In keeping with its drive to prevent mis-selling of mutual-fund products and help investors take informed decisions, market regulator Securities and Exchange Board of India (SEBI) on Monday issued a circular stating, with effect from July, fund companies shall have to label their fund offerings to convey various details about the products.

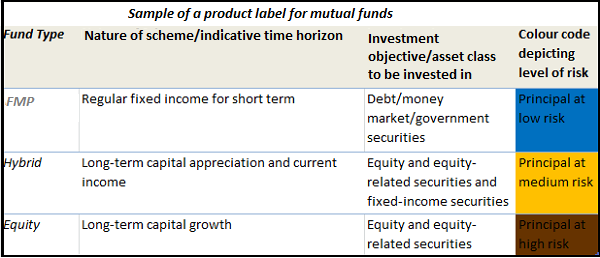

The label--to be displayed prominently on application forms, scheme information documents and the key information memorandum of all fund schemes--would specify the fund's nature and investment horizon, state the objective and asset class it would invest in, and carry a tag indicating the risk the asset class carries: blue for liquid/debt funds meaning low risk of capital loss, yellow for hybrid funds, indicating medium risk and brown for equity funds conveying high risk.

Additionally, a disclaimer would ask the investor to consult their financial advisor if they are not clear about its suitability.

Will it work?

The move is the latest among the many the regulator has undertaken in recent years to curb mis-selling of fund products to investors without regard to their investment objective or risk profile.

In a market such as India where investor awareness is low and funds remain a push product rather than a pull product, such labelling is likely to be a powerful communication tool providing a clear indication of the different levels of risks different fund products carry.

However, industry experts have expressed concerns about the labeling system carrying the same tag for a single category of funds, within which you could have products of different risk profiles.

For instance, an index equity fund may not be as risky as an active equity fund, a conservative-allocation fund, or an MIP, would carry lower risk than an aggressive, or equity-oriented allocation fund even as both sport the yellow colour code, while for funds sporting the blue tag, an FMP is far less risky than a long-duration gilt fund.

So there is a chance investors could look at the tag a particular fund sports in isolation without taking into consideration the fund's investment objective/horizon and their own risk profile.

The move is thus a step towards conveying the broad risk associated with each asset class in an uncomplicated, but perhaps oversimplified, way.

What is also needed in greater magnitude are efforts to create more understanding about and thus demand for mutual-fund products in particular, and equity and debt instruments in general, among individual investors--a goal that the regulator, the industry and the financial media need to work together towards.

Several studies have shown that investors over-estimate their appetite for taking risks during booming markets and underestimate it in a bear market, that is, they would believe they are capable of investing in a higher-risk product if recent performance of that asset class has been good (a la 2004-2007) while lowering their perception of their own risk appetite after going through a nerve-wracking fall in the markets, a point we made in a previous article on risk (why past volatility cannot the same as future risk).

Financial advisors try to understand investors' risk tolerance by asking them to fill up a questionnaire, looking through their age and financial status, enquiring about their goals or asking questions like: can you foresee yourself taking a 50% hit on your portfolio?

While these are certainly a good indicator of an investor’s risk profile, considering the various behavioural quirks investors are often guilty of, it would not be surprising if a "low-risk" investor who is shying away from a "yellow-labelled" hybrid fund today--thanks to stocks' dismal performance in the past few years--would want to push the envelope and be keen to lap up the higher-risk, "brown-labelled" equity offering at the peak of a booming market in the future.