Equity markets continued to be under pressure in August, after a weak show in the previous month. Interest rate sensitive sectors like banking, realty and capital goods continued to underperform. However, certain export oriented sectors like healthcare and technology continued to benefit from the depreciating rupee and outperform the broader markets. Metals sector saw a strong recovery in August on the back of positive data out of China, and the BSE Metal index surged 13% during the month.

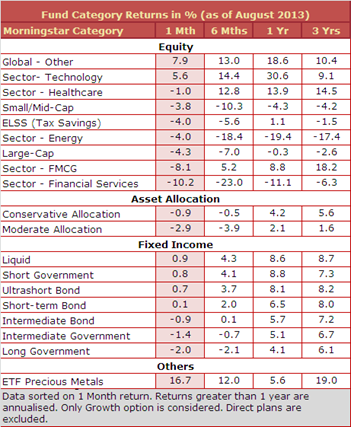

The biggest losers from the equity space in August were financial sector funds, which delivered an average return of -10.2% during the month, on the back of an average loss of 13.5% posted in the previous month. YTD, these funds are now down around 30% (on average). Surprisingly defensive sector funds like FMCG also saw some profit booking during the month--delivering an average return of -8% in August, compared to -6.7% returned by the S&P BSE FMCG index. Infrastructure funds also suffered during the month as rate-sensitives underperformed significantly. Infrastructure funds delivered a return of -6.3% (on average) in August, bringing their YTD losses to a significant -27%.

Meanwhile global funds fared better in August and returned around 8% on average, mainly benefiting from the sharp rupee depreciation. International gold mining funds especially stood out with gold prices recovering recently. Besides that, technology sector funds also fared well in August, delivering an average return of 5.6%, compared to 7.6% returned by the S&P BSE IT index.

Large-cap equity funds were trumped by their mid-cap counterparts in the month of August, delivering an average return of -4.3%. Small/mid-cap equity funds delivered an average return of -3.8% in August, but are down by an average 18% YTD in 2013.

It was another bad month for the fixed income markets in August, although the damage was relatively less than in the month of July. Bond yields continued to be volatile, with the rupee depreciating further, and the RBI announcing new measures from time to time. The yield of the benchmark 7.16% 2023 government bond rose to 9.23% on Aug 19, but then later subsided to close the month at 8.60% -- up 43 bps from previous month’s close. Duration products were generally hit, and long term gilt funds were the bottom performers from the fixed income space, delivering an average return of -2% in August.

Gold ETFs delivered their best historical monthly return of an average 16.7% in August (based on its NAV), on the back of a 12% return in the month of July. Domestic gold prices touched an all-time high in August, benefiting from the sharp rupee depreciation and the recovery in international gold prices. Meanwhile, gold fund of funds (FoF) returned about 10% (on average) during the month of August.