The spectacular returns delivered by gold has attracted many investors towards safe haven in times of economic uncertainty. This was evident by close to four lakh growth in folios in the Gold ETFs category. The investor base in Gold ETFs rose from 3.59 lakh in September 2019 to 7.59 lakh in September 2020. During the same period, the assets under management rose by Rs 7,956 crore or 140%, from Rs 5,667 crore to Rs 13,622 crore. Gold ETF category has yielded 30% return over one-year period.

Chirag Mehta, Senior Fund Manager - Alternative Investments, Quantum Mutual Fund, notes that while gold prices have corrected recently, the demand for yellow metal is intact. “Gold rallied sharply by ~20% between April and July, reaching an all-time high in early August. When prices increase at such a lightning pace, there is often a phase of correction and consolidation, like the one we are currently in. The metal’s prices have declined by ~8% over the last couple of months. But this pullback is likely tactical in nature. Because despite the weaker prices, investment demand via gold ETFs has continued to increase. As per the World Gold Council, global net inflows of 1,003 tons in 2020 have taken gold ETF AUM to an all-time high of 3,880 tons or US$ 235 billion. This tells us that even though gold’s popularity seems to have temporarily waned, its long-term strategic positioning is intact.”

Should investors who have missed the gold rally enter now? Chirag says that if you haven't already allocated 10% to 15% of your client’s investment portfolio to gold yet, this Dhanteras could be a good time. "Since purity is a concern when buying physical gold and since the purchase of gold bars and coins comes at a premium on account of mark ups and making charges, we suggest Gold ETF route for investing. If you have completed your allocation, just sit tight and watch gold play a risk-reducing, return-enhancing role for your portfolio."

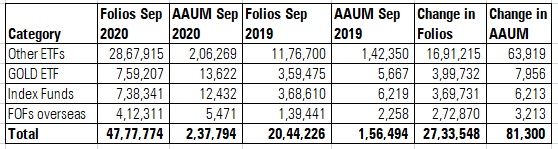

Growth in folios in AUM

The four categories (ETF, index funds, Gold ETFs and overseas fund of funds) collectively added 27.33 lakh folios in one year.

ETFs and index funds

Exchange Traded Funds, or ETFs, (excluding gold ETFs) added 16.91 lakh folios in one year. ETF assets increased by Rs 63,919 crore, from Rs 1.42 lakh crore in September 2019 to Rs 2.06 lakh crore.

There have been a slew of ETF launches. Starting from the launch of plain vanilla ETFs tracking broader indices, fund houses have now started offering sectoral/thematic and smart beta ETFs. For instance, Mirae Asset Mutual Fund recently launched Environmental Social and Governance, or ESG, ETF. ETFs which follow a rule-based investing style are SBI ETF Quality, Nippon India ETF NV20, Kotak NV 20, ICICI Prudential NV20, ICICI Prudential Nifty Low Volume 30 ETF, Principal Nifty 100 Equal Weight Fund and Edelweiss Nifty 100 Quality.

Edelweiss launched Bharat Bond ETF - April 2023 and Bharat Bond ETF - April 2030 in December 2019 which garnered Rs 12,378 crore in its new fund offer, or NFO. The second tranche - BHARAT Bond ETF - April 2025 and BHARAT Bond ETF - April 2031, launched in July 2020 collected Rs 11,024 crore.

Clearly, investors today have a lot of ETFs and index funds to choose from. How should you go about choosing the right fit for your clients? “Investors should avoid passive funds based on mid- and small-cap themes. It is in these segments, which is often under-researched, that the potential to outperform the benchmark or generate alpha exists. Mid and small cap allocation can be in active funds. Don’t view passive funds as a competing strategy but rather, a complementary strategy. having a single factor product, such as momentum or quality or value can make the portfolio underperform at points of inflection when that particular factor does not do well due to changes in the underlying market. So multi-factor funds, such as a mix of quality, growth and value could have a better potential to perform across market cycles,” said Anil Ghelani, Head of Passive Investments & Products at DSP Mutual Fund.

Index funds, which are ideal for investors who do not have a demat account, also saw good traction. Folios under index funds category increased by 3.69 lakh in one year.

Fund of Funds overseas

Mouth-watering returns delivered by a few international fund of funds tracking markets/themes like U.S., China and gold mining funds has put the spotlight back on the category which was perhaps most ignored by investors and advisers alike for long.

This category saw a growth of more than 2.72 lakh folios while the AUM increased by Rs 3,213 crore in one year. This category houses several funds which track different geographies such as U.S, Europe, Brazil, China, etc. Given the plethora of options, how should you go about choosing the right fund for your clients? “Don’t pick an emerging market country which is similar to India. Such emerging countries might exhibit the same kind of volatility as India. In technical terms, the co-relation might be high. You don’t get much diversification benefit by investing in a single emerging market country. Rather, you can choose a fund that invests in a basket of emerging markets like China, Brazil, Hong Kong, etc. One should also take exposure to developed markets like the U.S, Japan, and Europe. Don’t invest by looking at the past returns. Try to pick diversified funds that invest in multiple countries,” recommends Dhaval Kapadia, Dhaval Kapadia, Director – Portfolio Specialist, Morningstar Investment Advisers India.