How must one view the ITC stock?

Attractive? The case being a high dividend yield (5-6%) and low PE (13-14). Or a value trap that will stay cheap for a very long time?

VIVEK CHITALE, a chartered accountant and co-founder of Arthvigyan, attempts to answer that query.

Let’s talk moats.

The Economic Moat represents a company's sustainable competitive advantage. A company with an economic moat can fend off competition and earn high returns on capital for many years to come.

ITC has brand strength, pricing power, and the addictive nature of its core product. The company holds a greater-than-majority share of the organized cigarette market in India and has been able to raise prices while maintaining volume growth. As most smokers remain brand loyal for a long time and are addicted not only to smoking, but also to the taste of their particular brand, the company is on a strong footing. ITC is the largest cigarette manufacturer in India by revenue. Due to heavy taxes and ban on cigarette advertisements, it is almost impossible for a new player to break into this stronghold.

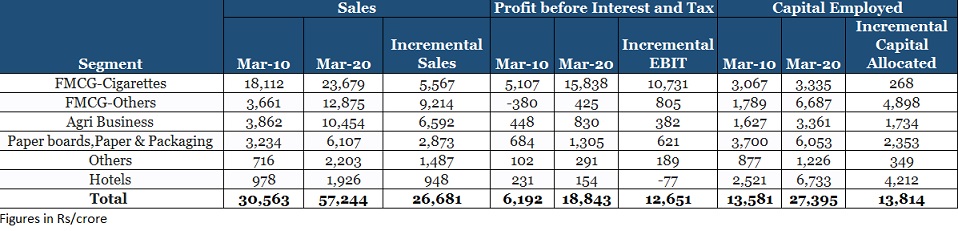

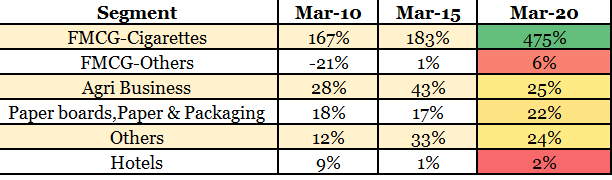

The conglomerate has been able to reduce the sales mix from the cigarettes business from 59% to 41% over the last 10 years, but is still extremely dependent on profits generated from its tobacco business (82-84%). Till the time ITC is able to generate reasonable returns (ROE of around 30-50% and profit margin of around 12-15%) from its FMCG-others business, the market will view continue to view it as a tobacco major.

Connor Leonard, from Investors Management Corporation, divides the world of great companies into “Legacy Moats” and “Reinvestment Moats”.

Businesses with a Legacy Moat possess a solid competitive position that results in healthy profits and strong returns on invested capital. In exceptional cases, a company with a Legacy Moat employs no tangible capital and can modestly grow without requiring additional capital. However, because there are no reinvestment opportunities offering those same high returns, whatever cash the business generates needs to be deployed elsewhere or shipped back to the owners.

In the case of ITC, they invested only Rs 268 crores in the cigarette business over the last 10 years. Excess cash was deployed in its other business like FMCG-Others, Hotels, Paper boards, and Paper and Packaging. ITC invested Rs 4,898 crore and Rs 4,212 crore of total incremental capital of Rs 13,814 crore in FMCG-Others and Hotels businesses, respectively. Businesses not as profitable as tobacco.

There is a second group of companies that have all the benefits of a Legacy Moat, but also have opportunities to deploy incremental capital at high rates because they have a Reinvestment Moat. These companies have their current profits protected by a Legacy Moat, so the core earnings power should be maintained. But instead of shipping the earnings back to the owner at the end of each year, the vast majority of the capital will be retained and deployed into opportunities that stand a high likelihood of producing high returns.

ITC does not have a reinvestment moat as can be seen from its low ROCE and low margin from other businesses.

Value trap or great bargain?

The company distributed 80-85% of profit as dividend. So, its reinvestment rate comes to 15-20%. Assuming ROCE of 35% (the 10-year average is 42%, the 5-year average is 35%), its intrinsic value growth (Intrinsic value growth = Reinvestment growth x ROCE) will be in the range of 5% to 7%.

Considering a dividend yield of 5 to 6%, the company is expected to give a 10 to 12% return over the long term.

If ITC is able to turnaround it’s FMCG-other and hotels business, the market should rerate the company and the stock may deliver a 20% to 25% return over the coming decade.

If the management is unable to do so, and cannot maintain or grow its cash flow from the tobacco business, ITC will continue to trade at a cheap valuation and will be a value trap. Don’t take this lightly. Heavy taxation can be a deterrent to cigarette consumers. Change in government regulation, such as the recent ban on selling loose cigarettes, can also deal blows.

If you invest in ITC, you must have the conviction on its non-tobacco business over the long term.

In May this year, Sanjiv Puri, ITC’s chairman and managing director, broached this subject in an interview.

10 years back, it was 60% tobacco and 40% non-tobacco. Today, it is about 60% non-tobacco. It is not that we are shrinking tobacco, it is just that the investments we are making today. The headroom for growth is much higher in our other segments. So, we expect other segments to grow much faster and certainly, the figure will go more and more in favour of our non-tobacco businesses.

Do note, to your advantage, is a limited downside due to its current cheap valuation.

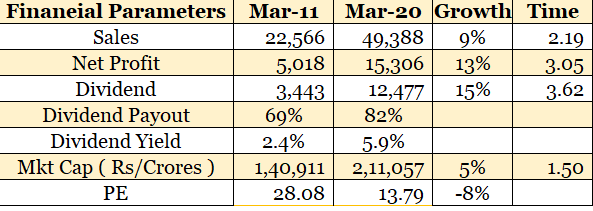

As is evident, ITC’s sales and profit has grown by 9% and 13% respectively. But the stock has delivered a mere 5% annualised return over the last 9 years, a reduction in P/E multiple to 14x from 28x.