The below is an extract from the India Domestic Fund Flows report, that is released every quarter. This report provides insights into estimated flows, asset trends, and performance for domestic funds focused on the Indian equity and debt market.

Assets under management of open-end funds stood at Rs 44,13,034 crore as of June 2023 up by 13% compared to March 2023 and up by 25% compared to last year.

Open-end mutual funds saw net inflows to the tune of Rs 1,84,789 crore in the first quarter of the new fiscal year after witnessing net outflows in the quarter ended March 2023.

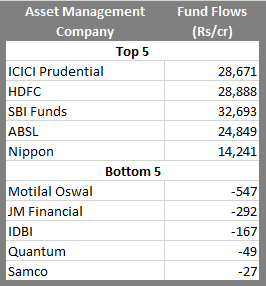

Quarter: April-June 2023

The AMCs that received the highest flows during the quarter were aided by the flows in their liquid,

ultra short term, and money market categories.

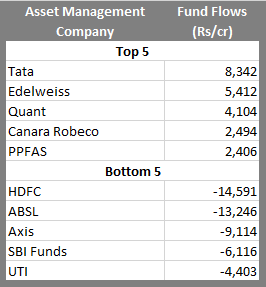

Quarter: January-March 2023

Edelweiss Mutual Fund and Canara Robeco Mutual Fund are seeing consistent inflows. They also featured in the Top 5 Flows last quarter. UTI Mutual Fund has featured in the Bottom 5 Flows over the last two quarters.

HDFC Mutual Fund and SBI Funds had a great run last quarter only to move from Top 5 to Bottom 5.

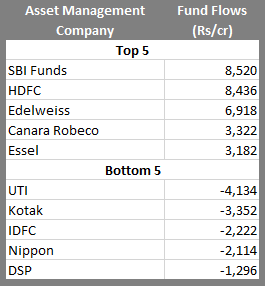

Quarter: October-December 2022

SBI Mutual Fund was aided by strong net inflows into its ETFs:

- SBI Nifty 50 ETF (Rs 4,706 cr)

- SBI S&P BSE Sensex ETF (Rs 3,511 cr)

On the other hand, an exodus of funds from the liquid category (Rs 4,670 cr) and overnight category (Rs 3,890 cr), among others, led to UTI AMC finding a place among the AMCs with the highest net outflows during the quarter.

-

Figures are in Indian rupees (INR crores).

-

Data is of domestic open-end funds and Exchange Traded Funds (ETFs)

-

A domestic fund is one that is domiciled in India and invests primarily in Indian markets. In this report, we have included the asset flows of funds and ETFs with an allocation to Indian stocks and bonds as of March 2023.

-

This report provides insights into estimated flows, asset trends, and performance for domestic funds focused on the Indian equity and debt market. The flows are estimated from assets and total returns for the quarter ended June 2023. Morningstar calculates estimated net cash flows for global open-end funds and exchange-traded funds, an estimate of the money put in or withdrawn by fund investors, accounting for reinvestment of distributions.

-

The disclosure of daily net assets is at the discretion of the fund provider.