Unit Linked Insurance Plans, or ULIPs, have been in the news recently. All along, they enjoyed a tax benefit that gave them an edge over mutual funds. The insurance factor added to its charm. The assets under management in ULIPs stood at Rs 4.11 lakh crore as on FY 2018-19.

Union Budget 2021 brought parity on the tax arbitrage enjoyed by ULIPs. Now ULIPs will also attract similar tax as mutual funds if the annual premium exceeds Rs 2.50 lakh. A securities transaction tax (STT) will also be levied on maturity or partial withdrawal on ULIPs issued on or after February 1, 2021.

What are ULIPs? They are products offered by life insurance companies that combine insurance and investment. The premium paid (after deduction of premium allocation charge) is invested in equity and debt or a combination of both, as per the individual’s choice.

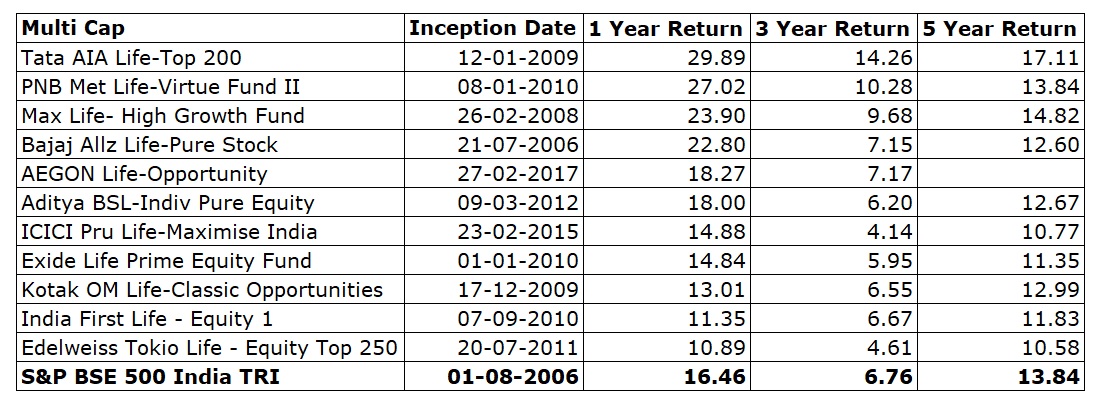

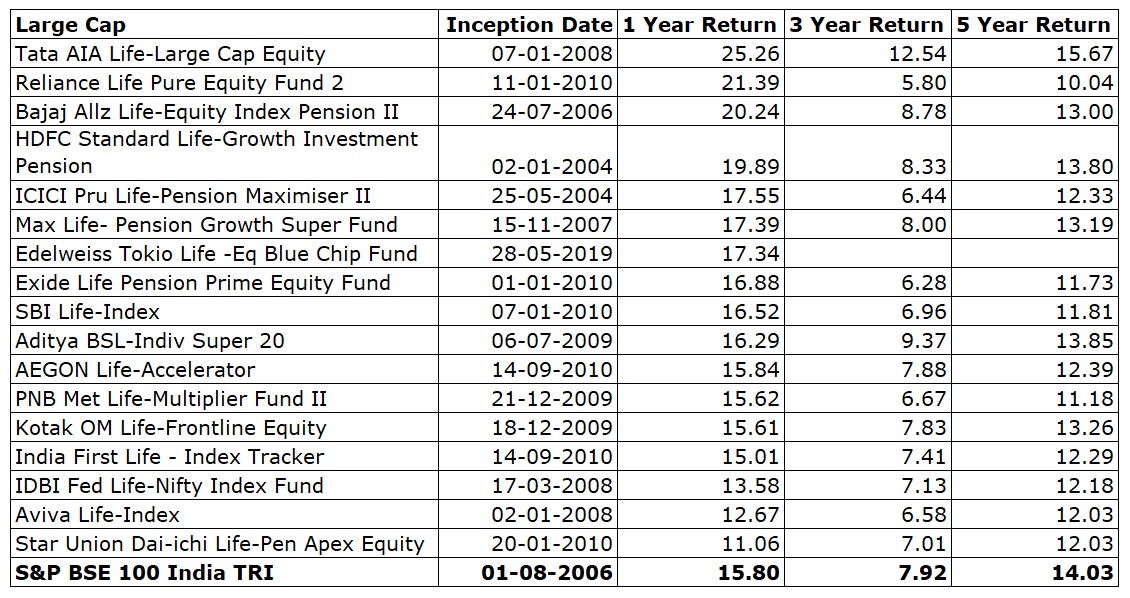

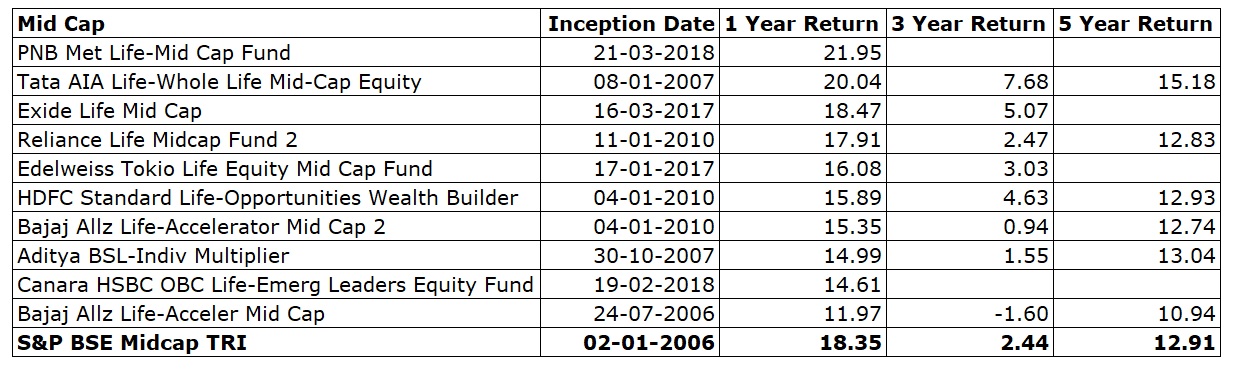

Here is a list of best performing ULIPs. Since there are multiple funds/options under the same category, we included only one fund per category from each firm.

- Source: Morningstar Direct

- Return in %

- Trailing returns are as on February 4, 2021

- Blank cells indicate that these funds have not completed 3 years

You can get more information on the performance of ULIPs here.