While China gets much of the spotlight when we thinking about emerging markets in Asia, there are plenty of other countries in the region worth an investor's attention.

While the prospects of these countries depend, to differing degrees, on China to prosper but many are dynamic in their own right and offer potential high economic growth in the coming years.

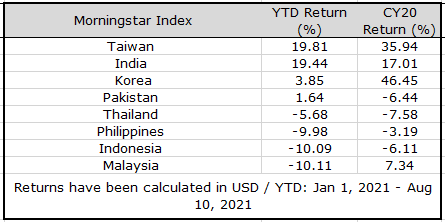

But overall stock market performance has been mixed this year, with Indian and Taiwan excelling and south-east Asia disappointing. We break down this year’s performance in terms of their equivalent Morningstar index (based on net returns in USD).

India

India has been one of the best performing stock markets in the region this year, even as the country deals with a severe second wave of coronavirus cases and deaths. The Morningstar India index is up 19% year to date, after a gain of 17% in 2020. What explains this disconnect? Unlike in the first wave, India’s economy has remained open in the second wave of coronavirus, while global investors have backed the country to make a recovery similar to that seen in China.

Ramesh Mantri, manager of the Ashoka India Equity investment trust, says the country’s leaders have taken the crisis as an opportunity to reform manufacturing, labour laws and accelerate the push to privatise various industries.

With increasing interest from domestic and foreign investors, the Indian IPO market has also sprung back into life, says Pictet emerging market specialist Kiran Nandra. Food delivery firm Zomato has just launched on the stock market, for example, and the offer was oversubscribed.

Vinay Agarwal, director at FSSA Investment Managers, thinks Indian companies are better at dealing with crises, whether political or economic, than others in emerging markets. “They are used to uncertainty, and accustomed to working in a system that is not as supportive as in many other countries.”

North Asia

Because of China’s dominance, other Asia Pacific countries are often overlooked by investors. But the rise of Taiwan Semiconductor means the company is now the largest weighting in the MSCI Emerging Markets index, overtaking giants Tencent and Alibaba.

Taiwan and South Korea make up around 13% of the index as at the end of June and have both benefited, as high-tech manufacturing hubs, from proximity to and close business ties with, China. The Morningstar Korea index was up more than 46% in 2020, helped by China’s boom, but has struggled to repeat that performance, rising just 4% this year. Taiwan has fared better this year with a gain of 20% in 2021, after a rise of 36% in 2020.

South-East Asia

These were the laggards.

Malaysia, Indonesia, Thailand and Philippines indices have all posted negative returns in 2021 so far. Coronavirus has curtailed the growth narrative in these countries, which have also fallen out of favour with global investors. Thai and Indonesian currencies have been under pressure this year as the economies flag and a rising US dollar shifts the dynamic for EM investors.

But Vietnam is the outlier in the region because of closer links to China and resilience during the pandemic, with its stock market rising 20% this year. Vietnam, though, is still classified as a frontier market, the topic of a different article this week. “The outlook for Vietnam remains positive, especially as it has been able to minimise the impact of Covid-19 compared to other Asian countries,” says Vu Huu Dien, manager of the Vietnam Enterprise investment trust. But he adds that the country is still lagging on ESG issues.