The mutual fund industry recorded 74th consecutive month of net addition in folios.

Across all scheme categories, the industry added 5.64 lakh folios, raising the aggregate folio count to 9.21 crore in July 2020 as against 9.15 crore folios in June 2020. Of this, around 2 crore are unique investors based on Permanent Account Number.

Debt funds gain traction

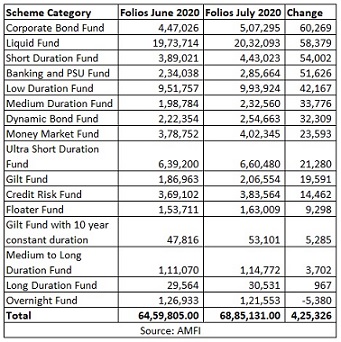

Barring overnight funds, all other categories in debt funds saw a growth in folios. Corporate Bond Funds added the highest number (60,269) of folios in July 2020, followed by liquid funds (58,379), short duration funds (54,002) and Banking and PSU Funds (51,626).

The credit crisis in debt funds has nudged investors towards funds with AAA portfolios. The assets under management in Corporate Bond Funds has surpassed Rs 1 lakh crore mark to reach Rs 1.14 lakh crore in July 2020. Similarly, Banking and PSU Funds manage assets worth Rs 1.02 lakh crore as on July 2020. Banking and PSU Funds category has delivered 10% return over one-year period.

A total of 4.25 lakh folios were added in the debt fund category in July 2020.

Equity

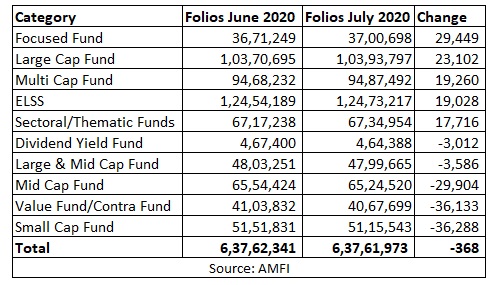

The overall folio base in equity funds dipped marginally in July 2020. Mid Cap, Small Cap and Value Funds saw a combined dip of over 1 lakh folios in July 2020. This could be partly attributed to profit booking due to the market rally. Focused, Large Cap and Multi Cap saw registered a growth in folios in July 2020. As on July 2020, there are 6.37 crore folios across open ended equity schemes.

Other Schemes

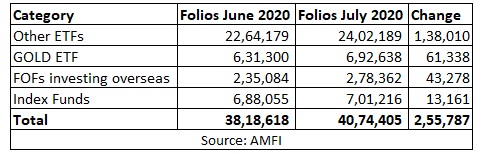

Equity ETFs added 1.38 lakh folios in July. There were 2 NFOs -BHARAT Bond ETF - April 2025 and BHARAT Bond ETF - April 2031 launched in July 2020.

Fund of funds investing overseas are also gaining traction among investors from a global diversification perspective. FOFs saw an addition of 43,278 folios in July 2020. The category average performance of FOF was 17% over one year period.

Gold ETFs added 61,338 folios in July. The flight to safety has pushed the prices of yellow metal upwards. Gold Funds have delivered 41% return over a one year period.