Fund houses launched as many as 32 open ended funds, including six Exchange Traded Funds (ETFs), during the second quarter of the fiscal year 2021-22, which collectively mopped up Rs 49,283 crore. If we take into account inflows in existing open ended funds, these funds garnered Rs 1.26 lakh crore.

Funds that collected the highest inflows were SBI Balanced Advantage Fund (Rs 14,551 crore), followed by ICICI Prudential Flexicap Fund (Rs 9,808 crore) and Kotak Multicap Fund (Rs 3,510 crore).

Here are funds that received the highest net inflows and outflows during the September quarter 2021.

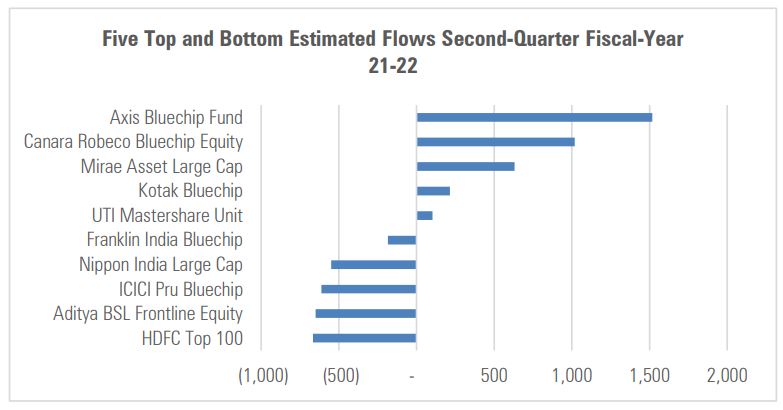

Large Cap

As of September 2021, the total assets in this category stood at Rs 2.18 lakh crore, which forms 17% over the overall open-end equity fund assets.

Axis Bluechip, Canara Robeco Bluechip Equity, and Mirae Asset Large Cap continued to be the highest recipients of funds. They garnered net inflows worth Rs 1,518 crore, Rs 1,019 crore; and Rs 631 crore, respectively, in second quarter fiscal-year 2021-22.

On the other hand, funds that saw the highest outflows were HDFC Top 100 Fund (-Rs 666 crore), followed by Aditya Birla Sunlife Frontline Equity (- Rs 649 crore) and ICICI Prudential Bluechip Fund (-Rs 613 crore), during the same period. These were the same funds that witnessed the highest exodus of outflows in the last two quarters as well.

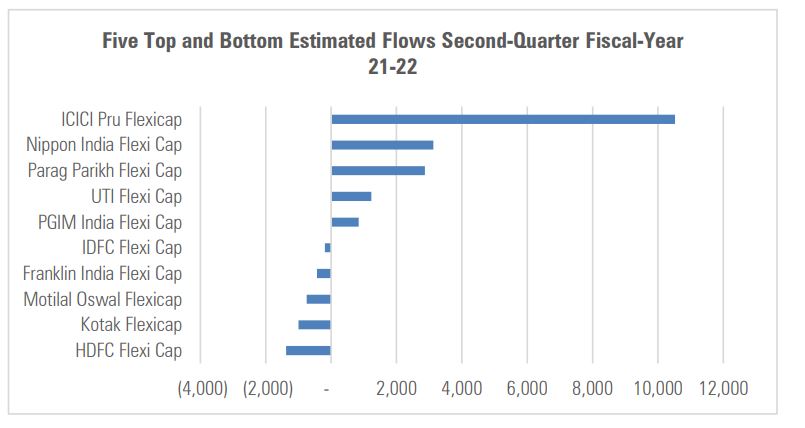

Flexi Cap

The funds that received the highest net inflows in second-quarter fiscal-year 2021-22 were ICICI Prudential Flexi Cap, (Rs 10,520 crore), followed by Nippon India Flexi Cap (Rs 3,125 crore), and Parag Parikh Flexi Cap (Rs 2,873 crore). The flows garnered by ICICI Prudential Flexi Cap was during the NFO period.

On the other hand, with net outflows of Rs 1,380 crore, HDFC Flexi Cap Fund recorded the highest net outflows during the quarter. This was followed by Kotak Flexi Cap and Motilal Oswal Flexi Cap, which lost Rs 1,001 crore and Rs 747 crore, respectively.

