Just like timing the market is difficult, timing the entry and exit in equity mutual funds is a futile exercise. This is corroborated by our latest study which analysed actively managed equity diversified funds over ten years.

We first looked at the Indian stocks’ outperformance data over a ten-year period. From March 2011 to February 2021, Indian stocks owed all their outperformance over cash to just eight months or 6.7% of all months.

We performed the same test against Indian actively managed diversified equity funds for a similar period to determine if the phenomenon applied to them as well. We found that actively managed funds are finding it increasingly harder to beat benchmarks, in addition the number of months contributing to overall outperformance versus benchmarks of these funds is shrinking. The results show that on an average Indian actively managed diversified equity funds' outperformance was attributable to a smaller proportion of months: six months or 5% of all months.

Results

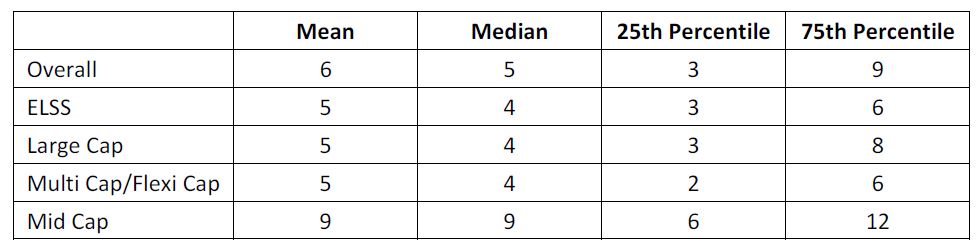

The table below displays aggregate statistics for critical months (Critical months are those months whose removal from the return series would eliminate the fund's outperformance over its benchmark.) first in aggregate and then grouped by fund category.

One can immediately see that whether it's mean, median, or the top- and bottom quartile breakdowns, these numbers are small and should give little comfort to investors who try to find the best times to buy and sell actively managed funds. In aggregate, the median number of critical months was five. That means that half of the funds' outperformance was due to five or fewer months. One in four funds (25th percentile) owed their outperformance to three or fewer months. Finally, three fourths (75th percentile) of all the funds' outperformance was attributable to nine or fewer months. Mid Cap Funds were the best of the pack, while expectedly funds with a Large Cap bias came in with the poorest results.

Average no of critical months by category

What should you do?

- Investors should not try to time investments in actively managed funds. Staying invested is the name of the game.

- Investors are best served to identify consistently managed funds and stay invested. Investing basis recent performance can be counterproductive, resulting in missing of critical months of performance in both the newly invested funds as well as the exited funds.

- The most practical implication of our findings—is that trying to find the best time to buy or sell a fund is most likely futile. Most of the time, even outperforming funds basically track or trail the index.

- If you think you have identified a skilled manager, the best course of action is to buy in or rupee cost average, regardless of the moment, and hold on to the fund over long periods of time. The obvious, and perhaps even more important, corollary is that a fair amount of patience is required to adhere to such a program. A good manager may take a long time before critical months materialize. Thus, don't sell based on the “what have you done for me lately” rationale. The gospel of wisdom can be adapted to active management: No one knows the day or the hour when outperformance will strike.

(Only equity funds regular share class (ELSS, Large Cap, Multi Cap (Flexi Cap) & Mid Cap) were considered for this study.)

Download the full report here.