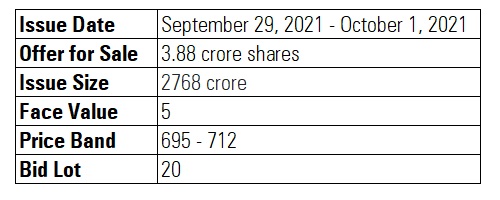

Aditya Birla Sun Life AMC Limited Initial Public Offering opened for subscription on September 29, 2021. ABSL is the fourth largest fund house in India in terms of assets under management as on June 2021. Around 1.29 crore shares have been reserved for retail investors.

HDFC AMC, Nippon India and UTI AMC are among its listed peers.

Issue Details

Objects of the Offer

- To achieve the benefits of listing.

- Carry out the offer for sale of up to 3.8 crore equity shares by the selling shareholders.

- Enhance visibility and brand image.

- The selling shareholders will be entitled to the entire proceeds of the offer. The company will not receive any proceeds from the offer.

About the Company

The fund house managed 118 schemes comprising 37 equity schemes, 68 debt schemes, two liquid schemes, five ETFs and six domestic FoFs, as of June 30, 2021. Since its inception in 1994, the company has established a geographically diversified pan-India distribution presence covering 284 locations spread over 27 states and six union territories. Its distribution network is extensive and multi-channeled with a significant physical as well as a digital presence.

It is ranked as the largest non-bank affiliated AMC in India by QAAUM since March 31, 2018, and among the four largest AMCs in India by QAAUM since September 30, 2011, according to the CRISIL Report. The fund house managed total AUM of Rs 2,936.42 billion under its suite of mutual fund (excluding our domestic FoFs), portfolio management services, offshore and real estate offerings, as of June 30, 2021.

The company has achieved this leadership position through its focus on consistent investment performance, extensive distribution network, brand, experienced management team and superior customer service. Since its inception in 1994, the firm has established a geographically diversified pan-India distribution presence covering 284 locations spread over 27 states and six union territories.

Its distribution network is extensive and multi-channelled with a significant physical as well as digital presence, and included over 66,000 KYD-compliant MFDs, over 240 national distributors and over 100 banks/financial intermediaries, as of June 30, 2021.

The fund house has maintained a market leading position in B-30 penetration over the years, which has further contributed to the growth of its individual investor base as well as improvement in profitability. Its B-30 cities MAAUM was Rs 447.01 billion as of June 30, 2021, and the share of MAAUM from B-30 cities in total MAAUM as of June 30, 2021 was the second highest amongst the five largest AMCs in India in terms of MAAUM, according to the CRISIL Report.

The company’s share of MAAUM from B-30 cities in total MAAUM increased from 13.44% as of March 31, 2019 to 15.76% as of June 30, 2021, which was the highest increase among the five largest AMCs in India in terms of MAAUM, according to the CRISIL Report.

Its systematic transactions have achieved similar growth with its number of outstanding SIPs more than tripling from 0.86 million as of March 31, 2016 to 2.80 million as of June 30, 2021. Correspondingly, its AUM from SIPs grew from Rs 85.23 billion (representing 25.70% of its total equity-oriented mutual fund AUM) as of March 31, 2016 to Rs 456.92 billion (representing 41.70% of total equity-oriented mutual fund AUM) as of June 30, 2021.

