Interest rates are currently at their historic lows. While the Reserve Bank of India, or RBI, has maintained its accommodative stance to boost economic growth, once growth kicks in, interest rates could go up in the future. With expectations of an increase in interest rates building up, floater rate funds, which benefit from a rise in rates are in the limelight.

Floater rate funds have received inflows worth Rs 27,134 crore since April 2020. Reflecting this trend, the assets under management in the category has almost doubled from Rs 31,615 crore to Rs 62,638 crore during the same period.

“In the recent past, interest rates have moved lower across the yield curve to multi-year lows following sharp rate cuts and other measures by Reserve Bank of India. Concerns over a roll-back of these support measures leading to a possible upward move in interest rates have increased the attractiveness of the floater funds category. As a result, this category has seen increased traction over the past 6-8 months. The recent Budget announcement of higher government borrowing coupled with rising interest rates across the globe has further exacerbated concerns over a pick-up in interest rates. Hence, the floater funds category may further attract investor interest,” says Dhaval Kapadia, Director – Portfolio Specialist, Morningstar Investment Advisers India.

This category houses just ten funds including the ones launched by DSP and IDFC recently.

What are floater funds?

As the name suggests, these funds aim to invest a minimum of 65% in floating rate bonds issued by corporates, central and state governments that offer variable interest rate that is pegged to the Mumbai Interbank Offer Rate (MIBOR). MIBOR is the interest rate benchmark at which banks borrow unsecured funds from one another.

These funds typically do well when interest rates are set to rise since the floating rate bonds reset their yields as per the prevailing interest rates. But this is not as simple as it appears because there aren’t many issuers of floating rate bonds. Thus, these funds employ a derivative strategy to comply with the minimum 65% investment in floating rate bonds by buying fixed rate bonds.

These funds use Overnight Index Swap (OIS) to hedge interest rate risks. An OIS is an interest rate swap agreement where a fixed rate is swapped against a pre-determined published index of a daily overnight reference rate like NSE MIBOR.

In an OIS, two parties agree to exchange the difference in the accrued interest arrived according to the fixed and floating interest rates at the maturity on the notional principal amount.

Where do they invest?

Floating rate funds typically maintain a duration of two years and invest in a mix of sovereign, corporate, money market and interest rate swaps. A large portion of the portfolio is invested in AAA rated instruments. Further, these funds are less volatile as compared to longer duration funds, which is evident by the low standard deviation of this category. Do note that some of these funds also take credit exposure.

Performance of floater funds

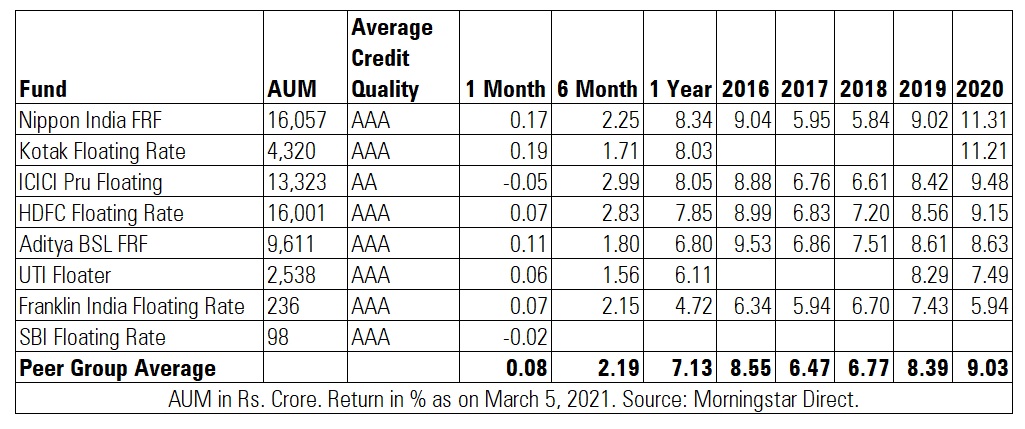

Floater funds category has delivered 7.13% over a one-year period, 6.72% over a three-year period and 6.41% return over a five-year trailing period. However, the returns are negative 0.19% over a two-month period.

Blank cells indicate that these funds have not completed that particular period in existence.

Should you invest?

Financial advisers say that retail investors would be better off avoiding these funds. “I don’t think there are enough opportunities in terms of availability of floating-rate paper in India. Fund houses are trying to complete their product basket by filling the gaps. We already have too many debt fund categories. I don’t see much value in this category,” says Gajendra Kothari, Managing Director and Chief Executive Officer, Etica Wealth.

Siliguri-based mutual fund distributor Prabin Agarwal is of the view that such products are not easily accepted by retail investors as they are quite complex. “These funds are not typically understood by retail investors. It will take some time for such funds to become popular among retail investors. Investors are ready to accept volatility in equity funds but they don’t want to see negative returns in debt funds. Hence, we stick to relatively safer categories like overnight, liquid, and ultra-short funds.”

We recommend investors consult their financial advisers to understand how these funds fit in their overall portfolio and goals.