I systematically invest very month in 3 large-cap funds: Nippon India (Rs 2,000), Mirae Asset (Rs 5,000) and Axis Bluechip (Rs 3,000). I have observed that a particular mutual fund will generate a good return for some time and then it becomes an underperformer.

So must I continuously switch my investment? Looking at my portfolio, the Nippon fund is not performing. What must I do?

You have hit the nail on the head, funds will go through cycles of good performance followed by periods of relative underperformance. That is a function of market cycles.

Most fund managers will follow a particular style (Growth, Value, Blend, Momentum, etc) across market cycles. When the market cycle is not in favour of their style, the fund could underperform. But in the long run, by sticking to an investment style, good managers will add value.

Timing market cycles is impossible as no one can predict when they will turn. As investors, it is a good idea to build an all-weather portfolio by investing in funds managed in different styles so that you can truly diversify your portfolio across market cycles. Identify good managers with a steady investment process and stay invested despite short term underperformance.

Here are the calendar year returns of large-cap funds over the last 10 years. As is evident, no single manager has been a consistent top performer each year.

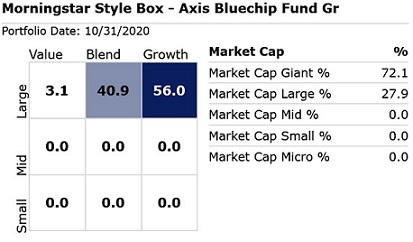

Axis Bluechip

The fund is run with a clear growth bias, the manager Shreyas Develkar looks to invest in companies that can grow at above average growth rates consistently. He is cognizant that these companies trade at rich valuations and doesn’t mind paying a premium valuation for the quality of growth. The growth bias is evident in the funds’ stylebox below. Read the analyst view here.

Mirae Asset Large Cap

This fund is run with a more Growth at a Reasonable Price (GARP) approach. Gaurav looks to invest in growth stocks but is cognizant of valuations and looks for a margin of safety in his investments. He may also look to invest into some value opportunities as a part of his portfolio. Read the analyst view here.

Nippon Large Cap

Shailesh Raj Bhan also runs this fund with a GARP approach but does also take on significant counter-cyclical stocks in his portfolio i.e. Stocks/sectors that are going through a temporary downturn but are fundamentally sound. Read the analyst view here.

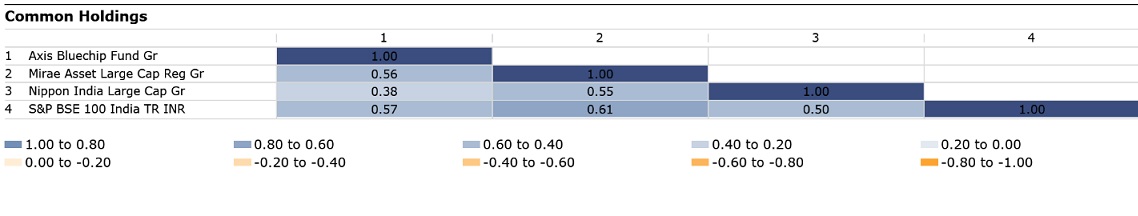

Below is the holding similarity of the portfolios of the three funds. As is clearly visible, the overlap between the three portfolios is limited and thus it would make sense for you to continue to hold on to your investments in all three funds.