Senior fund analyst Himanshu Srivastava revisited the analysis of Franklin India Prima Plus and Franklin India Bluechip and has reiterated the Gold rating in both cases.

Both funds fall into Morningstar’s Large-Cap category and are headed by Anand Radhakrishnan, a skilled fund manager and proficient stock-picker.

Radhakrishnan’s style is evident in the portfolios of both funds. For instance, he prefers private-sector entities over their public-sector counterparts, in line with his belief that the former offer more robust business models and superior operational efficiencies. Consequently, private sector banks such as HDFC Bank and ICICI Bank appear in his portfolio, not their cousins - the public banks.

In both funds, his bottom-up stock picking approach reigns with a tinge of contrarianism. The July portfolio of Franklin India Prima Plus showed that he was overweight (11%) health-care versus the category average (7%). His overweight positions in telecom in Franklin India Bluechip since late 2009 is another case in point. In both funds, his investments in cement stocks in 2013, in the midst of an economic downturn, bear out his willingness to invest against the grain.

Being valuation-conscious helps the funds hold their own in market downturns, but they tend to lag behind its peers in a growth-driven market. But that does not faze Radhakrishnan who refuses to shy away from taking big long-term contrarian bets, despite near term headwinds.

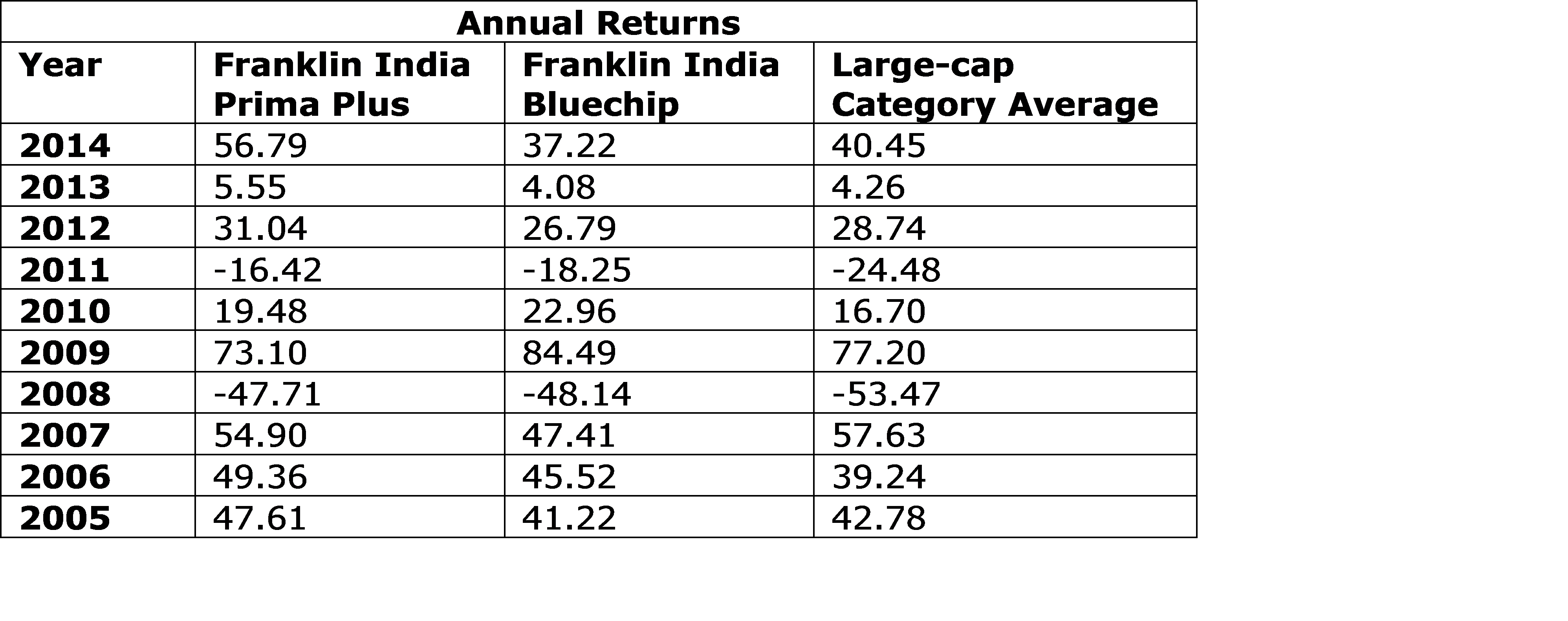

If you take a look at the annual returns below, Franklin India Prima Plus has put up a very good show when compared to the category average. On the other hand, Franklin India Bluechip, underperformed the category average five times over the past decade. This is not because the fund is an inferior offering – far from that! It is just that the fund has stayed loyal to its mandate.

According to Srivastava, “Franklin India Bluechip is a true blue large-cap fund with over 90% of the portfolio invested in such stocks. Franklin India Prima Plus invests around 70% in large caps with the balance in smaller fare.”

It is the exposure to mid and small caps that gives Franklin India Prima Plus the additional alpha. But investors who want a consistent exposure to large caps can well consider Franklin India Bluechip. Over the long run, they will not be disappointed. It’s 5-, 10-, and 15-year return as on November 24, 2015, is ahead of the category average. You can check the performance details here.