Morningstar analysts recently came out with a report titled 'Rising Incomes, Changing Tastes: How Africa, India, and China Will Reshape the Global Food and Agriculture Landscape'. The report covers each aspect of the emerging markets' diet – from trends in meat and dairy consumption, to those in beer and processed food. To read the full report, write in to Suruchi.Jain@morningstar.com. An excerpt from the report is reproduced below.

Amid the slowdown in China’s infrastructure- and real-estate-led economic model, emerging-market growth stories are looking scarcer. Food and agriculture are commonly cited possibilities. But how much opportunity remains? And where are the pockets of greatest potential? This report examines a broad swath of dietary, demographic, and economic data to answer those questions and identifies the companies best positioned to benefit.

We expect India and sub-Saharan Africa to play starring roles in the emerging-market diets growth story, overturning what has been a China-centric narrative.

In this report, you will find insights such as the following:

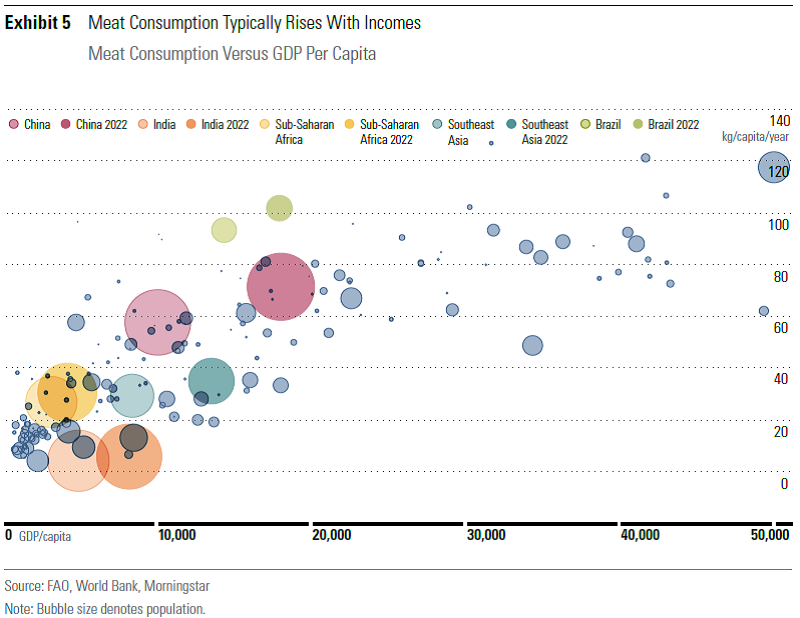

- While caloric intake growth loses steam past GDP of roughly $15,000 per capita, dietary changes persist much further up the income ladder. Up to around $30,000 per capita, animal products, including meat and milk, typically displace cheaper calories like rice, wheat, and potatoes. Exceptions are typically religious in nature.

- Among poorer countries, the outlook for cereals is very positive. In sub-Saharan Africa and India, population growth will magnify rising per capita consumption, driving cumulative consumption increases of 44% and 17%, respectively.

- The outlook for cereals is negative among higher-income emerging-market countries. We expect total rice consumption to decline 5% in China, the world’s largest consumer of the crop.

India: Strong caloric intake growth highlighted by huge gains in dairy

In a detailed discussion on the evolving Indian diet of a largely vegetarian population, our analysts have the following key insights.

