Morningstar analysts recently published a consumer observer report focused on consumer stocks in emerging markets, including India. Equity analyst Suruchi Jain contributed to the India section, an excerpt of which is reproduced here. She can be reached at Suruchi.Jain@morningstar.com.

To access the complete report titled “Investing in the Emerging-Market Consumer—Why Companies With Moats Are Poised for Excess Returns”, drop in a mail to Deepak.Khurana@morningstar.com.

What advice does Morningstar give to investors looking for exposure to emerging-market consumers? We believe that consumer staples companies with established economic moats—structural competitive advantages—are disproportionately advantaged when deploying emerging-market strategies.

In particular, we believe investors should look for a number of criteria when screening for companies best-positioned to capitalise on the growth potential of emerging-market consumers, each of which ties directly into the sources of its economic moat. These include structural supply chain and distribution advantages, economies of scale, sufficient resources to extend brand reach, pricing power to withstand softness in volume growth, and an understanding of emerging-market economies.

Companies meeting these criteria offer investors the most effective way to participate in the tremendous growth potential of emerging-market consumers. They can leverage their existing supply chain and distribution assets (to an extent) relative to smaller emerging-market peers, have easier access to cheaper capital, can foster brand awareness and loyalty through preexisting brand awareness and expansive advertising budgets, and typically utilise sensible go-to-market strategies to capitalise on the tremendous population and wealth creation opportunities.

Top investment ideas

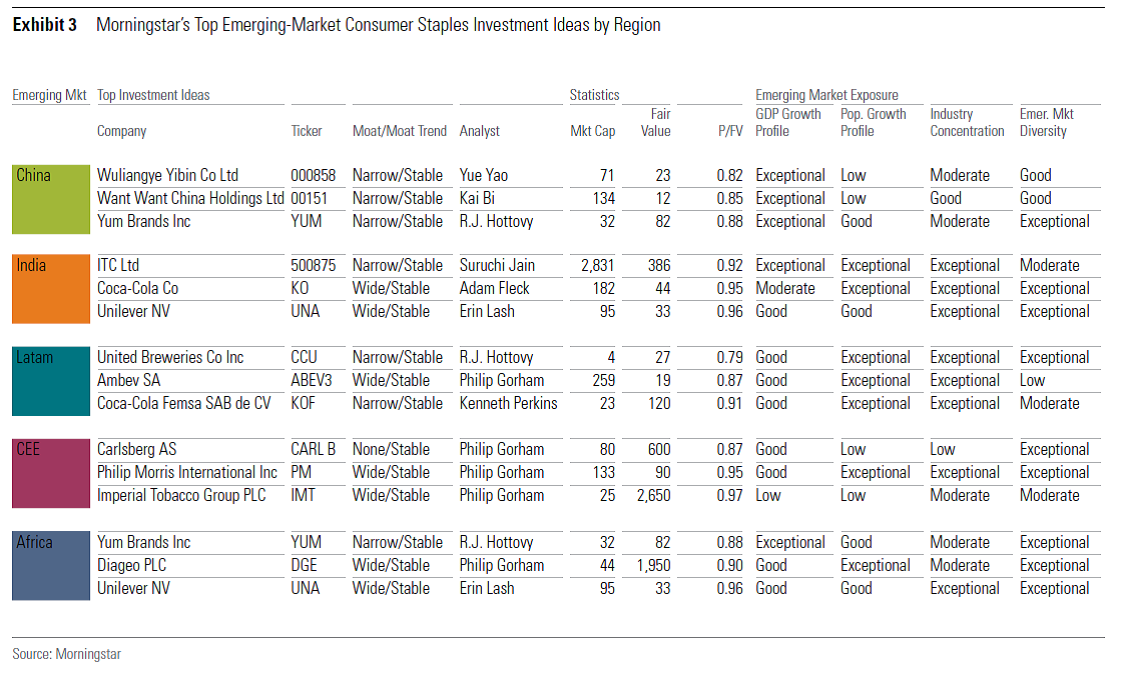

In Exhibit 3, we’ve presented our top investment ideas for each region, which factors in each company’s current price relative to our fair value estimate as well as its competitive position within the emerging markets in which it operates, and ability to adapt to changing consumer preferences, industry structures, and regulatory policies as emerging markets evolve over the next several decades.

Click here for the India excerpt