I need a corpus of around Rs 70 lakhs in the next 25 years.

My current investments in mutual funds to achieve the same goal are: HDFC Sensex (Rs 10,000), Mirae Asset Emerging Fund (Rs 5,000), Parag Parikh Long Term Equity (Rs 5,000), Axis Mid Cap (Rs 3,000), SBI Small Cap (Rs 2,000), HDFC Gold Fund (Rs 2,000) and Nippon Liquid Fund (Rs 3,000).

We are assuming that this Rs 30,000 is your monthly systematic investing.

With an investment horizon of 20-25 years, the overall asset class allocation in your portfolio is well placed, with 75% in Indian equities. The current allocation to gold is ideal, as it acts a portfolio hedge.

There is a fair split between various market caps, with respect to your stock holdings. We arrived at this on the basis of the underlying holdings of the portfolios. Since you have a 25-year horizon, you can continue to maintain the same allocation.

The mix of funds in your portfolio is ideal, with very little overlap in the underlying holdings of the funds given their distinct nature. This further helps in diversification of your portfolio. Holding an index fund is also a great option as a core part of the portfolio as it gives you equity market exposure, without having to worry about picking the right active fund that can provide you some alpha. The funds you hold are all well managed and we don’t see any need to make any changes to your investments.

You can read our analysts’ views on funds.

As you start approaching your target date for investments, start reducing your equity allocation and shifting to less volatile asset classes such as fixed income. This helps better preserve the value of your investments closer to the target date.

Keep increasing your SIP amounts by 5-10% on a yearly basis. As per the current SIP amounts and time horizon, you will be able to comfortably meet your target corpus of Rs 70 lakhs after 20-25 years with adequate buffers.

But you should also factor in inflation as Rs 70 lakhs down the road, 25 years to be exact, will have the same purchasing power equivalent to Rs 20.67 lakhs today, assuming 5% inflation.

Asset Allocation:

- Indian equity: 74.4%

- International equity: 5.1%

- Fixed income: 13.8%

- Gold: 6.7%

Equity Fund Allocation:

- Large cap: 69.4%

- Mid cap: 23.6%

- Small cap: 7%

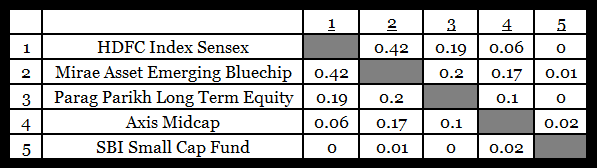

Common Portfolio Holdings:

Use the numbers to understand the portfolio overlap of stocks. For example, HDFC Index Sensex and PPLTE have an overlap of 0.19. This means that 19% of the portfolio is common between the two funds.

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.