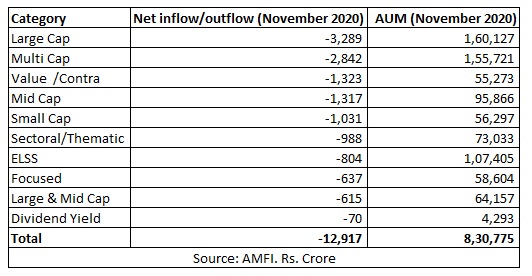

Investors continued to cash out from equity funds with markets reaching an all-time high. This was evident by Rs -12,917 crore net outflow from equity funds. Even hybrid funds that invest in a mix of equity, debt, and gold saw outflows to the tune of Rs -5,249 crore in November 2020.

“The outflow would not have gone completely out of equities as an asset class, but probably moved to direct equities as investors have had some success in the past few months investing directly. Some portion of this liquidity could have also been channelized into real estate with renewed interest amongst genuine buyers wanting to own a home at lower interest rates and falling taxes and prices. Also, some investors would be sitting on cash to deploy once again post any meaningful correction in near future,” said Akhil Chaturvedi, Head - Sales, Motilal Oswal Asset Management Company.

Due to mark-to-market gains, the industry's equity assets increased by 10% from Rs 7.77 lakh crore as on October 31, 2020 to reach Rs 8.57 lakh crore as on November 30, 2020.

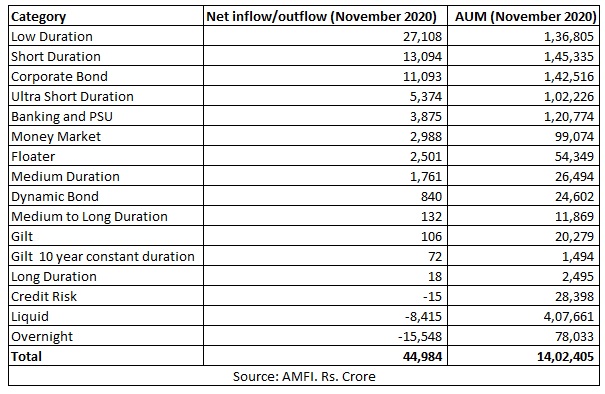

Fixed Income

The fixed income category received inflows worth Rs 44,984 crore in November 2020. Low duration funds received the highest inflow worth Rs 27,108 crore in November, followed by short duration and corporate bond funds at Rs 13,094 crore and Rs 11,093 crore, respectively.

The flows into the medium duration category continue to increase month after month. In November, the category received a net inflow of Rs 1,761 crore, higher than the net inflow of 1,566 crore in October. Since July, the category has recorded a net inflow of Rs 6,012 crore. "This category houses some credit-oriented strategies and suffered significantly during the March, April and May period of liquidity crises. From March 2020 till June 2020, the category witnessed a net outflow of Rs 10,274 crore. However, since then, the credit profile of these funds has improved with higher investments in AAA or equivalent rated securities. Also, on the duration front, the category is positioned well in the current environment. This continues to attract investors towards the category," says Himanshu Srivastava, Associate Director, Manager Research, Morningstar Investment Advisers India.

“Investors are aligning their allocation in debt schemes more towards duration schemes and corporate bond funds to maximize their debt returns, and on the other hand booking their profits in equity funds owing to surge in equity valuations,” said N. S. Venkatesh, Chief Executive Officer, Association of Mutual Funds in India.

Net outflows from credit risk funds have been subsiding as compared to the levels seen in April 2020 when the category saw an outflow of Rs 19,239 crore.

New Fund Offers

The industry launched four new schemes which collectively mopped up Rs 1,254 crore in November.

- Axis Banking ETF and Nippon India ETF Nifty CPSE Bond Plus SDL - 2024: Rs 1,085 crore.

- Mahindra Manulife Focused Equity Yojana: Rs 154 crore.

- quant ESG Equity Fund: Rs 15 crore.

Other Schemes (Net inflow/outflow)

- Index Funds: Rs - 222 crore.

- GOLD ETF: Rs - 141 crore.

- Other ETFs: Rs – 641 crore.

- Fund of funds investing overseas: Rs 411 crore.

The industry’s asset base breached the Rs 30 lakh crore mark for the first time at the end of November 2020 owing to mark-to-market gains in equity funds and robust inflows in debt funds.