This article has been written by Dwaipayan Bose, Co-Founder of Advisorkhoj.

There is no denying that Unit Linked Insurance Plans, popularly known as ULIPs, are now much better products than what they were before 2010. The IRDA regulations in 2010 made significant changes with respect to the life cover of ULIPs as ratio of annual premium, policy surrender procedures (including charges) and most importantly with respect to the rationalization of costs of the policies.

Despite these changes which have made ULIPs better life-insurance-cum investment products, I still remain a fan of mutual funds. I will explain why.

- The life insurance factor

It is fair to remember that ULIPs offer life insurance, and that is an important financial need for all of us. But let us deliberate on that point. The minimum life cover or sum assured in ULIP, as per IRDA regulations, is 10 times the annual premium for investors below the age of 45. But is a life cover of 10 times your annual premium adequate? Life insurance thumb rules suggest a minimum life cover of 10 to 12 times your gross annual income.

Your annual ULIP premium is only a fraction of your gross annual income. Therefore, it is clear that your ULIP policy will not be able to meet your life insurance needs. You have to buy additional life insurance to get adequate financial protection in the event of an unfortunate death.

Let us now compare the costs of ULIPs and mutual funds. There are different costs involved with ULIPs:

- Premium allocation charges

- Policy administration charges

- Mortality charges

- Fund management charges

- Surrender charges

Let’s not get into a discussion on each of costs, but let’s simply focus on the impact of these costs on yield of ULIPs.

As per IRDA regulations, the maximum reduction in yield, excluding mortality charges, due to ULIP costs are capped as follows:-

- First 5 years: Maximum reduction in yield is capped at 4%

- Years 5-10: Maximum reduction in yield is capped at 3%

- Year 10 onwards: Maximum reduction in yield is capped at 2.25%

By maximum reduction in yield, we mean the maximum amount your gross returns can go down due to the costs. It is important to reiterate here that the maximum reduction in yields exclude mortality charges (the cost of life insurance cover). Therefore when we compare the costs of ULIPs without mortality charges and mutual funds, we are making a like-to-like comparison.

What are the costs of mutual funds?

That is expressed in one simple measure - the Total Expense Ratio, or simply expense ratio. Expenses in mutual funds are regulated by the market regulator Securities and Exchange Board of India, or SEBI.

Expense ratios vary from one mutual fund scheme to another, based on the expenses of the scheme and the assets under management. Expense ratios in equity funds can range from 1.5 to 3%. In debt funds it is usually much lower.

For the purpose of comparison of expenses between ULIPs and mutual funds, let us assume the expense ratio to be 2.5%. Compared to the maximum expense cap specified by the IRDA, a mutual fund with 2.5% expense ratio is significantly less expensive than ULIPs in the first 5 years. And continues to be so for 10 years. However, from year 10 onwards, ULIPs will be less expensive assuming that the mutual fund expense ratio does not change.

What is the impact of difference in costs on returns?

Let us first assume that fund performances of the mutual fund and ULIP are exactly the same. Assume that the gross return given by both is 12%.

Let’s also assume that your annual premium regarding the ULIP is Rs 1 lakh and the policy term is 20 years. Similarly, you make an annual investment of Rs 1 lakh in the mutual fund. Let us now see the difference in final fund values at policy maturity / investment term of 20 years.

End of 5 years

Once you factor in mortality charges the fund value of your mutual fund investment will be higher by a bigger amount than the ULIP. However, we are excluding mortality charges to make an apples-to-apples comparison.

At the end of 5 years, the fund value of your mutual fund investment will be higher than the ULIP fund value by Rs 16,000. This difference will continue to compound over the investment / policy term. Assuming 12% returns on investment, the Rs 16,000 difference will grow to a difference of Rs 28,000 by the end of the tenth year.

Years 5 to 10:

The fund value of your mutual fund investment will be higher than the ULIP fund value by Rs 5,300 in 5-10 year period. If you add the Rs 28,000 difference at the end of the tenth year, due to the higher mutual fund net yield in the first 5 years, the total difference in fund value at the end of first 10 years be Rs 33,500. This difference compounded at the rate of 12% over the next 10 years will be Rs 104,000.

Year 10 onwards:

In this period the ULIP is cheaper. Assuming the same gross performance, the fund value of your ULIP investment will be higher than the mutual fund by Rs 12,800 in the 10-20 years slot. But at the end of 20 years, the mutual fund investment will still be of higher value. The Rs 1,04,000 difference in fund value, due to higher ULIP costs in the first 10 years, is offset only to the extent of Rs 12,800. The net difference is still over Rs 90,000.

Some may argue that we have been unfair towards ULIPs by taking the highest possible costs for ULIPs when comparing with mutual fund costs.

Let’s understand the mechanics of the costs.

The various expenses of a mutual fund scheme are charged proportionately against the assets under management, or AUM, of the scheme. Some of these expenses are variable, while others are fixed. Therefore, when the AUM grows, the expense ratio comes down over time. If you look at the expense ratios of some large sized mutual fund schemes, you will observe that they are much lower than average expense ratios.

The mechanics of ULIP expenses are different. If you go through the product brochure of different ULIPs, you will see that premium allocation and policy administration specified are usually a percentage of your premium. In fact, in many ULIPs the total expenses are closer to the IRDA cap unlike large-sized mutual fund schemes where the expense ratios are much lower than the SEBI cap.

Granted, in the recent years, several low cost ULIPs have been launched where over a long investment horizon the costs might be comparable or even slightly lower than mutual funds. However, for want of a long-term performance track record it is difficult to gauge how these ULIPs will perform in the long term.

Comparison of ULIP and mutual fund performance

So far, we have discussed only the impact of costs. We will now see how ULIP funds have performed versus mutual funds.

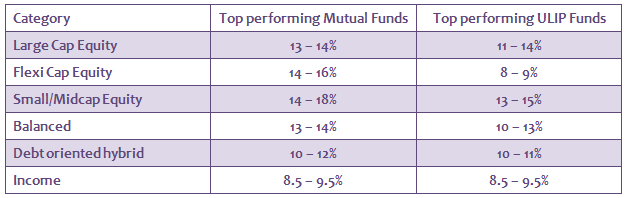

I do not know for sure whether mutual funds are more actively managed than ULIP funds. Therefore I will not make that assumption. I will look at the actual historical returns of top performing mutual funds and ULIP funds in different categories over the last 10 years.

From the table above we can see that, while ULIP funds have matched mutual fund returns for some categories, mutual funds have outperformed ULIP funds in many categories. If we combine the impact of costs and potentially higher returns, mutual funds do make more attractive investment choices compared to ULIPs.

Should you continue with your ULIP?

It is not always an easy decision.

If you surrender or discontinue your ULIP within the lock in period, your fund value gets transferred to a discontinued fund after deduction of surrender charges. The final fund value of your units will be paid to you on the completion of the lock-in period. Though the units in the discontinued fund earns interest at a rate specified by IRDA, the amount of value you lose in surrender charges can be substantial depending on when you surrender your policy.

For this reason, you should do your homework properly before investing in ULIPs.

We mentioned earlier that ULIPs are a much better product now than what they were and they are not as bad as they are made out to be by some quarters in the investment community, but a combination of a term life insurance plan and good mutual funds can deliver better results.