This column was written by Parag Parikh, Chairman and CEO, PPFAS Asset Management, for the India Markets Observer.

All medicine bottles carry a warning regarding potential side effects. Rather than the positive aspects of its curative properties, we are fed the negatives. Ditto with mutual funds. Ads for these tax-friendly investment vehicles carry a warning: “Mutual funds are subject to market risk...” Retail investors are dissuaded with this statutory warning.

Equity mutual funds are considered risky. This is a mental heuristic: the brain takes a short cut and does not process the complete information.

This leads to biases, two of which dominate investor decision making: Availability bias and Representativeness bias.

In availability bias, investors make decisions based on the readily available and vividly displayed information. Information on an equity mutual fund cautions the investor. Instead of being driven by passion they are driven by fear.

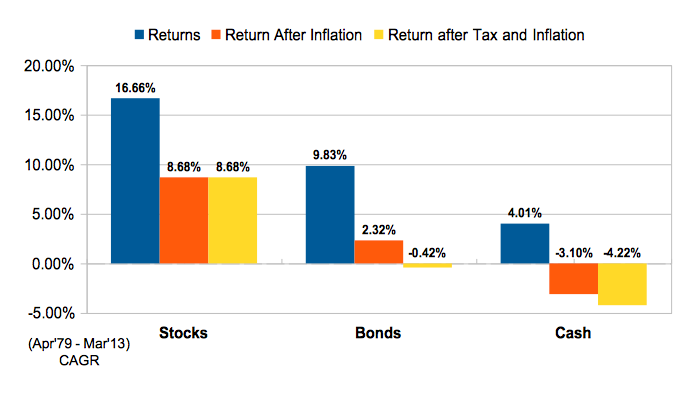

The investor finds an equity fund representative of a risky investment due to the volatility in equities and the cautions imposed despite them returning historically good returns over the long term. If investors process all the information, the picture changes (see chart below).

The statutory warning on a medicine bottle is for the self-medicated. One would be reasonably safe when prescribed by a doctor. Similarly, one would be well advised to take the help of a financial adviser.

There is a paradox of choice. Decades ago, if you wanted to buy a pair of jeans, you went to a store and picked one. Today you have different brands and types: slim/ straight/ relaxed fit, faded, torn, button up, low waist, and so on and so forth. We are put into decision paralysis.

The fund market is flooded with multiple schemes: real estate, infrastructure, close ended, mid cap, small cap, growth, value, and so on. If investors were able to make investment decisions by themselves, they would buy stocks directly. An investing vehicle intended to simplify the process confuses investors with multiple choices leading to decision paralysis. The right investing process and the ability to hold on for the long term is the way to wealth creation. Not chasing fancies.

Loss aversion: Give a beggar Rs 100 and tell him that the tax is 30%. He is happy to have the income (Rs 70) rather than worry about the tax. Investors flinch at the mention of tax and make irrational decisions. Instead of considering ourselves fortunate to have that income, we worry about tax because we don’t like to see a dip in income.

If investors were risk averse, they would not enter the market. They are loss averse. That makes them sell winners quickly and hold on to losers; exit the market when the Sensex dips; prefer fixed income over equity.

Mental accounting: Money is fungible. The value of Rs 1,000 is the same, earned by way of salary or a lottery.

Humans accord different values to the same amount depending on how it has been earned, the effort taken, and the amount in question.

If you invest in a fixed income security and earn a rate of interest, you will treat that income as earned income. Yet you treat dividends as free income because you did not know for sure whether you would get it or not, nor were you sure of the quantum. So you are likely to splurge this dividend income as in your mental account it is “free money”.

Mutual funds understand this bias well and declare dividends to excite investors. How do mutual funds work? Investors pool in their resources to be managed by a fund manager. As the value of the investment grows, so does the NAV. If the NAV is Rs 20 per unit and the fund declares a dividend of Rs 2 per unit, after the dividend payout the NAV falls to Rs 18. Your own money is given back to you.

Dividends from a mutual fund is not income, it is the return of investors’ money disguised as dividends- very different from the dividends you get from stocks.

Representative bias is at work here.

Dividends by funds is a marketing exercise. To give yourself a dividend, redeem units. When you do so, you will be more disciplined and will redeem only what you really require.

All investment decisions can be distorted by various heuristics and biases. Understand your biases and make informed decisions.

To view the other contributors, click here.