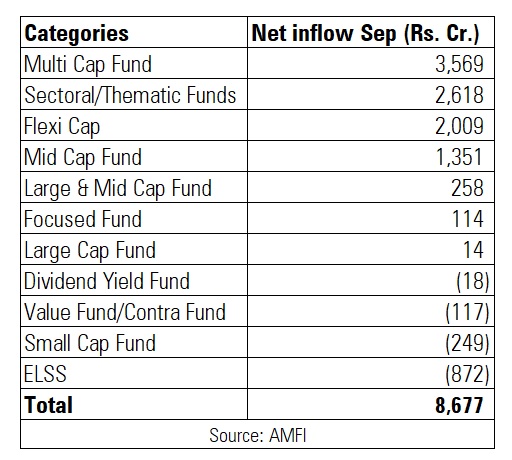

As markets continued to scale new highs, net inflows in equity funds remained steady at Rs 8,677 crore in September 2021. The inflows were spread across categories like Flexi Cap, Thematic/sectoral, Multi Cap and Mid Cap.

Further, inflows from systematic investment plans (SIP) continued to be robust. From Rs 9,923 crore in August 2021, SIP inflows in September increased to Rs 10,351 crore. The number of SIP accounts increased from 4.32 crore in August 2021 to 4.48 crore in September 2021.

“SIP inflow is reflective of continued retail investor confidence in the mutual funds. Retail Investors are preferring mutual funds, over low-yielding traditional savings avenue like Bank FDs, and also gold and real estate. On the back of rapidly improving economic scenario aided by conducive RBI policy and easing of Covid related restrictions, equities asset class would continue to deliver superior risk-adjusted returns,” N. S. Venkatesh, Chief Executive Officer, Association of Mutual Funds in India.

Himanshu Srivastava, Associate Director – Manager Research, Morningstar Investment Advisers India, shares his views.

The relaxation in the lockdown norms across the country, resumption of business activities and vaccination drive gaining pace has improved growth outlook. This has aided the markets to touch new all-time highs on expectation of economic recovery, thereby side-lining the risk of a possible third wave of the pandemic. This secular bull run in the markets and high returns have attracted several investors towards equity mutual fund, as a means, to participate and benefit from this growth in the equity markets. Relatively lower returns from traditional investments have also made equity mutual funds attractive investment destination for investors. Additionally, with the SIP book growing consistently, equity oriented funds have been receiving robust flows.

Equity-oriented NFOs continue to attract investors thus garnering robust flows. During the month five equity oriented NFOs were launched which combined collected around Rs 6,579 crore, thus significantly contributing towards the net inflows.

Passively manged funds continue to attract investors interest on the back of sharp rally in the equity indices. Consequently, Index funds and other ETF category recorded a net inflow of Rs 10,764 crore in September. What also added to the net inflow were four NFOs, two each in Index and other ETF category, which collected Rs 1,211 crore.

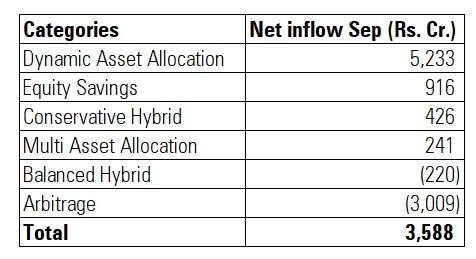

Hybrid Funds

Dynamic Asset Allocation Funds is emerging as a category. The category has received Rs 29,378 crore so far, this fiscal.

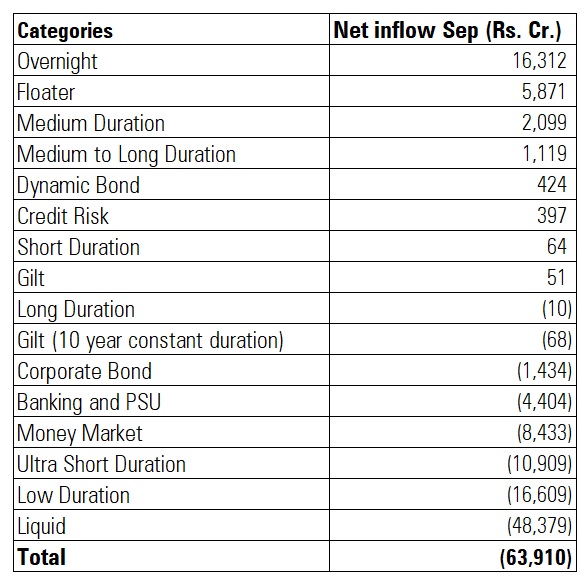

Debt Funds

Debt funds witnessed net outflows to the tune of Rs 63,910 crore owing to quarter-end.

“Credit Funds continued to witness inflows on the back of improvement in scenario on the fixed income side. This would have prompted investors to take a calculated risk by allocating some portion of their investments in credit funds,” added Himanshu.

Average asset size of the industry increased from Rs 36.09 lakh crore in August 2021 to Rs 37.40 lakh crore in September 2021.