I have always been a fan of the Pareto Principle.

From what I have read, economist Vilfredo Federico Damaso Pareto noticed that 20% of the pea plants in his garden generated 80% of the healthy pea pods. Pareto extrapolated this imbalance to other aspects of life and found that roughly 20% of the population controlled 80% of the wealth.

While not a scientific absolute, this observation on uneven distribution has been found to be applicable in many areas of life. Probably, 20% of the clothes in your wardrobe are worn 80% of the time. I use this principle as a reminder to stay focused on the 20% that matters.

So when I saw a tweet applying this principle to a portfolio, I was intrigued:

The 80:20 rule applies everywhere. 20% of the winners in your portfolio will give extreme returns. But, if I don't ride the winners and book early profits, the remaining duds will keeping dragging the overall portfolio performance. Have a process to average up your winners.

I asked investor Vivek Mashrani, who tweeted that, to elucidate. He obliged and has explained it in detail below.

The Pareto Principle is ubiquitous and finds an expression in virtually every aspect of life. Some examples:

- 20% of the population own 80% of the world’s wealth

- 20% of time spent on various activities produce 80% of results

- 20% of customers generally bring in 80% of the revenue

- 20% of focussed employees create 80% of the impact in an organisation

Why would this principle, observed in so many spheres of life, not be applicable to investing? If we observe our own investing portfolio, we would witness a similar trend: 20% of stocks in our portfolio generally produce 80% of the returns. To understand this, we need to dig deeper.

Every business begins with an idea before it becomes a start-up. Then comes the journey from a micro cap to a small cap to a mid cap to, eventually, a large cap.

No matter how brilliant the idea, or how adaptable and relevant the business, there are the inevitable challenges. Distribution network, supply-chains, deploying the right technology, employee training, management bandwidth, logistics etc. Not all the companies which started from idea phase can grow big.

Durgesh Shah shared this during CFA Society Value Investing Summit:

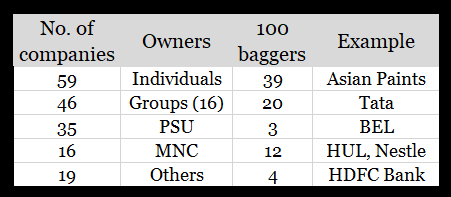

There are just 175 Indian companies which make over $100 million (Rs 700 crore) in annual pre-tax profit. Out of these, only 78 companies saw their market value increase 100x. Others may have listed at a decent size or got carved out from a group.

Even if we consider approximately 3,000 decent listed companies, only 5% companies are able to scale-up extremely well and 20% will scale to a decent extent.

Let’s understand the math behind portfolio returns before we figure out how to maximize it.

Portfolio returns are simple weighted average or sum product of (%) allocation and (%) returns generated. Naturally, we need our winners to have a higher allocation and ride them, at the same time trim laggards to prevent them from dragging portfolio returns.

I quote the legendary Peter Lynch here:

It's easy to make a mistake and do the opposite, pulling out the flowers and watering the weeds. If you're lucky enough to have one golden egg in your portfolio, it may not matter if you have a couple of rotten ones in there with it. Let's say you have a portfolio of six stocks. Two of them are average, two of them are below average, and one is a real loser.

But you also have one stellar performer. Your Coca-Cola, your Gillette. A stock that reminds you why you invested in the first place.

In other words, you don't have to be right all the time to do well in stocks. If you find one great growth company and own it long enough to let the profits run, the gains should more than offset mediocre results from other stocks in your portfolio.

Retail investors generally don’t have an information edge. And future predictions are made with great uncertainty. So, it’s fair to assume based on efficient market theory that even if we are able to select fairly good businesses in our portfolio, at best we are getting that at fair price and our predictability of finding stellar performer is like that of tossing a coin (otherwise we would just buy one company and allow it a 100% allocation.)

How do we ensure the highest allocation to winners?

It’s only possible by averaging up –adding allocation to businesses which keep growing and scaling-up with time. And this will automatically mean that we are not allocating or trimming our laggards in the portfolio. Eventually maximizing portfolio returns. So, we are not only staying invested in our stellar performer -- that Coca-Cola, Asian Paints, Pidilite, etc -- but also allocating higher as they become stronger.

As a trader, how do we manage risk by buying at higher prices?

It is very important to have an exit strategy in place when we are averaging up.

Let’s say your initial purchase was at Rs 100 and had a 30% drawdown threshold for exit. This means that your initial risk was Rs 30. If the price moves up to Rs 200 and you have same 30% drawdown threshold, your exit price criteria is Rs 140. So, in either scenario, you take home Rs 40 profit vs. your buying price of Rs 100. This is known as residual risk and here it is minus 40.

Effectively, if you are averaging up your position at Rs 200, you are actually funding it from negative residual risk of your earlier tranche and thus your cumulative risk is actually decreasing as you keep averaging up.

Also, averaging up improves your risk:reward metric. Initially, we take a small position to start with and if it doesn’t work out we don’t give back much. Example, if we take 1% initial position and it didn’t work out as expected and we lost 30%, effectively it’s just 0.3% of capital (1%*30%) but if we win and keep averaging up, we might have increased position sizing to 5% allocation and even 60% of return on full position will increase our capital by 3%.

Hence, the risk:reward is tilted in our favour (1:10 of risk:reward in this example) and probability of maximizing portfolio returns increases drastically.

Ultimately...

More than stock selection, investing is all about having the probabilities in your favour, having right mind-set and proper execution based on universal mathematical principles. This will give you those 20% winners that will create 80% of returns in your portfolio using the powerful concept of averaging up.

The stocks mentioned above are NOT recommendations but purely for illustrative purposes.