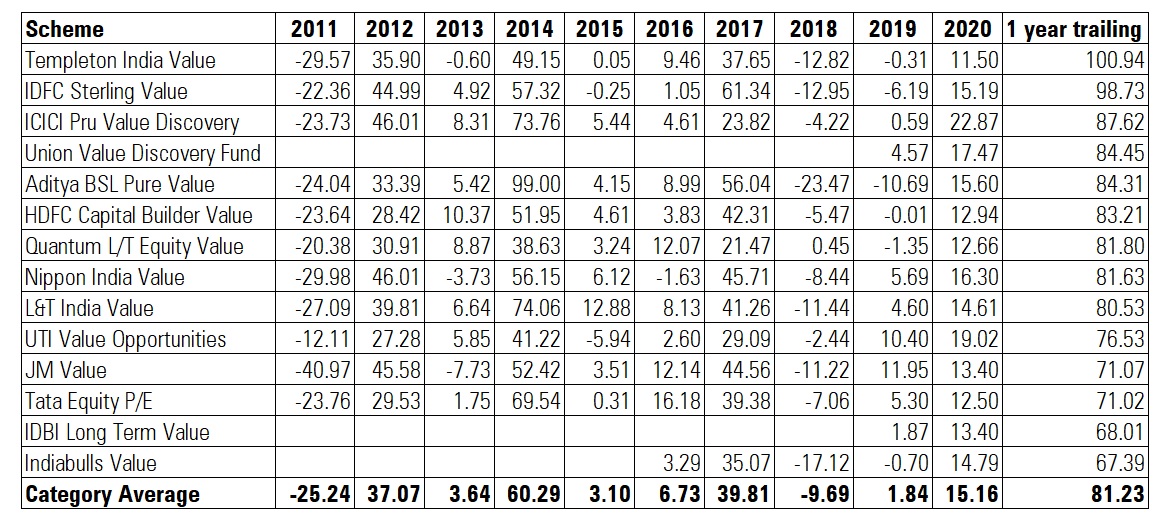

After languishing in 2018 and 2019, value funds have made a decent comeback. The category has delivered 73.74% return over a one year period, outperforming most other categories like large cap, multi cap and ELSS during this period. The best performing Templeton India Value has delivered 100.94% return while the bottom performer Indiabulls Value has delivered 67.39% return, over a one-year trailing period.

(Returns in %. 1 year trailing return as on March19, 2021. Blank cells indicate these funds were not in existence during that period. Data source: Morningstar Direct.)

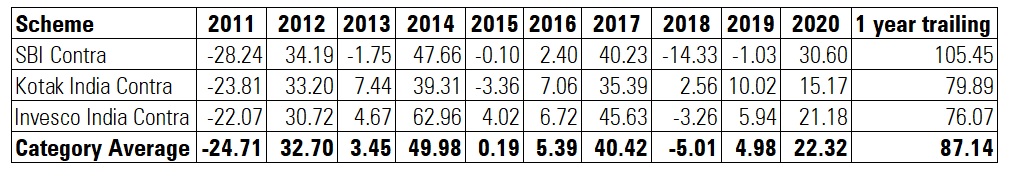

Another type of funds - contra funds, which are also clubbed under the same umbrella by the Securities and Exchange Board of India, or SEBI, has delivered the third-highest return at 79.48% over a one year period.

Let us understand the difference between value and contra funds and whether you should invest in such funds.

Value funds

Value funds invest in stocks that are currently undervalued due to certain headwinds faced by the firm. Typically, fund managers try to identity value stocks through fundamental analysis. They use metrics such as Price to Equity, or PE, discounted cash flows, dividend yield, and so on, to filter stocks.

By applying these metrics, fund managers try to hunt for stocks that are currently trading below their intrinsic value and have the potential to reach their fair value in future. Such stocks would typically have low PE ratios, which means their stock prices are battered but the company has potential but currently the market is not recognising this due to various reasons

But low PE is not the sole criteria to shortlist a stock. A low PE could indicate that the company’s prospects are viewed as not being great, which is reflected in the low stock price. In the same vein, a very high PE does not mean that the company is a bad investment. It is just that there is more demand for the stock because investors are expecting higher growth from such companies in the future and the business has been reporting good profits/revenue every year.

