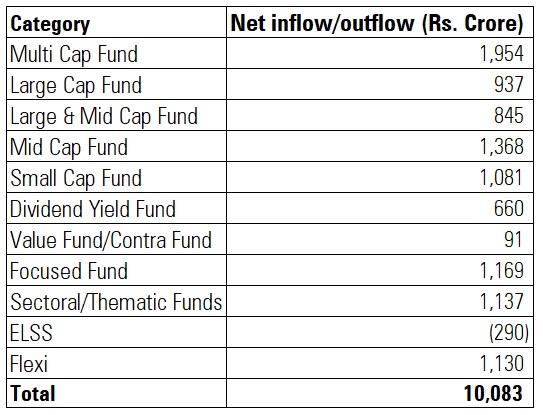

Buoyant equity markets helped the industry receive Rs 10,083 crore net inflow in May 2021 in equity funds.

The redemptions were also lower in May 2021 as compared to April 2021. Further, three new equity fund offers launched in May received Rs 3,125 crore.

“Domestic Institutional Investors and retail investors have kept the markets buoyant in last three months when Foreign Institutional Investors (FIIs) have been net sellers. Thus, the Indian markets are more broad-based now with more participants thereby reducing volatility and vulnerability to sentiments of FIIs,” said Akhil Chaturvedi, Head of Sales & Distribution, Motilal Oswal Asset Management Company.

Inflows from Systematic Investment Plans (SIP) increased from Rs 8,596 crore in April 2021 to Rs 8,819 crore in May 2021. The number of SIP accounts increased from 3.79 crore to 3.88 crore during the same period.

N. S. Venkatesh, Chief Executive Officer, AMFI said, “Retail equity-oriented contribution continues to be on the upward trend driven by net flows predominantly in Arbitrage, Multicap, Midcap schemes, as also smart diversification in Fund of Fund schemes which invest in foreign equities. Retail SIP Accounts, SIP AUMs and SIP Contribution which signifies retail activity in the mutual fund industry has seen a continued upward trend for the second month this fiscal, leading to overall Industry AUMs moving to record high of Rs 33.05 lakh crores and 10 crore folios.”

Hybrid

The hybrid category received Rs 6,217 crore net inflow in May 2021. Arbitrage Funds received the major chunk of inflows worth Rs 4,521 crore. Dynamic Asset Allocation/Balanced Advantage Funds received Rs 1,363 crore. Conservative Hybrid Funds, which invest up to 25% in equities, received Rs 395 crore.

Fund of funds investing overseas

This category has been gaining traction. In one year, the category has received net inflows worth Rs 11,000 crore. Recently, the Securities and Exchange Board of India (SEBI) has hiked the investment limit in overseas securities for fund houses from $600 million to $1 billion per fund house.

To cash in on the rising appetite for international funds, fund houses are lining up such funds. Aashish P Somaiyaa, CEO, White Oak Capital, says that investors need to tread with caution while investing in international funds at this juncture. “Basis recency bias one is seeing a rising trend of money flowing into international funds and investors need to be wary of trend following piling more and more money into developed market technology stocks in the late stages of a multi-year boom.”

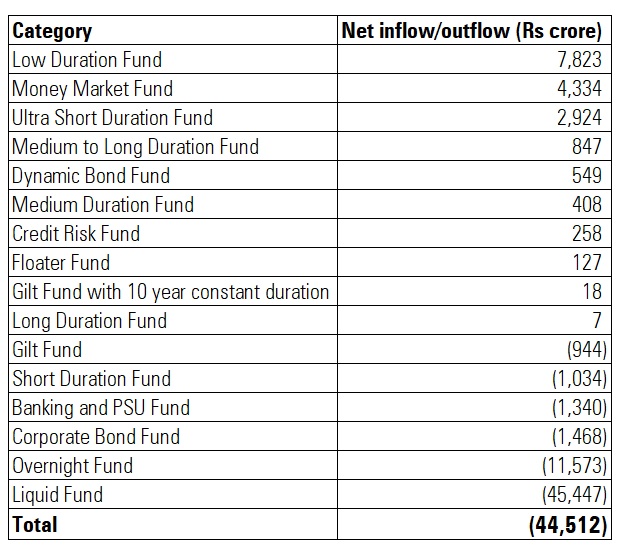

Debt

After witnessing net inflows worth Rs 1 lakh crore in April 2021, Debt funds saw net outflows worth Rs 44,512 crore in May 2021 mainly due to huge outflows from liquid and overnight funds. Investors are moving to short end of the curve, which is evident by inflows in categories like Low Duration, Money Market and Ultra Short Term Funds.

“After witnessing consistent net outflows, credit risk fund received a net inflow of Rs 258 crore. The improvement in scenario on the fixed income side would have prompted investors to take a calculated risk by allocating some portion of their investments in credit funds. The medium duration category also received net inflows of Rs 407 crore, which was higher than the net inflow of Rs 339 crore recorded in April. The category has seen improvement in credit profile, which, given the prevalent scenario in the debt markets, would have attracted investors. Banking & PSU funds again witnessed net outflows this month, which could be a result of the new guidelines around valuations and fund exposure norms for AT1 bonds,” says Himanshu Srivastava, Associate Director – Manager Research, Morningstar Investment Advisers India.