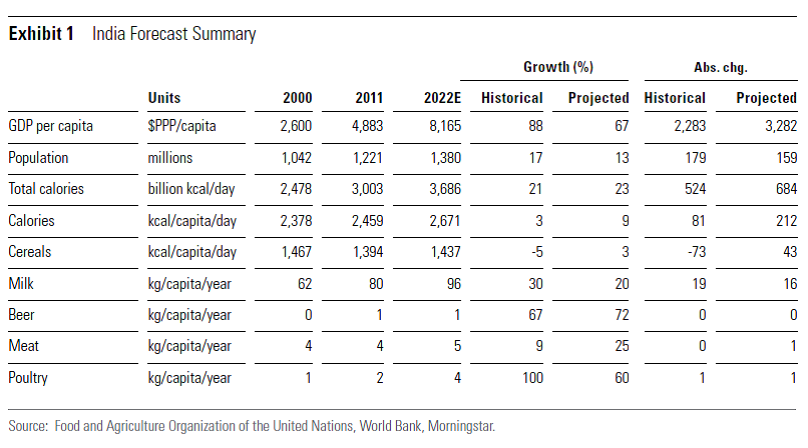

- Religious practices limit India’s meat consumption potential. We expect annual meat consumption to rise from 4.2 kilograms per capita in 2011 to 5.5 kg by 2022, a paltry figure compared with emerging markets such as China (57.5 kg) or Brazil (93.0 kg).

- Indian milk consumption is massive and likely to increase. Our forecast has the country’s annual milk consumption swelling from 98 billion kg to 133 billion kg by 2022, equivalent to the current milk consumption of the world’s second- and third-largest milk consumers (the U.S. and China) combined.

- We expect 5% annual per capita growth in spending on beverages and processed foods. Coupled with population growth, we think total spending on processed foods and beverages will nearly double from 2011 to 2022.

- Higher food subsidies could materially boost caloric intake, but implementation questions remain. A government plan passed in late 2013 is set to increase food subsidy spending to roughly $20 billion a year, a 33% increase from the previous level. Based on our estimates, India’s caloric intake per capita could increase significantly as a result (low single digits in percentage terms).

Spending on beverages and processed foods could double from 2011 to 2022

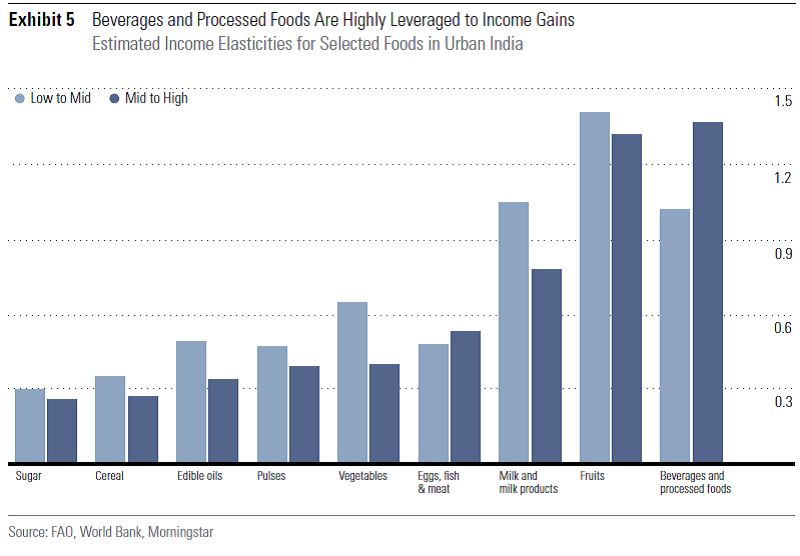

Country-level data in India show a strong relationship between income and spending on beverages and processed foods, which are included in the same spending category by the Indian government. In the urban data, as we move to the 70-80 percentile income group (we’ll call this group High), from the 50-60 percentile group (Mid), spending on beverages and processed foods increases 56% compared with the 40% increase in total expenditures between the two groups. This income elasticity ranks as the highest among India’s important food categories, as seen in Exhibit 5, which also shows elasticities from a Low income group (30–40%) to Mid (50–60%).

We expect strong growth in beverage and processed food spending—likely around 5% per year through 2022 (cumulative growth of about 75%). Coupled with the country’s massive population, strong per capita growth in beverage and processed food spending represents a sizable opportunity for beverage and processed food producers with leverage to India. We think spending on processed foods and beverages will nearly double from 2011 to 2022.