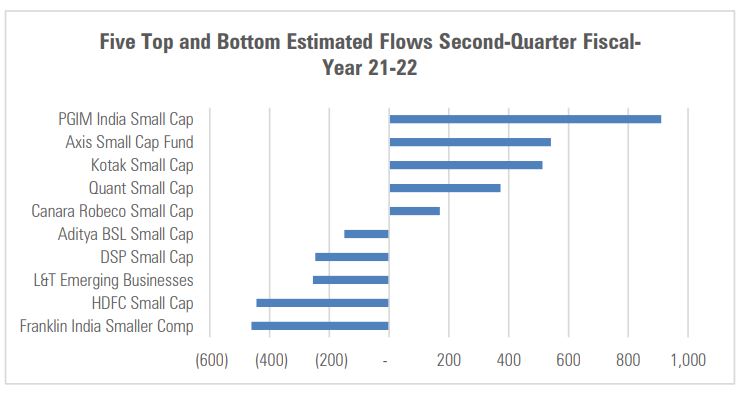

Small Cap

The total AUM of the small-cap category as of September 2021 stood at Rs 98,014 crore. Small caps form 8% of total open-end equity assets.

The biggest beneficiaries in the second quarter of fiscal-year 2021-22 were PGIM India Small Cap with net inflows of Rs 910 crore; Axis Small Cap, with net inflows of Rs 541 crore; and Kotak Small Cap, with net inflows of Rs 513 crore. The net inflows into PGIM India Small Cap came during its NFO stage as the fund was launched in July 2021.

During the same quarterly period, Franklin India Smaller Companies Fund witnessed the highest net outflows— Rs 461 crore—followed by HDFC Small Cap Fund and L&T Emerging Business Fund, which saw around Rs 444 crore and Rs 255 crore eroded from their coffers, respectively.

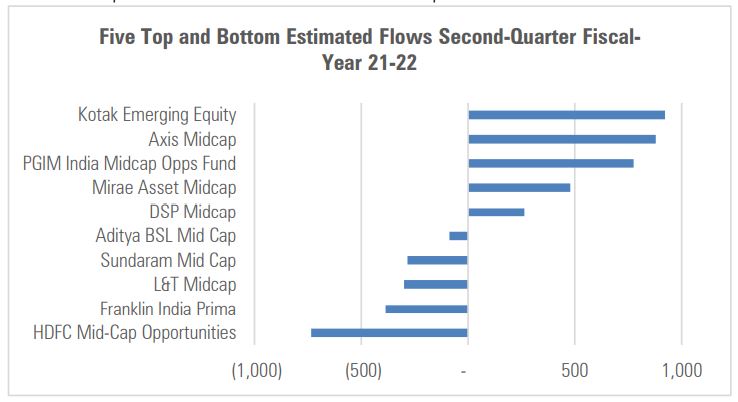

Mid Cap

The total AUM of the mid-cap category as of September 2021 was Rs 1.53 lakh crore, which is 12% of the overall open-end equity category.

Similar to last quarter, the funds that received the highest net inflows in the second-quarter fiscal-year 2021-22 were Kotak Emerging Equity (Rs 922 crores); Axis Midcap Fund (Rs 879 crore); and PGIM India Midcap Opportunities Fund (Rs 775 crore).

On the other hand, with net outflows of Rs 734 crore, HDFC Midcap Opportunities Fund recorded the highest net outflows during the quarter. This was followed by Franklin India Prima Fund and L&T Midcap Fund, which lost Rs 387 crore and Rs 300 crore, respectively.

Hybrid

The open-ended allocation/hybrid category of funds received the highest net inflows worth Rs 41,775 crore in the second quarter of fiscal-year 2021-22. The Balanced Advantage/Dynamic Asset Allocation received net inflows of Rs 24,258 crore during the quarter. SBI Balanced Advantage Fund, which garnered over Rs 14,500 crore during its NFO in August 2021 accounted for most of the inflows in this category. Scrutinizing the data closely reveals that the Balanced Hybrid/Aggressive Hybrid category experienced positive flows only twice in the last 30 months.

The category overall was also aided by net inflows in the arbitrage category (Rs 13,708 crore) over the quarter. The cumulative assets under the Allocation/Hybrid category now total Rs 4.50 lakh crore and form 12% of the overall open-end assets, up by a sharp 16% since the last quarter and 53% over the last year.