With the market recovering 88% since its March 2020 low, many investors have preferred to either switch to debt funds or book profits from equity funds. This was reflected in the sustained net outflows from equity funds since July 2020. In January too, equity funds witnessed net outflows to the tune of Rs -10,147 crore.

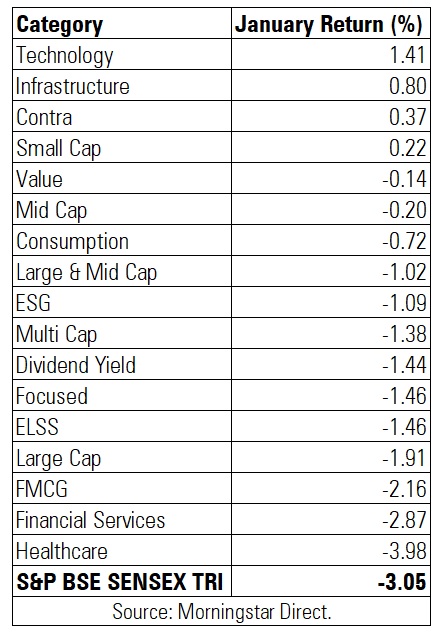

The Sensex scaled an all-time high of 50,184 on January 21, 2020. However, the market lost steam by slipping 3% in January 2021. This was reflected in the performance of funds across categories. Only four categories (technology, infrastructure, contra and small cap) managed to generate a positive return in January 2021.

While the returns in tech funds came off in January 2021 as compared to December 2020 it was still the highest in comparison to other categories. Technology sector funds yielded 1.41% in January 2021, compared to 11.74% return in December 2020. This category stood out in this pandemic era by posting 53.34% return over a one-year period, which was the highest among all fund categories.

Infrastructure funds delivered the second-highest return in January 2021 at 0.80%. Infrastructure funds have started looking up recently, especially in the last three months. This category has delivered 22.91% return over a three month period. In the Union Budget 2021, Finance Minister Nirmala Sitharaman announced a capital expenditure of Rs 5.54 lakh crore for the infrastructure sector in the next fiscal and gave a big thrust to monetizing assets to achieve the goals of the National Infrastructure Pipeline (NIP). Sitharaman proposed to set up Development Financial Institution (DFI) which will have a lending portfolio of at least Rs 5 lakh crore in three years’ time for providing long term debt financing.

Small caps delivered 0.22% return in January 2020. Small Cap funds have delivered 16.28% return in the calendar year 2020. Small Cap funds can be susceptible to huge drawdown and investors need to have a longer time horizon to benefit from this category.

Healthcare sector funds have delivered the second-highest return over a one year period at 53.06%, trailing tech funds. However, health care funds delivered the lowest return at -3.98% in January 2021.

Here’s how different categories of equity funds performed in January 2021.