The PE of two different industries usually differ. For instance, Bajaj Finance has a PE of 89.12 while Infosys has a PE of 32.46. The PE of Avenue Supermarts, which owns the Dmart chain, is 183.39 because investors are pricing in higher sales growth in the days to come. This does not imply that a stock with a low PE is a relatively poor investment prospect company. They all are good companies in their own spheres, which is evident by their ownership by large institutional investors. The top 20 funds, including domestic mutual funds and offshore funds, hold 11.48% of the total shares of Infosys. Fund managers consider many other quantitative and qualitative factors while shortlisting stocks and P/E is one of the filters. PE should not be looked at in isolation.

It is not necessary that only value category funds follow a value investing strategy. You would find many funds from other categories which follow a blend strategy, which is a blend of value and growth. A classic case is HDFC Top 100 Fund managed by Prashant Jain with a valuation-conscious approach.

Risks

While the recent performance of value funds looks attractive, these funds come with their own share of risks. “These funds can underperform in momentum-driven, growth-oriented, or polarised markets. Also, the value picks may result in value-traps if stocks bought based on attractive valuations continue to fall further. It could also be attributed to the value style of investing being out of favour and markets being extremely polarised—wherein areas that were expensive became more expensive and value became deep value,” cautions Himanshu Srivastava, Associate Director, Manager Research, Morningstar Investment Advisers India.

Contra funds

There are just three contra funds in the industry – Invesco India Contra, Kotak India Equity Contra, and SBI Contra Fund.

Contra funds ignore companies that are in the limelight or chased by most investors. Instead, they try to scout for stocks that are currently out of favour in the market but have the potential to deliver when the tide turns. For instance, if a fund manager had been overweight healthcare and IT when such sectors faced headwinds, the fund would have benefited immensely in the aftermath of coronavirus pandemic since these sectors have delivered stellar returns.

Similarity between value and contra

Although value and contra are two distinct investing strategies there is a common element between both investing styles. A contrarian fund manager would also invest in companies that are undervalued based on evaluating metrics such as PE or book value. The differentiation is that the contrarian manager would avoid stocks that are overhyped or are very popular among investors and thus go against the grain.

Since contra funds can also invest in stocks that are undervalued, you would find that there could overlap of stocks in contra and value funds.

We looked at the common stock holdings of two funds – ICICI Prudential Value Discovery and Invesco Contra Fund and found that 27.89% of holdings of both funds are common. As fund managers need to take exposure across market caps and styles to diversify, you would always find some amount of holding overlap in any two funds.

Portfolio 1 – ICICI Pru Value Discovery

Portfolio 2 – Invesco Contra Fund

(As on February 2021.)

Investment horizon

These funds are not thematic or sector investments, which means that these funds are well diversified across sectors and market capitalisation. However, investing in such funds requires a long-term view and patience as such funds could underperform even when the broader market is doing well.

“In the current low interest rate world, good companies rarely come cheap. Hence it becomes important to apply disciplined rules to identify such companies at reasonable prices. Our approach is focused on being less prone to bias and offering better risk management to investors. Investors in value funds should have a long term orientation to endure phases of underperformance that is a part of the value investing journey,” says Kalpen Parekh, President, DSP Investment Managers.

Mumbai-based mutual fund distributor Rushabh Desai says that investors could gain from value strategy if their investment horizon is longer. “The recent uptake in the broader Indian market has led many cyclical and value companies to outshine. On a Year to Date basis, the MSCI Value Index has started to outperform the MSCI World Growth Index which indicates a strong demand for value stocks. As per The Bank of America Report, which surveyed 225 fund managers overseeing $645-billion assets, around 52% of fund managers expect value companies to outperform growth in the next 12 months. Thus, this makes the value segment a very sweet spot for investors to take advantage from a valuation point of view in the current market. Investors should understand that the value segment needs a longer time horizon to achieve optimum returns and will need a slightly higher risk appetite and at least a 6 to 7-year time horizon. Investors can venture in this segment in selective funds via systematic investment route.”