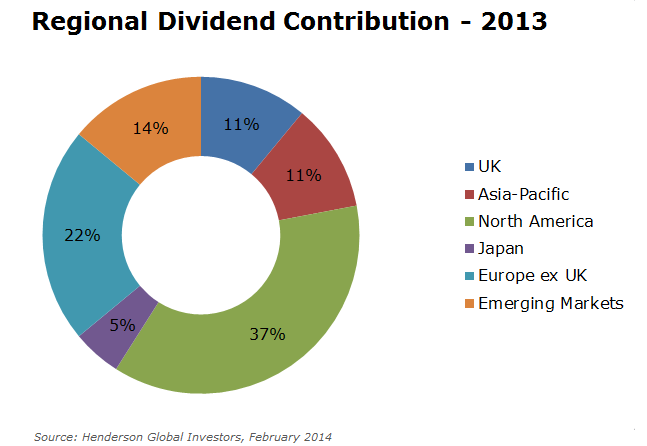

According to a report from Henderson Global Investors, North American companies contribute the lion’s share – 37% while companies listed in the U.K. contribute 11% of the total global dividend pay-outs.

European companies also contribute more to the global total than British firms, with Europe ex-UK contributing 22%, while companies primarily listed in the Emerging Markets contribute 14%. In line with the UK, Asia-Pacific companies contribute 11% and Japanese just 5%.

The total amount paid out by companies around the world has growth substantially over the past 5 years, hitting a record $1.03 trillion in 2013, up 45% compared to 2009. The increase in pay-outs mirrors the broader improvement in global stock market performances over this period, with healthier earnings leading to wealthier dividend recipients.

Though they may still only account for 14% of the total, the greatest increase in the past 5 years has come from emerging markets' companies, where pay-outs have more than doubled since 2009. Most of this impressive growth took place between 2009 and 2011 and has since stalled as emerging markets, though they still make up $1 in every $7 paid out globally, according to the report.

Of course emerging markets are not a homogenous group; the BRIC countries (Brazil, Russia, India and China) account for over half of the emerging market dividends, and dividend growth has happened notably faster than at other emerging markets’ firms.

Asia-Pacific companies have also done a strong job of returning capital to shareholders, with dividends up 79% over the past five years. The underperformers have been our European cousins, who saw dividends increase by just 8% to $200 billion since 2009. As one would expect, the Henderson report confirms that those countries hit worst by the euro crisis are returning less to shareholders. Scandinavian countries, in contrast, have seen something of a dividend boom.

U.K. pay-outs have grown in line with the global average and the U.K’s 11% share of total global dividends is disproportionately large compared to the size of our economy. A comforting tale for local investors seeking income in our low interest rate environment. As in the rest of the world, financials, oil companies and telcos dominate the list of top dividend payers.

Importantly for investors, the outlook for 2014 is set for even faster dividend growth globally. For 2014, Henderson expects dividend growth to accelerate after the slower pace of 2013, with developed markets delivering better income growth than developing markets. “A global approach to income investing can bring real diversification benefits, commented Henderson’s head of global equity income, Alex Crooke.

This report by Holly Cook originally appeared on Morningstar's U.K. website.