.

If you do not have cash or are not willing to buy equity, sit tight. Do not stop your SIPs in equity mutual funds.

Don’t panic and sell. Don’t convert paper losses into real ones. This too shall pass.