In India, debt funds have traditionally been considered to be low risk investment avenues. Expectedly, this has led to them being considered as apt investment avenues for risk-averse investors. However, the way domestic fixed income markets have behaved over the last few months (and in turn, their impact on performance of debt funds) has forced many to revisit their thinking.

Typically, investors’ focus on the risk aspects of debt funds tends to be low. However, the fact remains that investing in debt mutual funds entails taking on some inherent risk, which an investor should be aware of. And the time to spread this awareness couldn’t be more apt with the domestic fixed income market witnessing an extremely turbulent phase.

In this article, we bring forth the risks associated with investing in debt funds and its impact on their performance with a view to help investors make informed investment decisions.

1. Interest rate Risk

Interest rate risk is one of the most prominent risks to which debt funds are exposed to. It refers to a change in the price of a bond due to the change in the prevailing interest rate. Hence, it directly impacts bonds and subsequently debt funds. For instance, a rising interest rate scenario is a positive for funds having a shorter maturity profile; whereas a falling interest rate scenario is a positive for funds having a longer maturity profile. Simply put, higher the maturity profile of the fund, more prone it is to interest rate risk.

Interest rate risk is mainly measured by duration, which is a measure of the sensitivity of a bond’s price to interest rate movement. Higher the duration of the bond, more its price will tend to fluctuate with the change in the interest rate.

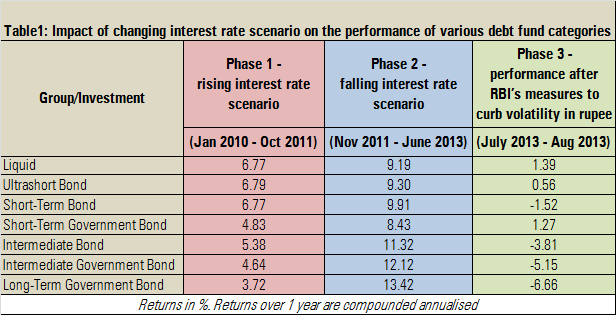

Let us now understand the impact of interest rate risk on the performance of various domestic debt funds. In India, the movement in interest rate has a close proximity with the country’s inflationary scenario. During rising inflation, the Reserve Bank of India (RBI) hikes interest rates (to check inflation) and vice-versa. Starting from the year 2010 till August 31, 2013, the country has witnessed both - rising as well as falling interest rate scenarios. The table below shows the impact of changing interest rate scenario on the performance of various debt fund categories. For this we have segregated the aforementioned period into three distinct phases, based on different stages of interest rate in the country.

Phase 1: Rising Interest Rate scenario (January 2010 - October 2011)

This was the period marked by high inflationary pressure. To bring inflation under control, the RBI went on a rate hike spree. Consequently, the returns from long-term bond funds were lower compared to liquid, ultrashort and short-term funds.

Phase 2: Falling interest rate scenario (Nov 2011 - June 2013)

In its guidance in the monetary policy announced on October 2011, the RBI not only indicated a pause in rate hike but also hinted at a cut in interest rates going ahead. Since then till August 31, 2013, the RBI cut repo rate by 125 basis points. This benefitted long-term debt funds as indicated by the returns delivered by Long-Term Government Bond, Intermediate Government Bond and Intermediate Bond categories.

Phase 3: Change in interest rate scenario due to rupee volatility

Over the last few months, the rupee has witnessed intense volatility and massive depreciation in its value against the dollar. The depreciation in the rupee makes imports costly thus putting an upward pressure on inflation. Not only are there doubts about further rate cuts this year, but there is speculation regarding rate hikes. This sudden change in the scenario has led to a reversal in market dynamics thus impacting debt funds adversely, especially long-term debt funds.

Hence, investors on their part would do well to fully comprehend how debt funds react under different interest rate scenarios before investing in them.

2. Credit Risk

Credit risk refers to the credit worthiness of the issuer of a bond. It applies to corporate bond funds since government bond funds do not carry credit risk as they are issued by the government. Credit risk takes into account whether the bond issuer is able to make timely interest payments and also the face value at the time of maturity of the bond. If the issuer is unable to do so, the bond is said to be in default. This brings down the credit rating of the issuer of the bond thus raising doubts on the entity’s credit worthiness. A downgrade in credit rating will cause the bond’s price to fall, in turn, negatively impacting the performance of the bond funds holding it.

The chances of credit downgrades are high during an economic downturn. Further, leveraged companies (companies which use debt to finance operations) are especially more prone to credit risks. Investors should be cautious while investing in funds having high exposure to such companies. Investments in funds with high credit risk should be made only if investors have the appetite for the risk associated with such funds.

3. Liquidity Risk

Liquidity is the ease with which a fund manager can sell a particular security in the market. A fund faces liquidity risk if the fund manager is not able to do so due to lack of demand for the security. Broadly speaking, the debt market in India is still not well developed. There are very few players in the market with majority being institutions. Furthermore, retail participation in the debt segment of mutual funds is very low.

The domestic debt market is comprised of the government bond, corporate bond and money market segments. While the government bond and money market segments enjoy high participation thus making them liquid in nature, the participation in corporate bond segment is still low. Further, corporate bonds which have high credit ratings witness much higher demand from investors than comparatively lower rated bonds, thus making them more liquid. Hence, during a downturn, when sentiment turns risk averse, funds having illiquid papers typically find it difficult to stay afloat. Also, if faced with redemption pressure, the fund manager may be forced to sell his papers at a significant loss, which could adversely hit the fund performance.

Besides the above mentioned risks, at times there could be some unexpected events emerging which could also hurt the performance of debt funds. One such instance of recent origin is the rupee depreciation, and the impact it had on the debt funds across tenures. Having said this, investors should know that movement in currency does not have a direct impact on the debt markets and debt funds. However, any policy decision taken in that regard by the central bank or the government could impact debt funds.

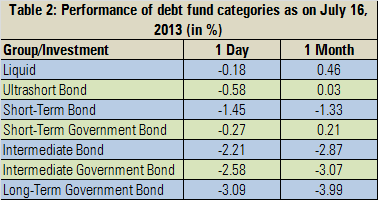

For some time now, the rupee has been weakening prompting the RBI to take measures to bolster the rupee. A few such measures were taken by the central bank on July 15, 2013 when it increased the cost of short-term borrowing and squeezed liquidity from the system. These measures were aimed at deterring speculation on the rupee. However, these measures had a negative impact on debt markets.

As depicted in Table 2, on July 16, 2013, the day after the RBI announced measures; all debt fund categories registered a sharp fall in returns. Indeed, even the 1-month return as on July 16, 2013 for most of the categories (except for liquid and ultrashort bond funds) entered into the negative territory. While the squeeze in liquidity and increase in short-term borrowing rates dragged liquid and ultrashort-term bond funds down; fears of no further rate cuts and speculation of a hike in interest rates pushed long-term bond funds down.

What should an investor do?

Investment prudence demands that an investor must understand the risk/reward profile of a fund (whether equity or debt) before investing in it. Lower risk in debt funds compared to equity funds is no reason to ignore risks associated with debt funds. Debt mutual funds, like equity funds, are market- linked instruments and hence do not give any assurance of either returns or capital preservation. Hence, investments in debt funds should be made after fully understanding the risk associated with them.