Financials

Growth in Revenue and Profitability

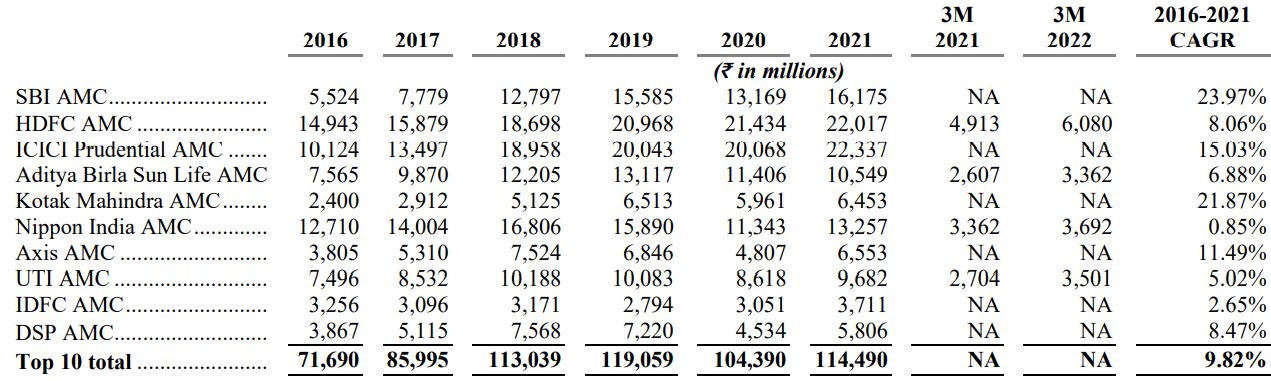

Aditya Birla Sun Life AMC held the fifth position in terms of total revenue in the financial year 2021 among peers. HDFC AMC leads the industry in terms of revenue with approximately Rs 22 billion in the financial year 2021, followed by ICICI Prudential AMC and SBI AMC with Rs 20 billion and Rs 16 billion, respectively. Aditya Birla Sun Life AMC’s revenue was Rs 10.5 billion in the financial year 2021, placing it in fifth position in the revenue list. The variation in the pecking order of various players in terms of QAAUM and revenues can be attributed to differences in the asset mix and the share of passive assets managed in the overall assets. Overall, revenues of the top 10 AMCs in the industry recorded a CAGR of 9.82% between the financial years 2016 and 2021.

Here is the total revenue of the top 10 AMCs in India (presented in descending order in terms of QAAUM as of June 2021) for the financial periods indicated:

(Click on the image to enlarge)

Industry

The Indian mutual fund industry has a history of over 50 years, starting with the passing of an act for the formation of UTI, a joint initiative of the Government and the RBI in 1963. The mutual fund industry and asset management companies are regulated by SEBI. The mutual fund industry has seen increased participation due to growing awareness, financial inclusion, and improved access to banking channels. The aggregate AUM of the Indian mutual fund industry has grown at a healthy pace over the past 10 years, against the backdrop of an expanding domestic economy, robust inflows, and rising investor participation, particularly from individual investors. Average AUM grew at a CAGR of 16.4% to Rs 33.18 trillion as of June 2021 from Rs 7.01 trillion as of 2011.

Risks related to business

- Underperformance of investment products could lead to a loss of investors, reduction in AUM and adversely affect our results of operations and reputation.

- The growth of our AUM may be affected due to the unavailability of appropriate investment opportunities.

- Credit risks related to the debt portfolio of funds may expose its schemes to losses, which may have an adverse effect on its business, results of operations, financial condition and cash flows.

- The fund house depends on third-party distribution channels and other intermediaries, and problems with these distribution channels and intermediaries or failure to continue to expand the current third -party distribution channels and intermediaries could adversely affect business and financial performance.

- Any concentration in the investment portfolio could have an adverse effect on our business, results of operations, financial condition and cash flows.

- Its investment activities are subject to investment, liquidity and other risks and limitations in its risk management system, and the company’s ability to effectively identify and mitigate such risks may have an adverse effect on its business, results of operations and cash flows.

- Competition from existing and new market participants offering investment products could reduce the company’s market share or put downward pressure on fees.

- Reductions of the expense limits prescribed under SEBI regulations may impact its profitability and cause us the company to decrease its marketing and other efforts on behalf of the funds.

- Fluctuations in the market value of its investments could adversely affect its results of operations and financial condition.

(The above information is sourced from Red Herring Prospectus.)

Should you subscribe?

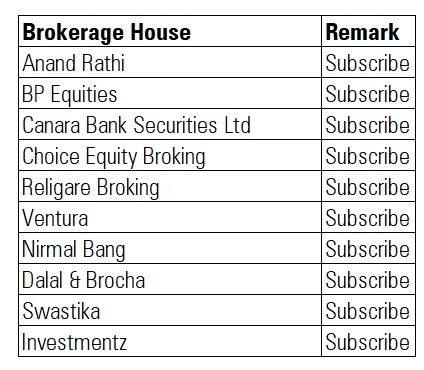

At least ten brokerage houses have issued a subscribe rating to the IPO.