Next time you say your portfolio is not doing well, give thought to what you really mean.

Start by answering these questions with clarity. What is your portfolio benchmark? What do you use to judge success? Do you have a number in mind, such as 12% CAGR? Do you just want to beat inflation by a few percentage points? Do you want to beat the market?

The idea of "the market" is a tricky one, and what we say about a market can depend on how it's defined. That is because an index doesn't tell the full story about the investable universe.

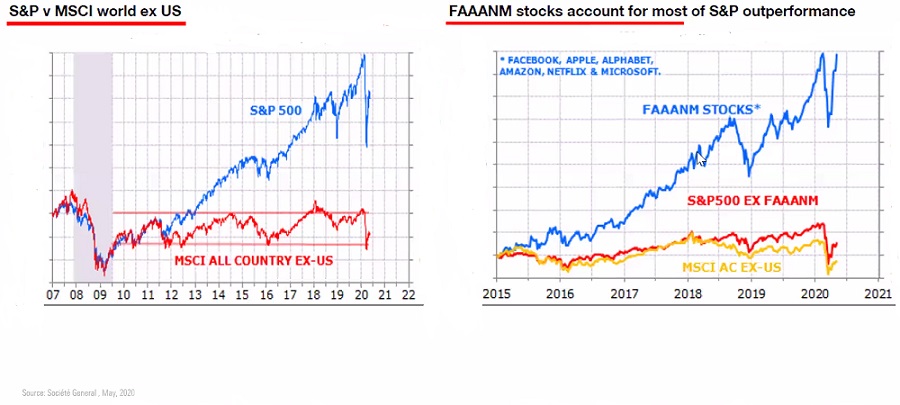

The image below shows just that (click to enlarge).

How the U.S. stock market did as against the rest of the world. (Index January 2007 = 100).

How the U.S. stock market did as against the rest of the world, if you take out the 6 tech giants – Facebook, Apple, Alphabet, Amazon, Netflix, Microsoft. The stark divergence disappears. (Index January 2015 = 100).

It is easy and convenient to compare your portfolio’s performance to the returns of the overall market. The Sensex is a measure of the stock values of 30 large companies. But what do the values of those specific companies have to do with your portfolio?

Or, it could even be a very narrow index. For example, Nifty Bank Index comprises of 10 of the most liquid and large capitalised Indian banking stocks. HDFC Bank and ICICI Bank together comprise of 46% of the weightage. So the movement of the index is naturally dependent on these two constituents. Let’s say both stocks witness a price drop for whatever reason, but the banking stocks in your portfolio are climbing the performance charts. Or vice versa. Naturally, there will be a disconnect.

Morningstar’s behavioural scientist Sarah Newcomb and director of research for Morningstar Canada, Paul Kaplan, have some great advice on this subject.

- The best benchmark is your own, personalized financial goal.

Your goal could be anything. It could be to reduce your debt to zero over the next 24 months. It could be to build an emergency fund over 12 months because you are planning to start a family. In both cases, the goal is not performance based, but just as worthy and essential as a goal to grow your assets.

Let’s say your goal is to aggressively increase your savings capacity over a few years. In such a case, you must see the trajectory of your expenditure. Has it been decreasing? Has the percentage of income saved risen? Are you saving your bonuses? Are you increasing the amount saved with every increment? So, rather than looking at the index’s return to measure the effectiveness of your strategy, look at the average growth of your portfolio over the last few years or so.

Is your goal just to preserve capital because retirement is not far away? Here too, the index will not be a good benchmark.

- Comparing your investment performance to these benchmarks ultimately answers the wrong question.

“Did I beat the index?” has little to do with whether or not you are on track to reach your financial goals. To truly judge the success of your investment strategy, you need to first be clear about your goal, and then choose a measure of success that suits the strategy for reaching that goal.

You should be concerned that your investments are on track to allow you to reach those goals. For example, seeing if you are on track to have enough money to retire.

The purpose of your investments is to meet your financial goals, not to beat the index.

- The right benchmark depends on what is being benchmarked.

Don’t compare a multi-asset portfolio to the Sensex or Nifty.

For example, if your portfolio holds 40% in large-cap stocks, 10% in mid-cap stocks, 20% in international equities, and 30% in bonds, it will be inappropriate to track it with a generic market index.

Your strategy should determine the benchmark, and unless your strategy was to track or outpace the Sensex or Nifty, their performance is pretty much irrelevant.

So don’t fret if your portfolio is lagging the Sensex. It could well be that just a few stocks in the Sensex are pulling it up. It could also be that it is most inappropriate going by what has been explained above.