After floating its consultation paper in July 2021, SEBI has introduced swing pricing mechanism for open ended debt mutual fund schemes (except overnight funds, Gilt funds and Gilt with 10-year maturity funds) from March 1, 2022.

The new norms aim to ensure a level playing field for existing, especially retail investors. Under swing pricing, the fund adjusts the scheme’s net asset value (NAV) up or down to effectively pass on transaction costs arising from investors moving in or out of the scheme.

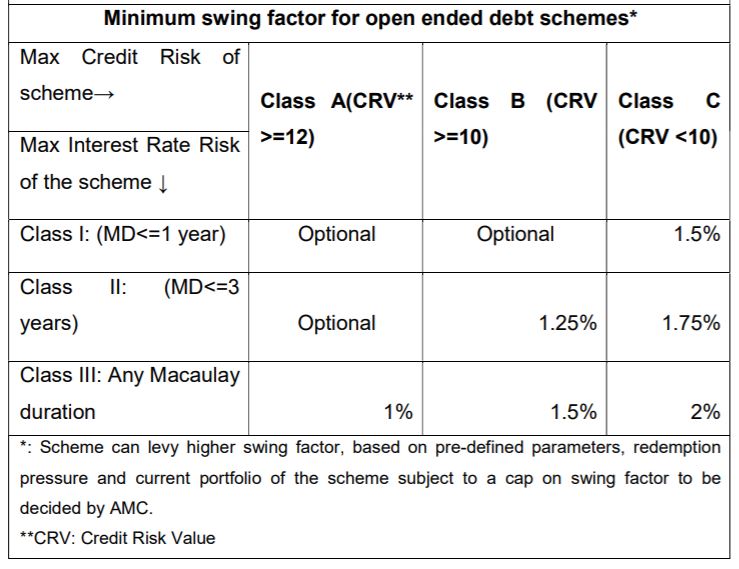

A minimum swing factor as under shall be made applicable to the schemes during market dislocation.

ALSO READ: Disclose interest rate and credit risk in debt schemes: SEBI

To begin with, the swing pricing framework will be made applicable only for scenarios related to net outflows from funds. It will be a hybrid framework with:

- a partial swing during normal times and

- a mandatory full swing during market dislocation times for high-risk open ended debt schemes.

Other aspects pertaining to swing pricing

- When swing pricing framework is triggered and swing factor is made applicable (for normal time or market dislocation, as the case may be), both the incoming and outgoing investors shall get NAV adjusted for swing factor.

- All AMCs shall make clear disclosures along with illustrations in the SIDs including information on how the swing pricing framework works, under which circumstances it is triggered and the effect on the NAV for incoming and outgoing investors.

- Swing pricing will be made applicable to all unitholders at the PAN level with an exemption for redemptions up to Rs 2 lakh for each mutual fund scheme for both normal times and market dislocation.

- The scheme performance shall be computed based on unswung NAV.

SEBI has asked the Association of Mutual Funds in India (AMFI) to develop a set of guidelines for Swing pricing during market dislocation and normal times. AMFI will also prescribe an indicative range of swing threshold to the industry for normal times.

SEBI will determine ‘market dislocation’ either based on AMFI’s recommendation or suo moto. Once market dislocation is declared, it will be notified by SEBI that swing pricing will be applicable for a specified period.

AMCs can decide on the applicability of swing pricing and the quantum of swing factor depending on scheme-specific issues.

Rationale

SEBI felt that there is a need for a mechanism that imposes certain costs on exiting investors (since they are contributing to a downward spiral in NAV) while incentivizing entering investors (since they are helping to stem the downward spiral in NAV).

Swing Pricing

Suppose a fund managing Rs 100 crore worth assets gets a redemption request from a large institutional investor for Rs 10 crore, which is 10% of the fund’s AUM, the fund house will first tap into its liquid reserves to meet the redemption request. Swing pricing may get invoked based on the threshold set by the AMC or the industry. Let us assume it is 5% of the AUM in this case. The fund manager will sell the securities in the market. However, the fund manager may not get the desired price for liquidating the security, especially when the market for the underlying security is illiquid. Additionally, the fund will incur trading/transaction cost which will eat up fund’s return, reflecting in the NAV. As a result, investors who remain invested in the fund are at a disadvantage. To penalise investors who are going out that day, the AMC adjusts the NAV downwards which accounts for the trading, taxes and liquidity cost. This ensures that the trading costs are borne by the exiting investor.

The fund house adjusts the scheme’s net asset value (NAV) up or down to effectively pass on transaction costs arising from investors moving in or out of the scheme.

Scenario 1

If the net inflows exceed a threshold, NAV is adjusted upward. This way, investors trading on that receive less units since NAV is adjusted upwards. The higher the NAV, lesser units you get and vice versa.

Scenario 2

If the net outflow exceeds a threshold, NAV is adjusted downward. This ensures that investors redeeming on that day compensate existing investors since exiting investors get fewer proceeds from downward adjusted NAV. The lower the NAV, the lower the redemption value.

Swing Pricing is already practiced in markets like U.S., Luxembourg, Hong Kong, France and U.K.

Access the circular here.