At the recent Morningstar Investment Conference, Samir Arora, founder and fund manager at Helios Capital Management, busted a few myths on the aura surrounding concentrated investing.

When Arora refers to a concentrated equity portfolio, he means 10 to 15 stocks, while a diversified portfolio would be in the range of 30 to 40 stocks. It could go higher but, as he confessed, a portfolio with too many stocks with the smallest weight being 1.5% or less, is not very viable.

Here are a few insights from his very detailed presentation.

Diversification is protection against ignorance. It makes little sense if you know what you are doing. – Warren Buffett

At the start of his career, Buffett had a lot of success with concentration. While he is undoubtedly a great investor, a streak of luck had a role to play in his thinking - his stocks delivered impressive returns in rapid succession.

In reality, we aren’t aware of our folly till the unexpected happens. Ignorance is identified in hindsight. We become aware of it later. Worse, what if you thought you were completely clued in and took a heavy bet? You could lose all your money.

Let’s assume a universe of 100 well informed investors, each holding concentrated equity portfolios of 10 stocks each. Since a lot of the stocks would overlap, collectively they would own at least 150 stocks. If there was no overlap at all, it would be 1,000 stocks.

When performance is measured over a common time frame, it would be observed that some do well. The success would be attributed to the concentration of the 10 best stocks. But there will also be portfolios that fare badly in comparison. It would be the result of a concentration of 6 wrong stocks but maybe 4 good ones.

It is not the concentration that is at fault. It is the stock selection.

All investors cannot outperform the market. All concentrated investors cannot outperform the market.

An investor should act as though he had a lifetime decision card with just twenty punches on it. – Warren Buffett

Don’t misunderstand this by taking it literally. It does not imply that one should just buy 20 stocks in his or her investing life. Buffett was conveying the importance of taking every decision seriously. By “acting” as if you had only 20 opportunities to invest in, it would ensure that your conviction is high, your research thorough and your thought process articulate.

In a 2010 paper titled Overconfidence, Under-Reaction, and Warren Buffett’s Investments the authors found that the median holding period for Berkshire Hathaway was 12 months. Approximately 20% of stocks were held for more than 24 months, while 30% of stocks were sold within 6 months. The period under consideration was April 1980 to December 2006.

Buffett himself did not follow what many have interpreted literally.

Implicit assumption of concentrated investors: It is possible to identify these companies in advance and place a large bet on these names.

Longer-term winners normally surprise even themselves, their managements and their investors with their growth success. It is not possible to identify them well in advance with a high degree of confidence.

When Steve Jobs died in October 2011, almost 80% of his wealth came from his stake in Disney which he got because he sold Pixar to Disney. Steve Jobs was obviously unaware of the success he would encounter in less than a decade.

Ditto with Bill Gates. Over the years he reduced his holding to a 1.3% stake.

We bought Bajaj Finance in January 2011 for the first time. We bought HDFC Bank during its IPO. On what basis were we supposed to believe that these stocks must form the major portion of our portfolio?

Nestle is up 120x, but one could just have easily chosen Colgate (20x) or Hindustan Lever (52x) (March 31, 1996 – October 23, 2020).

Stocks don’t go up as much as portfolios can.

Stocks don’t go up as much as an actively managed portfolio can potentially go up. Because the portfolio manager can change his stocks after a few years if he chooses to; 3 or 4 or 5 years. The portfolio performance is not constrained by the performance of a few.

But do note, it is not random buying of stocks that a diversified investor must do. Stocks should not be randomly purchased for the sake of diversification, but rather after detailed analysis, with the conclusion being that “we have no reason to reject it” as we say.

Why do I have to make a choice between two private sector banks that I like? There is value in differentiating between good and bad, not so much in differentiating between good and good.

Diversification does not hurt returns but makes it much more consistent. From March 31, 1996 to October 23, 2020, this is the absolute return of:

- Infosys: 1,700x

- Pidilite: 526x

- HDFC Bank: 467x

- Wipro: 425x

- Kotak Bank: 404x

- Titan: 322x

- Asian Paints: 229x

- Reliance Industries: 219x

- Nestle: 120x

Implicit assumption of concentrated investors: Very few companies do well and are worth owning.

Give up this idea that only a few stocks do well. Once you accept that a large number of stocks do well, then you will realize that diversification is not a compromise on return.

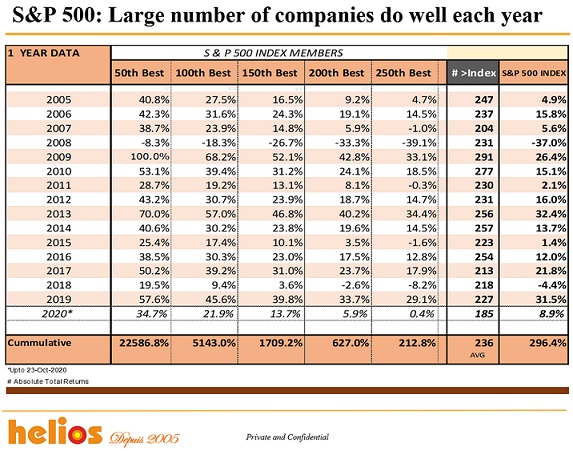

Let us look at the S&P 500. There are 500 stocks whose average is calculated to call it the market. It is not the pure average of these individual 500 performances and is weighed by market cap. But, broadly speaking, over time half the stocks will do better than the market and the other half worse. This is plain arithmetic.

So if 250 stocks are going to beat the other 250 stocks, 200 of them are going to beat it even more. And 150 of them, which is 30% of the market, are really going to beat the market because the market is just the average of these names.

This image shows the S&P 500 for each calendar year. Look at this year (YTD: October 23, 2020) where only 185 stocks have beaten the market. The 150th stock beat the market by around 5%.

If every year, you only have the 150th best stock of the market (not the average of the first 150 stocks, but the performance of the 150th stock), you would have been up 1,709.2% as against 296.4% of the index.