The Equity Linked Savings Scheme (ELSS) is one of the popular products to save tax under Section 80C. We looked at the performance of ELSS funds over three- year, five-year ten year period on a rolling return basis.

Rolling returns offer a useful lens into a fund's fuller return history and can help investors see through the haze caused by the latest data.

Performance

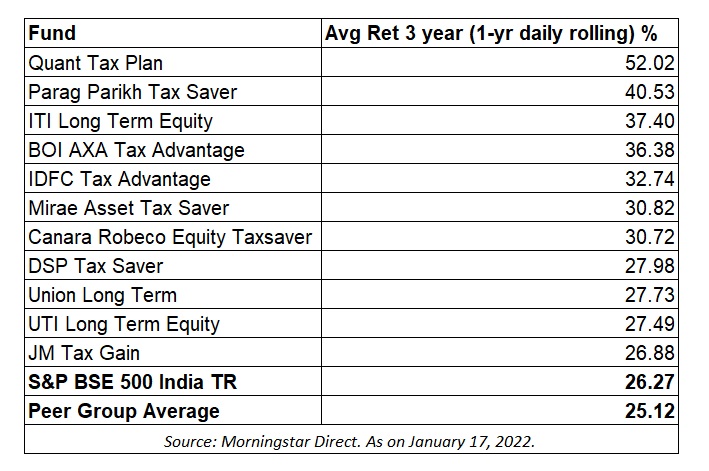

Three Year (1-year daily rolling return)

Of 41 funds, 11 funds outperformed BSE 500 TRI as of January 17, 2021. BSE 500 TRI delivered 26.27% during this period.

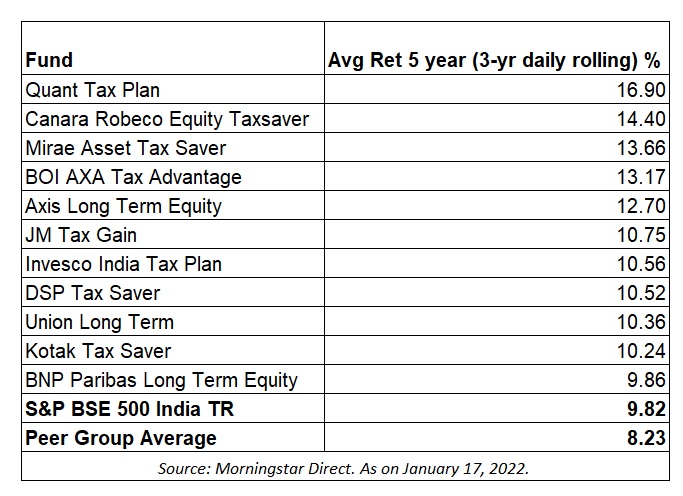

Five Year (3-year daily rolling return)

Over a five-year period too, 11 funds outperformed BSE 500 TRI as of January 17, 2021. BSE 500 TRI delivered 9.82% during this period.

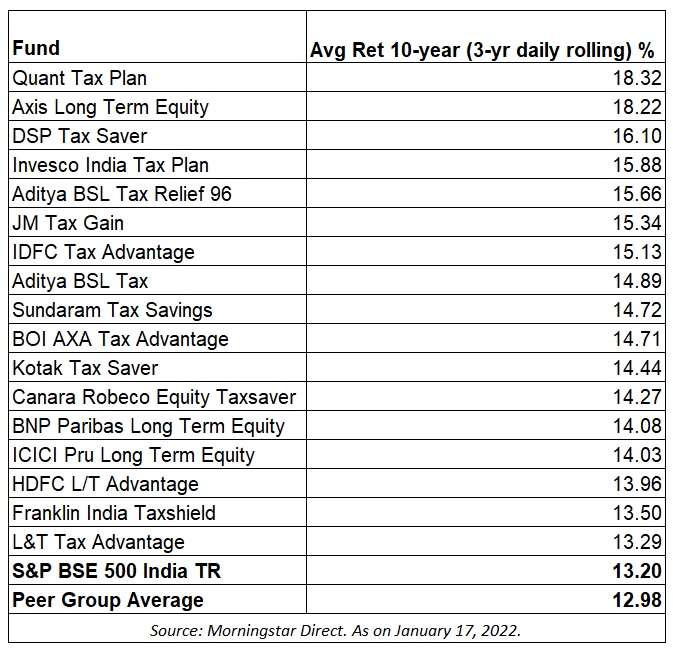

Ten Year (3-year daily rolling return)

Over a ten-year period, 17 funds outperformed BSE 500 TRI as of January 17, 2021. BSE 500 TRI delivered 13.20% during this period.

Among the funds that have completed ten years, five funds have outperformed over 3-year, 5-year and 10-year period. They are Canara Robeco Equity Tax Saver, DSP Tax Saver, JM Tax Gain, BOI AXA Tax Advantage and Quant Tax Plan.

ALSO READ: Most Popular ELSS Funds