This post has been written by Dhaval Kapadia, Director, Portfolio Specialist, at Morningstar Investment Adviser (India). It initially appeared on Moneycontrol.com.

Equity markets are trading just shy away from their all-time highs and the debate is on whether markets are currently overvalued or not and if it is the right time to invest.

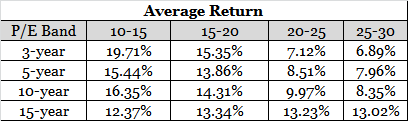

Our analysis shows that market valuations do play an important role in determining returns over the short term to medium term. In other words, investments made at lower valuations (for e.g. at lower Price to Earnings ratios) have historically yielded better returns as compared to investments made at higher valuation levels if the investment is held for 5 to 10 year periods.

But, for an investment horizon of 15 years and above, the impact of valuations on returns is minimal.

The table below shows the average 3, 5, 10 and 15-year returns from the Sensex at different Price to Earnings (or P/E) levels from January 1991 to May 2017. The P/E bands are based on trailing 12 month P/Es for the Sensex.

Does it mean that one should wait for the ‘right’ valuations to make investments and avoid investing at other times?

Trying to time the market hasn’t been a fruitful activity for most investors.

Markets have been known to remain ‘overvalued’ for long periods of time and waiting for sharp corrections to occur at times might be fruitless especially if one is investing to achieve a time-bound investment goal.

Besides, the definition of over and undervaluation itself is subjective based on the valuation parameter used and can vary from time-to-time.

So, how should investors plan investments? Rather than trying to time the market, investing for the long term through systematic investment plans (SIPs) appears to be the most suitable route.

SIPs for longer tenures would ensure that investments are made across up and down market cycles thereby reducing the impact of varying market valuations.

SIPs also inculcate discipline in savings & investing and avoids the endless debate on whether ‘this is the right time to invest’.