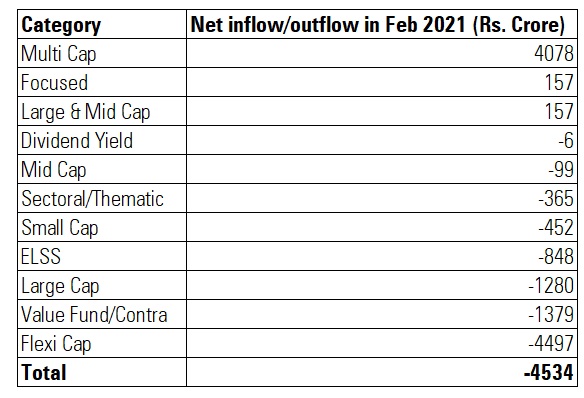

Investors continued to switch/cash out from equity funds as markets remained near an all-time high. Net outflows from equity funds stood at Rs 4,534 crore in February 2021, shows data from Association of Mutual Funds in India, or AMFI. This was the eight-consecutive month of net outflow from the equity funds category.

Inflows from systematic investment plans, or SIPs, dipped from Rs 8,023 crore in January 2021 to Rs 7,528 crore in February 2021.

Most categories of funds have delivered decent returns owing to a broad-based recovery. Over a three-month period, categories like infrastructure, small cap, mid caps have delivered the highest return at 23.44%, 20.04%, and 17.51% respectively. Even value funds have started performing well. Value category delivered 15.15% during a three-month period.

Passive Funds

Passive funds (including index funds and including exchange traded funds) received combined inflows worth Rs 2,438 crore in February 2021. Many fund houses are launching passive funds which is evident by the steady rise in assets under management in this category. The AUM in this category increased from Rs 1.74 lakh crore in April 2020 to reach Rs 2.90 lakh crore in February 2021. The Employees’ Provident Fund Organisation, or EPFO, also invests in ETFs managed by SBI MF and UTI MF.

International Funds

The international fund of funds category is gaining traction. From April 2019, the category witnessed 23rd consecutive monthly net inflow of Rs 969 crore in February 2021. There has been a rush towards international investing as investors are realising the benefits of diversifying away from domestic equities. The category has delivered 27.63% return over a one-year period. Fund houses are launching a series of international funds to capitalise on this trend. There were two new fund offers in this category - Axis Greater China Equity Fund of Fund and Kotak NASDAQ 100 Fund of Fund which collectively mopped up Rs 273 crore in February 2021.

Gold ETFs

Gold was one of the best-performing assets in 2020. The yellow metal is now losing sheen as economies around the world brace for recovery. Over a three-month period, Gold ETFs have delivered -10.69% return. Inflows in Gold ETFs subsided to Rs 491 crore in February 2021 from Rs 624 crore in January 2021. Gold ETF AUM has jumped by 53% from Rs 9,198 crore in April 2020 to Rs 14,102 crore in February 2021.

Given the recent slump in gold prices, some experts believe that it is a good time to enter gold. “The optimism that vaccines would heal the global economy in just a few months has been dampened by the outbreak of new variants and problems with the vaccine rollout in the developed world. Given the current risks, uncertainty and continued commitment to accommodative policies, gold prices definitely seem stretched to the downside, making now an opportune time to build your gold allocation,” said Chirag Mehta, Senior Fund Manager-Alternative Investments, Quantum Mutual Fund.

Fixed Income Funds

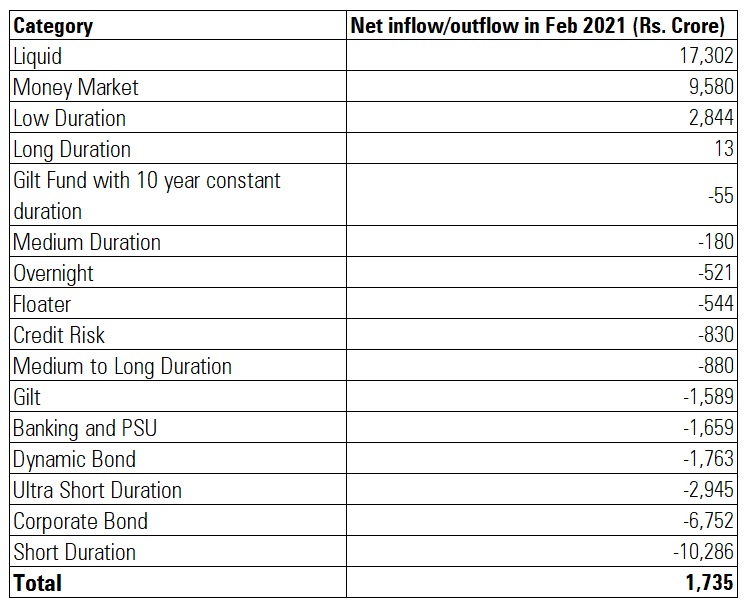

Barring long duration, low duration, money market, and liquid funds, all other categories of funds saw outflows. Short duration funds saw the highest outflows at Rs -10,286 crore followed by corporate bonds funds (Rs -6,751 crore). As a result, debt funds category saw inflows of Rs 1,734 crore in February 2021.

Short duration funds have seen net inflows for nine consecutive months till January 2021 to the tune of Rs 65,021 crore. Similarly, corporate bond funds saw ten consecutive months of inflows till January 2021 worth Rs 73,502 crore since April 2020. These categories benefitted in the aftermath of Corona virus induced lockdown as investors rushed towards relatively safer categories.

“The surge in yields in the bond market have impacted the categories largely having duration above one year. The bond yields surged in February 2021 primarily after the Union Budget and government announcing additional borrowing for the current fiscal. The surge in crude prices also pushed bond yields higher back home. In such a scenario, low duration and money market fund categories were better placed, and therefore attracted net inflows of Rs 2,844 crore and Rs 9,579 crore, respectively,” said Himanshu Srivastava, Associate Director – Manager Research, Morningstar Investment Advisers India.

All in all, the industry’s asset base inched up by 1% from Rs 31.84 lakh crore in January 2021 to Rs 32.29 lakh crore in February 2021.